Introduction

The aim of this project is to build a model which can make informed buy-and-sell decisions with respect to cryptocurrency trading. The model will do so by leveraging streaming news-feed data (Twitter, Bloomberg, etc.) as well as pricing data (open, close, etc.) to inform its predictions.

Configuration

Hyperparameters for neural networks.

class DictObj(object):

def __init__(self, mp):

import pprint

self.map = mp

pprint.pprint(mp)

def __setattr__(self, name, value):

if name == 'map':

object.__setattr__(self, name, value)

return

self.map[name] = value

def __getattr__(self, name):

return self.map[name]

Config = DictObj({

"LABEL_GENERATION": "tb",

"LAGGING": 0,

"MAX_LENGTH": 128,

"TRAIN_BATCH_SIZE": 128,

"VALID_BATCH_SIZE": 128,

"TEST_BATCH_SIZE": 128,

"MAX_EPOCHS": 10,

"EMBEDDING_SIZE": 300,

"NUM_CLASSES": 2,

"NUM_KERNELS": 128,

"DROPOUT_RATE": 0.1

})Load Data

The news is sourced from Bloomberg and spans the years 2014-09-23 to 2020-12-10. The row with the words “bitcoin,” “blockchain,” and “crypto” will be preserved. In terms of auto labelling, I used the Triple Barrier Method in this project because it provides the greatest results.

text_df = pd.read_csv(r"C:\Users\Yang\Desktop\Dissertation\data\processed\news\bloomberg\BloombergV2.csv")

text_df = text_df[["date", "title"]]

text_df.columns = ["date", "text"]

preprocess_func = lambda x: x.lower()

text_pipeline = TextPipeline(text_df, ["bitcoin", "blockchain", "crypto"], preprocess_func)

text_processed_df = text_pipeline.get_dataframe()

price_df = yf.download("BTC-USD", progress=False)

price_pipeline = PricePipeline(price_df, column="close", label=Config.LABEL_GENERATION)

price_processed_df = price_pipeline.get_dataframe()

text_price_pipeline = TextPricePipeline(text_processed_df, price_processed_df, lagging=Config.LAGGING)

text_price_df = text_price_pipeline.get_dataframe()Text Preprocessing

Text processing is an automated method of evaluating and categorising unstructured text input in order to extract useful information.

def clean_text(text):

REPLACE_BY_SPACE_RE = re.compile('[/(){}\[\]\|@,;]')

BAD_SYMBOLS_RE = re.compile('[^0-9a-z #+_]')

text = text.lower()

text = REPLACE_BY_SPACE_RE.sub(' ', text)

text = BAD_SYMBOLS_RE.sub('', text)

text = text.strip()

return text

text_price_df["text"] = text_price_df["text"].map(str)

text_price_df["text"] = text_price_df["text"].apply(clean_text)Tokenisation for Train/Validation/Test Sets

Tokenisation is the process of breaking down a phrase, sentence, paragraph, or even an entire text document into smaller components like individual words or phrases.

tokenizer = AutoTokenizer.from_pretrained("bert-base-uncased")

train_df = text_price_df.loc[:"2016-12-31"]

valid_df = text_price_df.loc["2017-01-01":"2017-12-31"]

test_df = text_price_df.loc["2018-01-01":]

input_ids = tokenizer.batch_encode_plus(train_df["text"].tolist(),

padding=True,

truncation=True,

max_length=Config.MAX_LENGTH,

add_special_tokens=True,

return_tensors="pt",

return_token_type_ids=False,

return_attention_mask=False)

X_train = input_ids["input_ids"].numpy()

y_train = train_df.label

input_ids = tokenizer.batch_encode_plus(valid_df["text"].tolist(),

padding=True,

truncation=True,

max_length=Config.MAX_LENGTH,

add_special_tokens=True,

return_tensors="pt",

return_token_type_ids=False,

return_attention_mask=False)

X_valid = input_ids["input_ids"].numpy()

y_valid = valid_df.label

input_ids = tokenizer.batch_encode_plus(test_df["text"].tolist(),

padding=True,

truncation=True,

max_length=Config.MAX_LENGTH,

add_special_tokens=True,

return_tensors="pt",

return_token_type_ids=False,

return_attention_mask=False)

X_test = input_ids["input_ids"].numpy()

y_test = test_df.labelConstruct Dataset and Dataloader

Dataset that allow you to use pre-loaded datasets as well as your own data. Dataset stores the samples and their corresponding labels, and DataLoader wraps an iterable around the Dataset to enable easy access to the samples.

class TextDataset(torch.utils.data.Dataset):

def __init__(self, input_ids, labels):

self.X = input_ids

self.y = labels

def __len__(self):

return len(self.y)

def __str__(self):

return f"<Dataset(N={len(self)})>"

def __getitem__(self, index):

X = self.X[index]

y = self.y[index]

X = torch.tensor(X, dtype=torch.long)

y = torch.tensor(y, dtype=torch.long)

return [X, y]

def create_dataloader(self, batch_size, shuffle=False, drop_last=False, num_workers=0):

return torch.utils.data.DataLoader(

dataset=self,

batch_size=batch_size,

shuffle=shuffle,

drop_last=drop_last,

pin_memory=True,

num_workers=num_workers)

train_dataset = TextDataset(X_train, y_train)

valid_dataset = TextDataset(X_valid, y_valid)

test_dataset = TextDataset(X_test, y_test)

train_dataloader = train_dataset.create_dataloader(batch_size=Config.TRAIN_BATCH_SIZE, shuffle=True)

valid_dataloader = valid_dataset.create_dataloader(batch_size=Config.VALID_BATCH_SIZE)

test_dataloader = test_dataset.create_dataloader(batch_size=Config.TEST_BATCH_SIZE)Modelling

Building representations of things in the ‘real world’ and allowing concepts to be probed is what modelling is all about.

Pytorch Lightning Module

Pytorch Lightning structures PyTorch code so it can abstract the details of training.

class LightningMultiClassModule(pl.LightningModule):

"""

Multi-class Classification Engine

"""

learning_rate = 1e-3

def __init__(self):

super().__init__()

self.train_losses = []

self.valid_losses = []

self.train_accuracies = []

self.valid_accuracies = []

def forward(self, inputs):

raise NotImplementedError

def configure_optimizers(self):

optimizer = torch.optim.Adam(self.parameters(), lr=self.learning_rate)

return optimizer

def training_step(self, batch, batch_idx):

batch, y = batch

y_hat = self(batch)

labels_hat = torch.argmax(y_hat, dim=1)

n_correct_pred = torch.sum(y == labels_hat).item()

loss = F.cross_entropy(y_hat, y.long())

self.log("train_loss", loss, on_step=True, on_epoch=True, logger=False)

return {'loss': loss, "n_correct_pred": n_correct_pred, "n_pred": len(y)}

def training_epoch_end(self, outputs):

avg_loss = torch.stack([x['loss'] for x in outputs]).mean()

train_acc = sum([x['n_correct_pred'] for x in outputs]) / sum(x['n_pred'] for x in outputs)

self.train_losses.append(avg_loss.detach().cpu().item())

self.train_accuracies.append(train_acc)

def validation_step(self, batch, batch_idx):

batch, y = batch

y_hat = self(batch)

loss = F.cross_entropy(y_hat, y.long())

labels_hat = torch.argmax(y_hat, dim=1)

n_correct_pred = torch.sum(y == labels_hat).item()

self.log("valid_loss", loss, on_step=True, on_epoch=True, logger=False)

return {'val_loss': loss, "n_correct_pred": n_correct_pred, "n_pred": len(y)}

def validation_epoch_end(self, outputs):

avg_loss = torch.stack([x['val_loss'] for x in outputs]).mean()

val_acc = sum([x['n_correct_pred'] for x in outputs]) / sum(x['n_pred'] for x in outputs)

self.valid_losses.append(avg_loss.detach().cpu().item())

self.valid_accuracies.append(val_acc)

def test_step(self, batch, batch_idx):

batch, y = batch

y_hat = self(batch)

loss = F.cross_entropy(y_hat, y.long())

labels_hat = torch.argmax(y_hat, dim=1)

n_correct_pred = torch.sum(y == labels_hat).item()

return {'test_loss': loss, "n_correct_pred": n_correct_pred, "n_pred": len(y)}

def test_epoch_end(self, outputs):

avg_loss = torch.stack([x['test_loss'] for x in outputs]).mean()

test_acc = sum([x['n_correct_pred'] for x in outputs]) / sum(x['n_pred'] for x in outputs)

def predict_proba(self, test_dataloader):

"""Prediction Step"""

# Set model to eval mode

self.eval()

y_probs = []

# Iterate over val batches

with torch.no_grad():

for i, batch in enumerate(tqdm(test_dataloader)):

x, y = batch

x, y = x.to(self.device), y.to(self.device)

# Forward pass with inputs

y_prob = self(x)

# Store outputs

y_probs.extend(y_prob.cpu())

return softmax(np.vstack(y_probs), axis=1)TextCNN

The convolutional neural network for text, or TextCNN, is a helpful deep learning technique for tasks including sentiment analysis and question classification.

class TextCNN(LightningMultiClassModule):

"""

https://finisky.github.io/2020/07/03/textcnnmvp/

"""

def __init__(self, embed_num, embed_dim, class_num, kernel_num=100, kernel_sizes=[3, 4, 5], dropout=0.5):

super(TextCNN, self).__init__()

Ci = 1

Co = kernel_num

self.embed = nn.Embedding(embed_num, embed_dim)

self.convs = nn.ModuleList([nn.Conv2d(Ci, Co, (f, embed_dim), padding=(2, 0)) for f in kernel_sizes])

self.dropout = nn.Dropout(dropout)

self.fc = nn.Linear(Co * len(kernel_sizes), class_num)

def forward(self, x):

x = self.embed(x) # (N, token_num, embed_dim)

x = x.unsqueeze(1) # (N, Ci, token_num, embed_dim)

x = [F.relu(conv(x)).squeeze(3) for conv in self.convs] # [(N, Co, token_num) * len(kernel_sizes)]

x = [F.max_pool1d(i, i.size(2)).squeeze(2) for i in x] # [(N, Co) * len(kernel_sizes)]

x = torch.cat(x, 1) # (N, Co * len(kernel_sizes))

x = self.dropout(x) # (N, Co * len(kernel_sizes))

logit = self.fc(x) # (N, class_num)

return logit

def configure_optimizers(self):

optimiser = torch.optim.Adam(self.parameters(), lr=self.learning_rate)

# scheduler = torch.optim.lr_scheduler.StepLR(optimizer, step_size=1, gamma=0.1)

# return [optimizer], [scheduler]

return optimiser

def init_weights(m):

if type(m) == nn.Linear:

torch.nn.init.xavier_uniform(m.weight)

m.bias.data.fill_(0.01)Start Training Process

The process of training an ML model entails sending training data to an ML algorithm (that is, the learning algorithm).

textcnn = TextCNN(embed_num=len(tokenizer.vocab),

embed_dim=Config.EMBEDDING_SIZE,

class_num=Config.NUM_CLASSES,

kernel_num=Config.NUM_KERNELS,

kernel_sizes=[3, 4, 5],

dropout=Config.DROPOUT_RATE)

textcnn.learning_rate = 3e-5

textcnn.apply(init_weights)

trainer = pl.Trainer(gpus=1, precision=16, fast_dev_run=False, max_epochs=20, num_sanity_val_steps=0)

trainer.fit(textcnn, train_dataloader, valid_dataloader)Performance

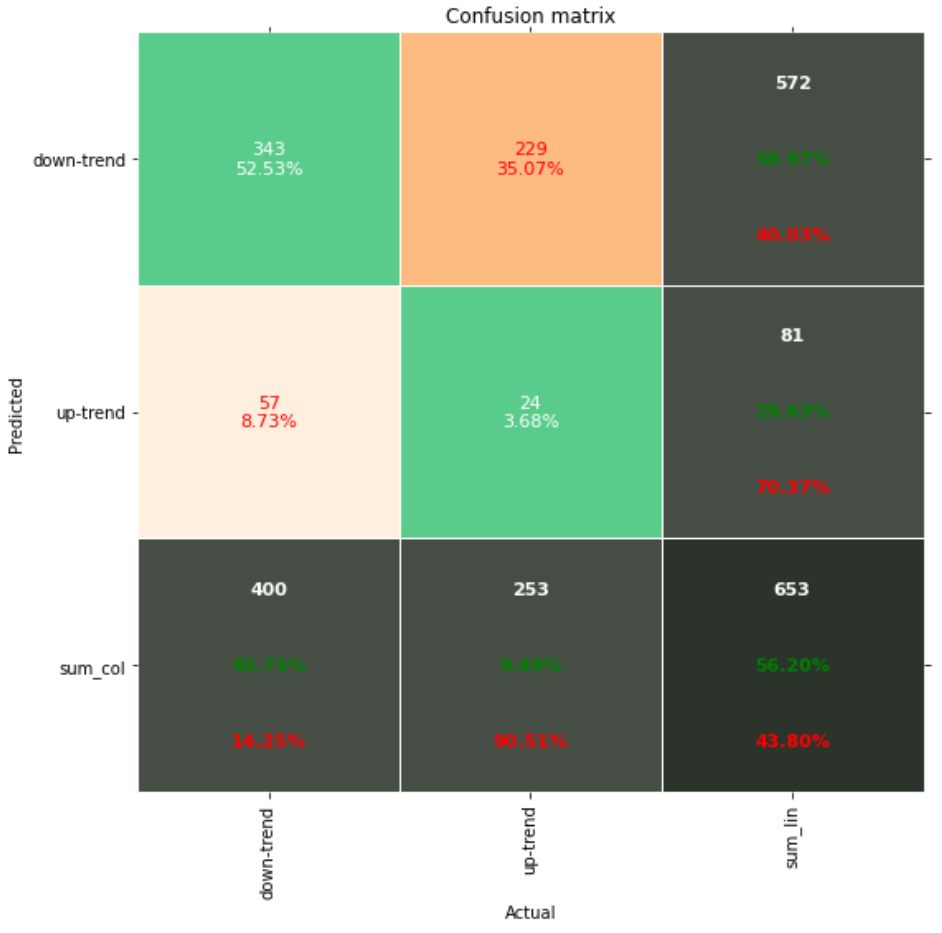

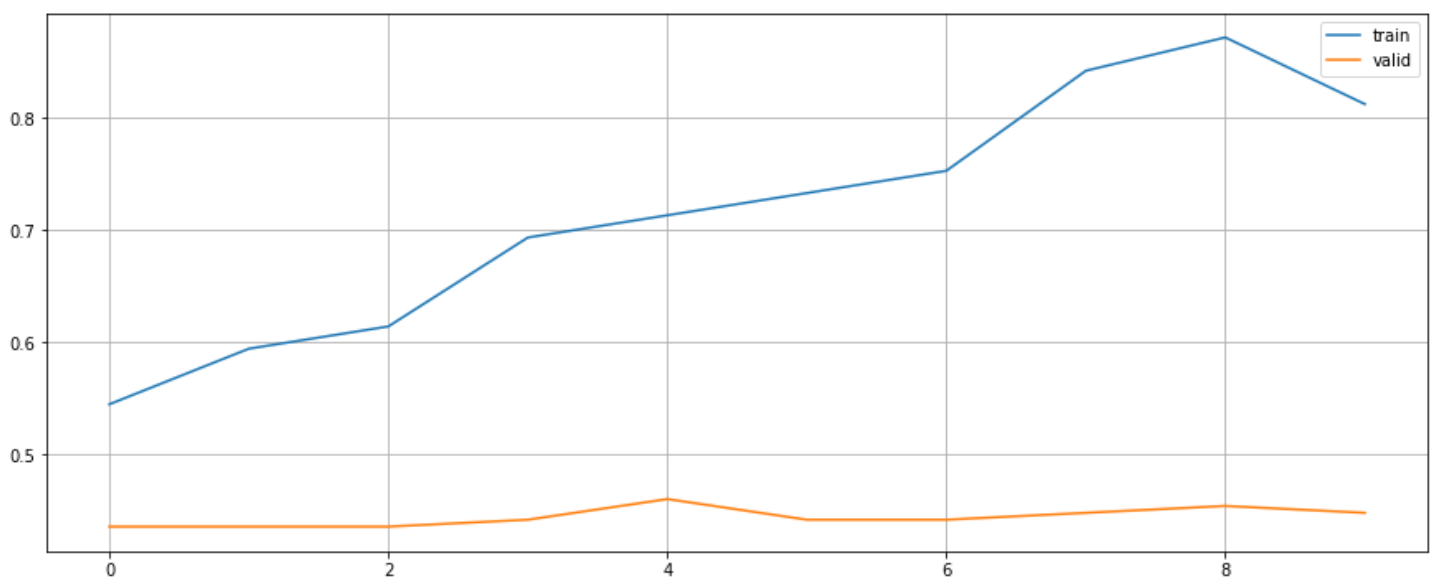

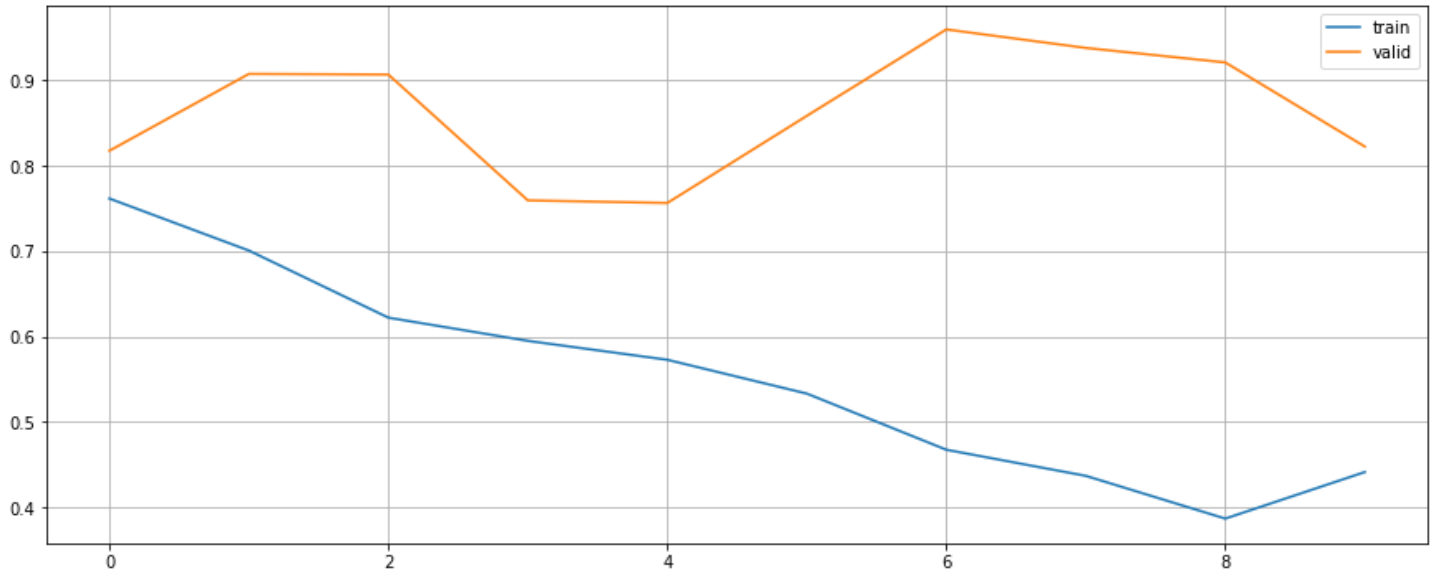

After training 20 epochs, we can get f1 score of 48.7999% and accuracy of 56.2021%.

test_probs = textcnn.predict_proba(test_dataloader)

test_preds = np.argmax(test_probs, axis=1)

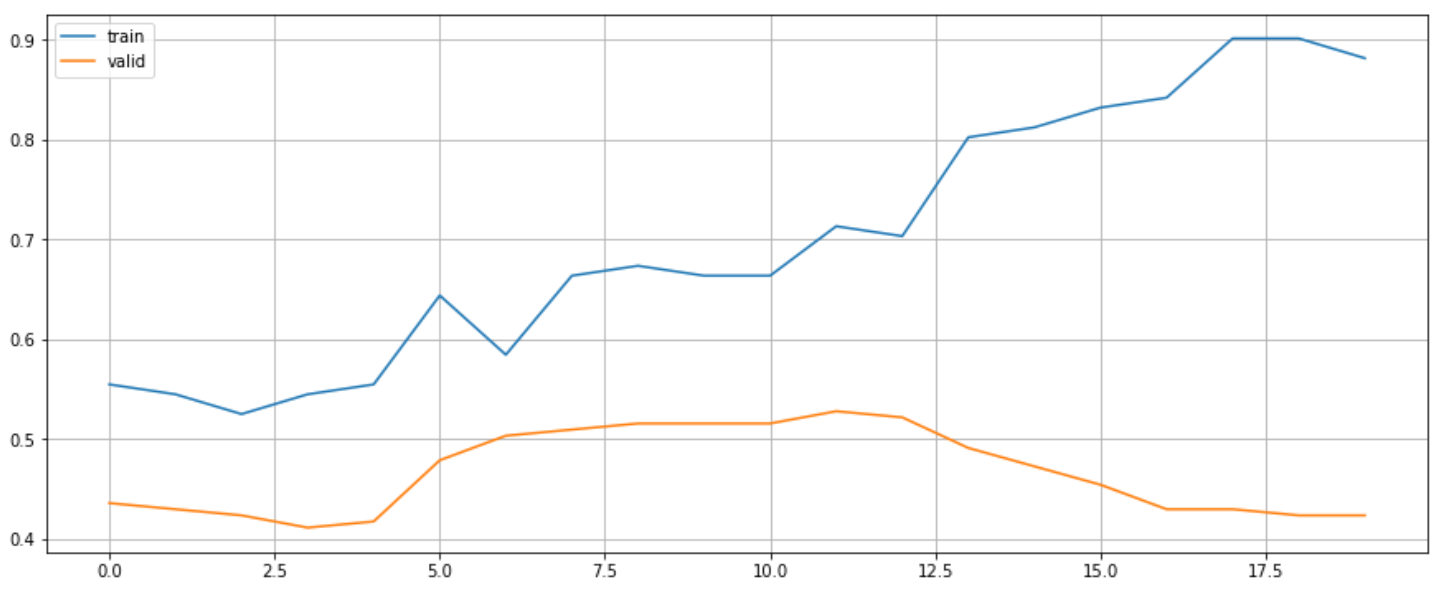

metrics.f1_score(y_test, test_preds, average="weighted"), metrics.accuracy_score(y_test, test_preds)Accuracy curve is as follow.

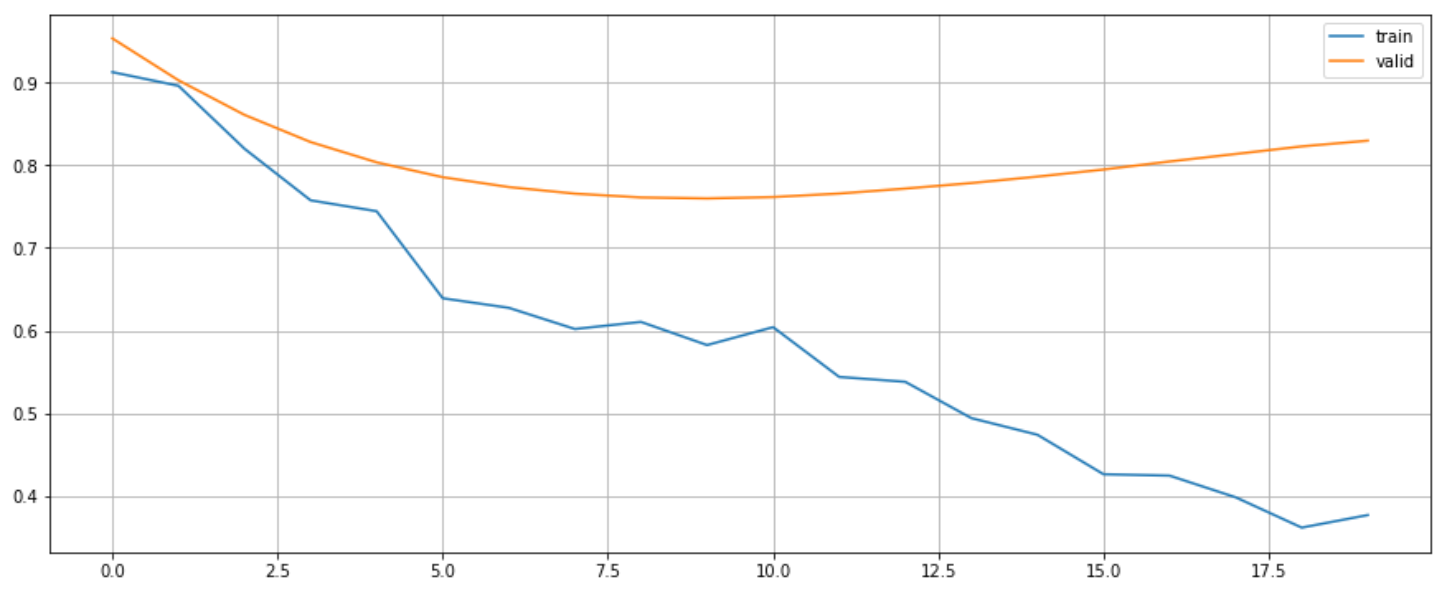

Loss curve is as follow.

Confusion matrix is as follow.

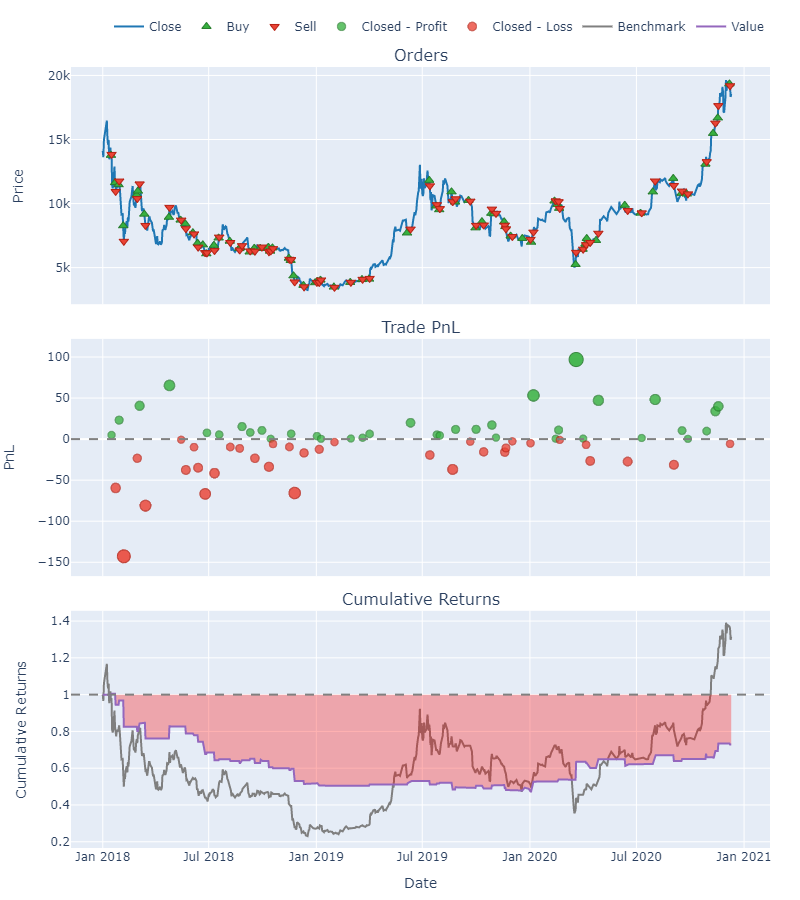

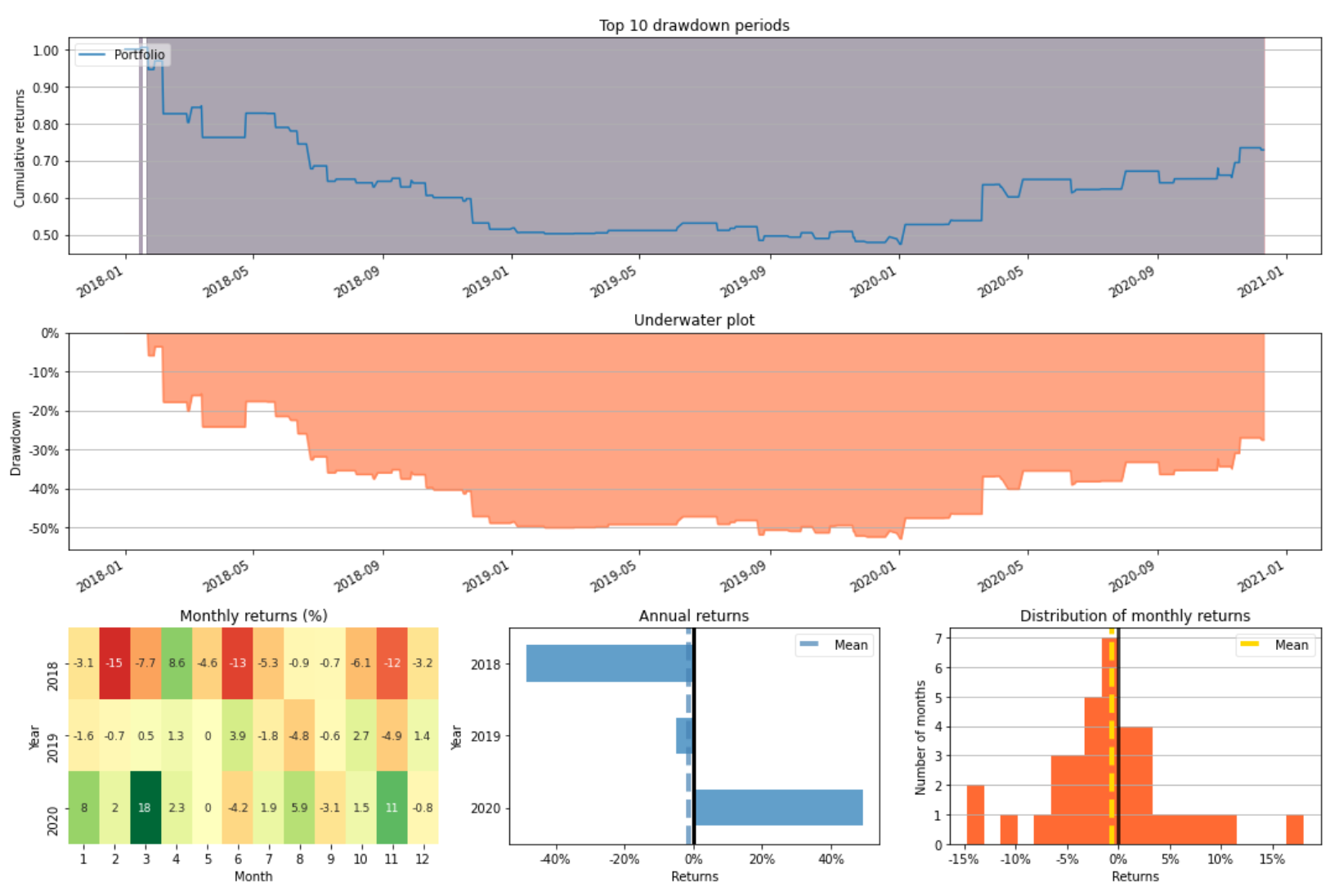

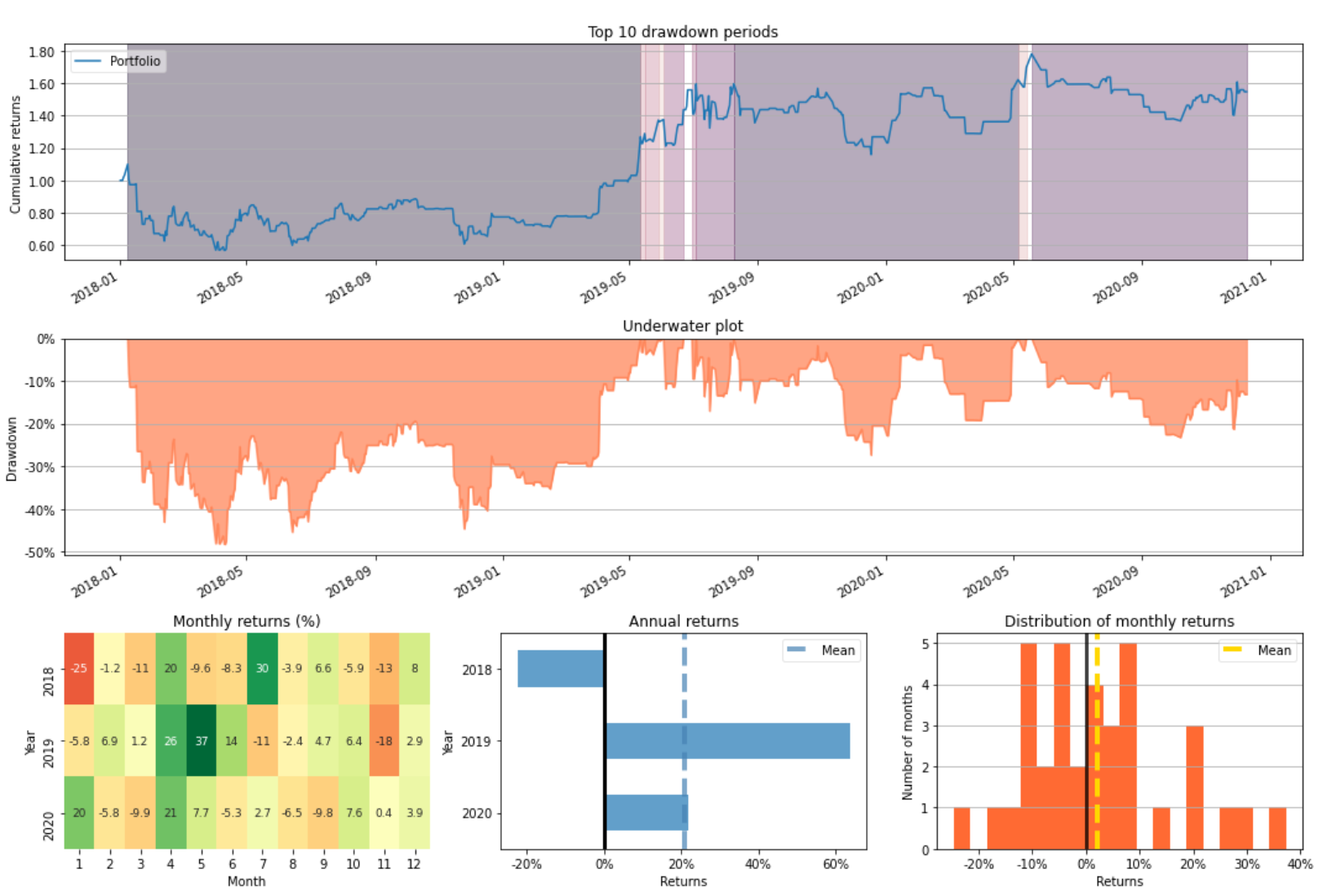

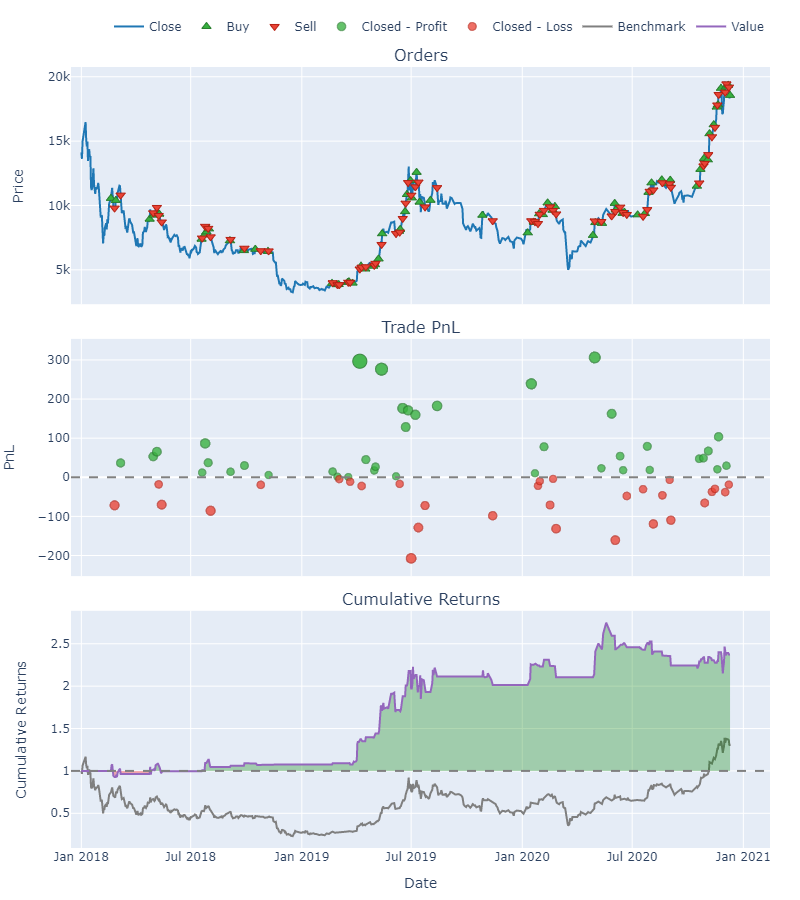

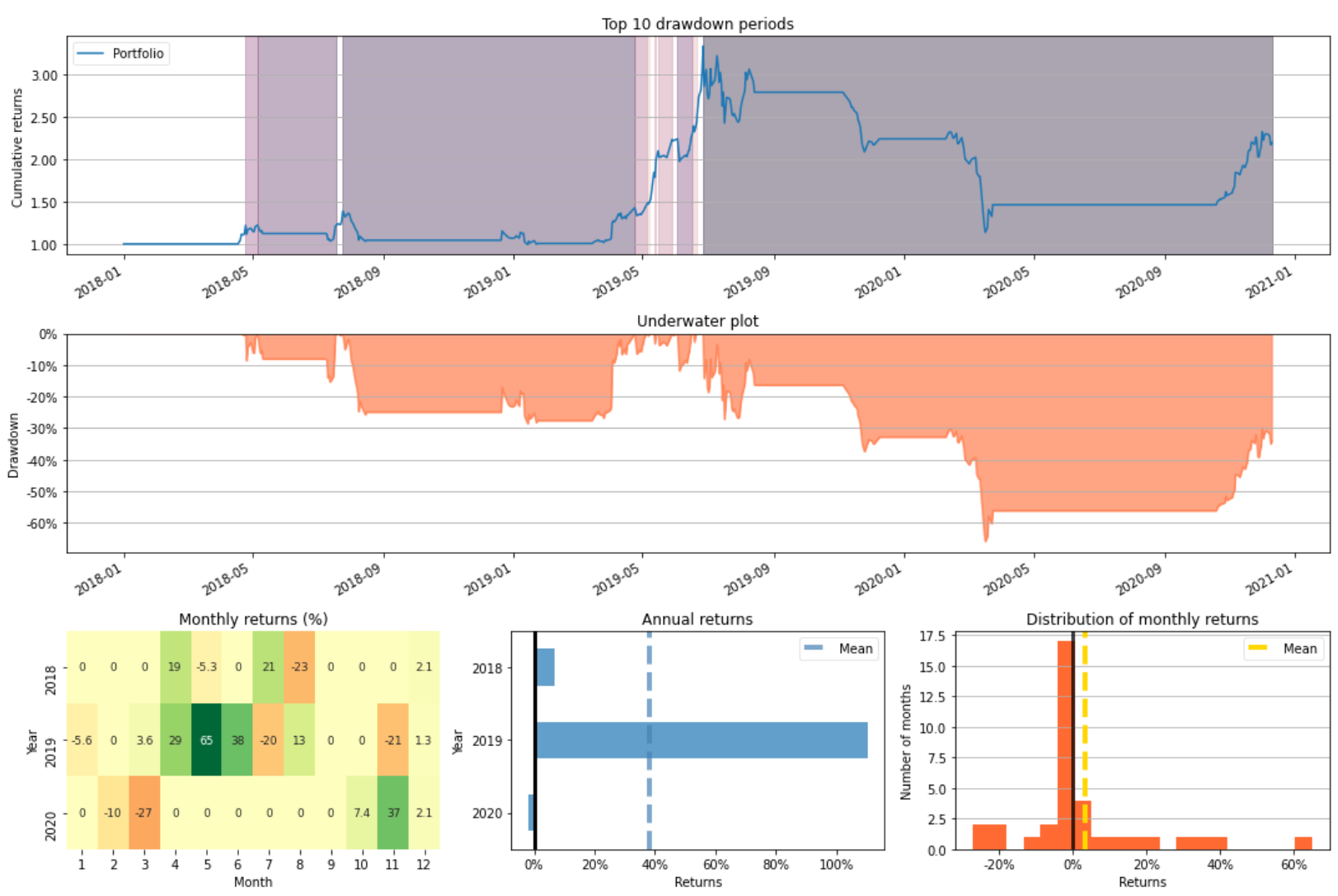

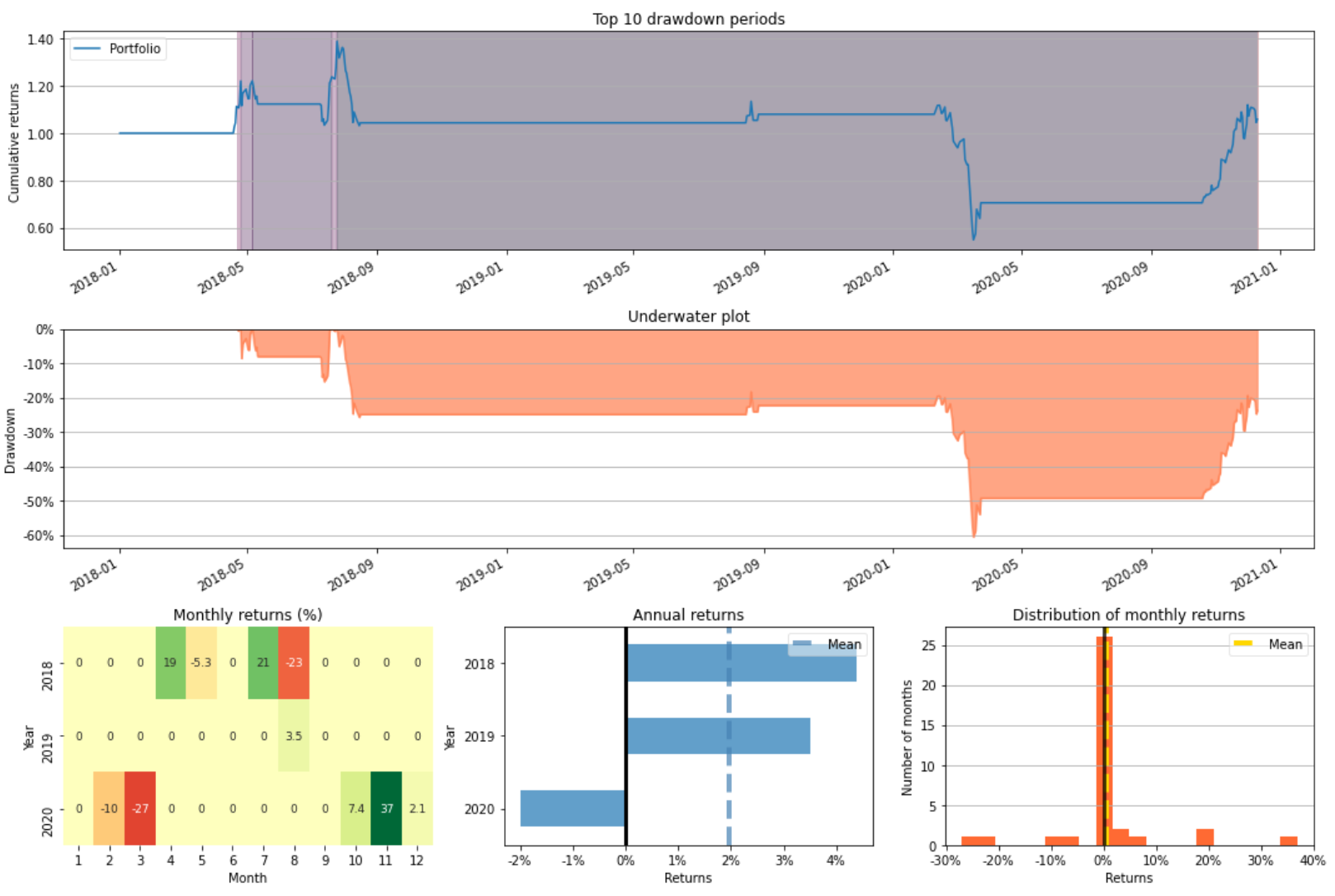

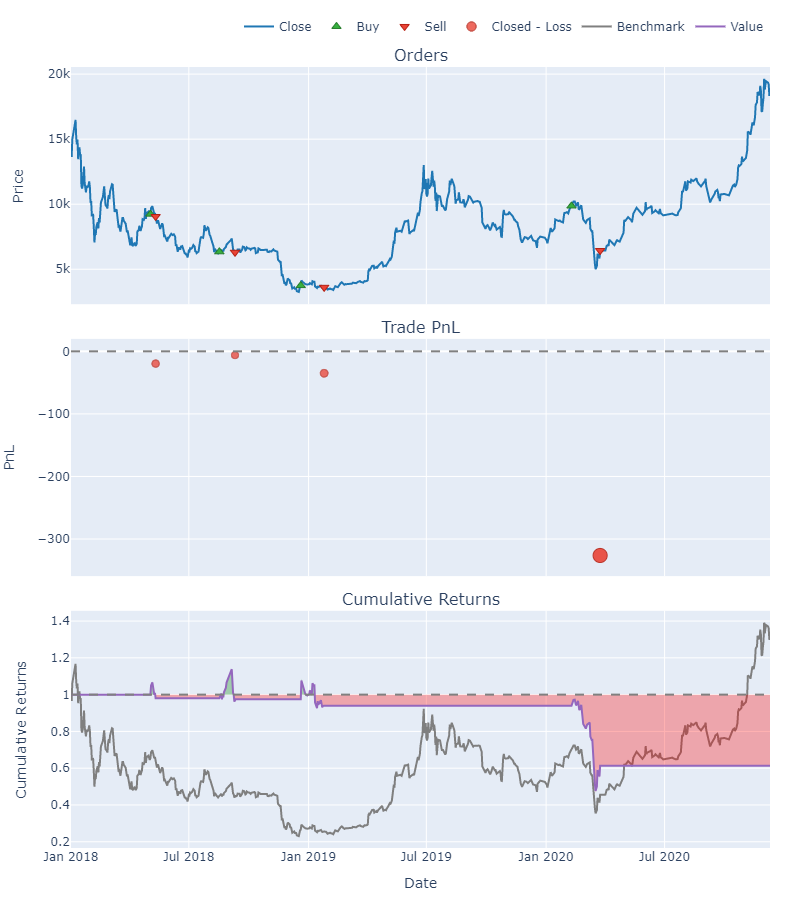

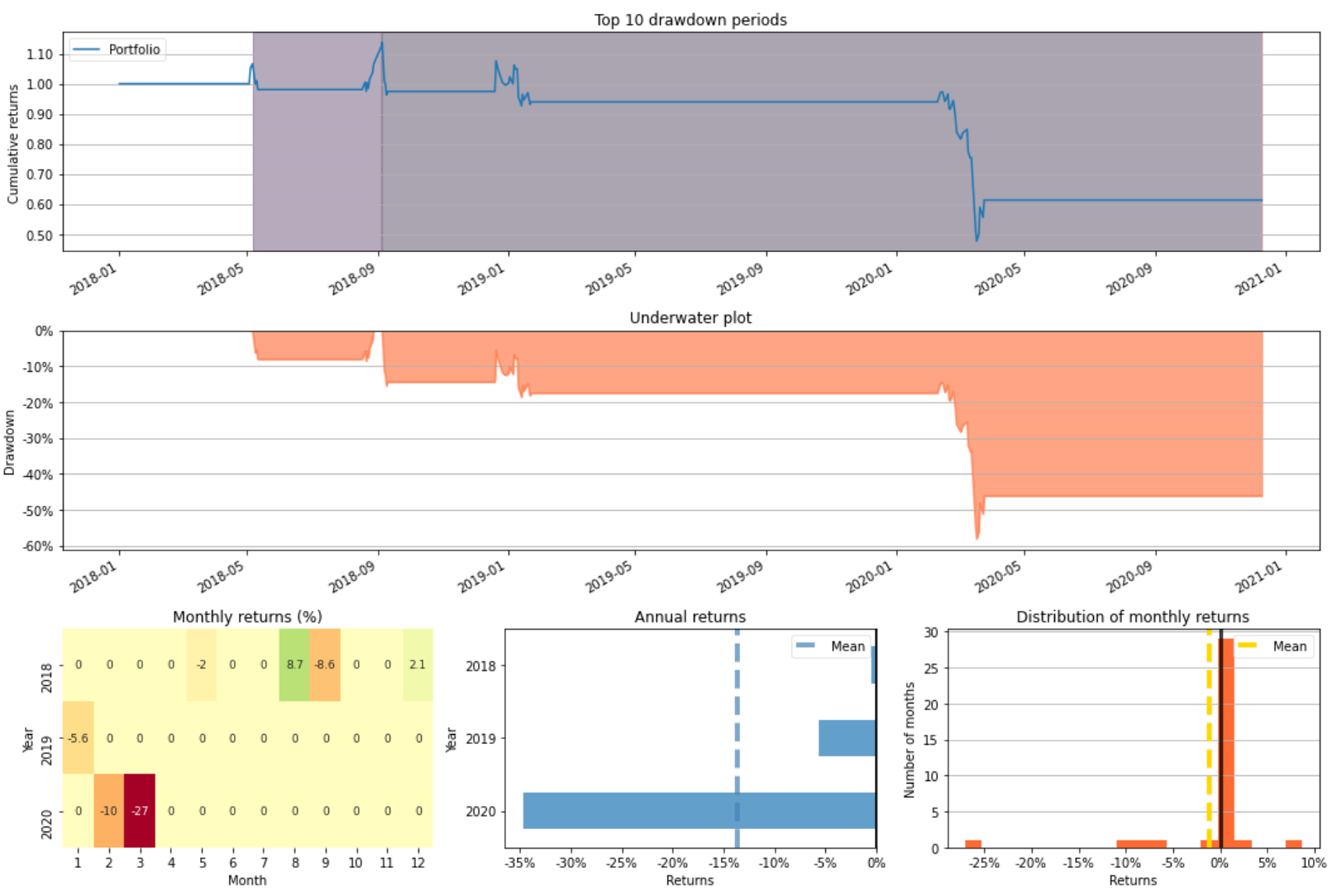

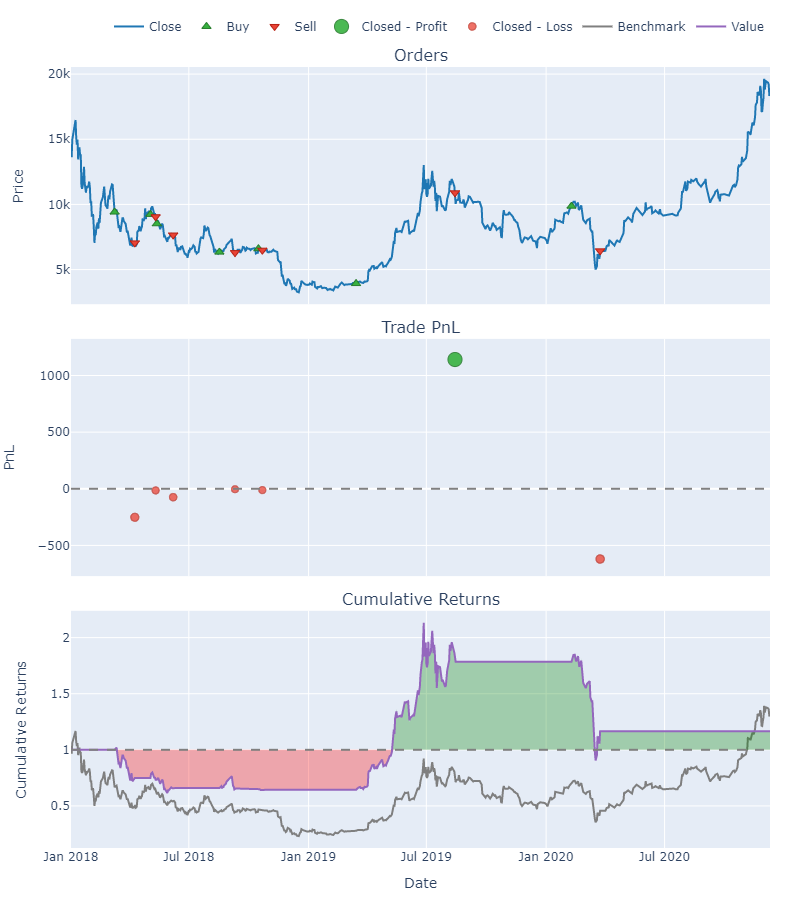

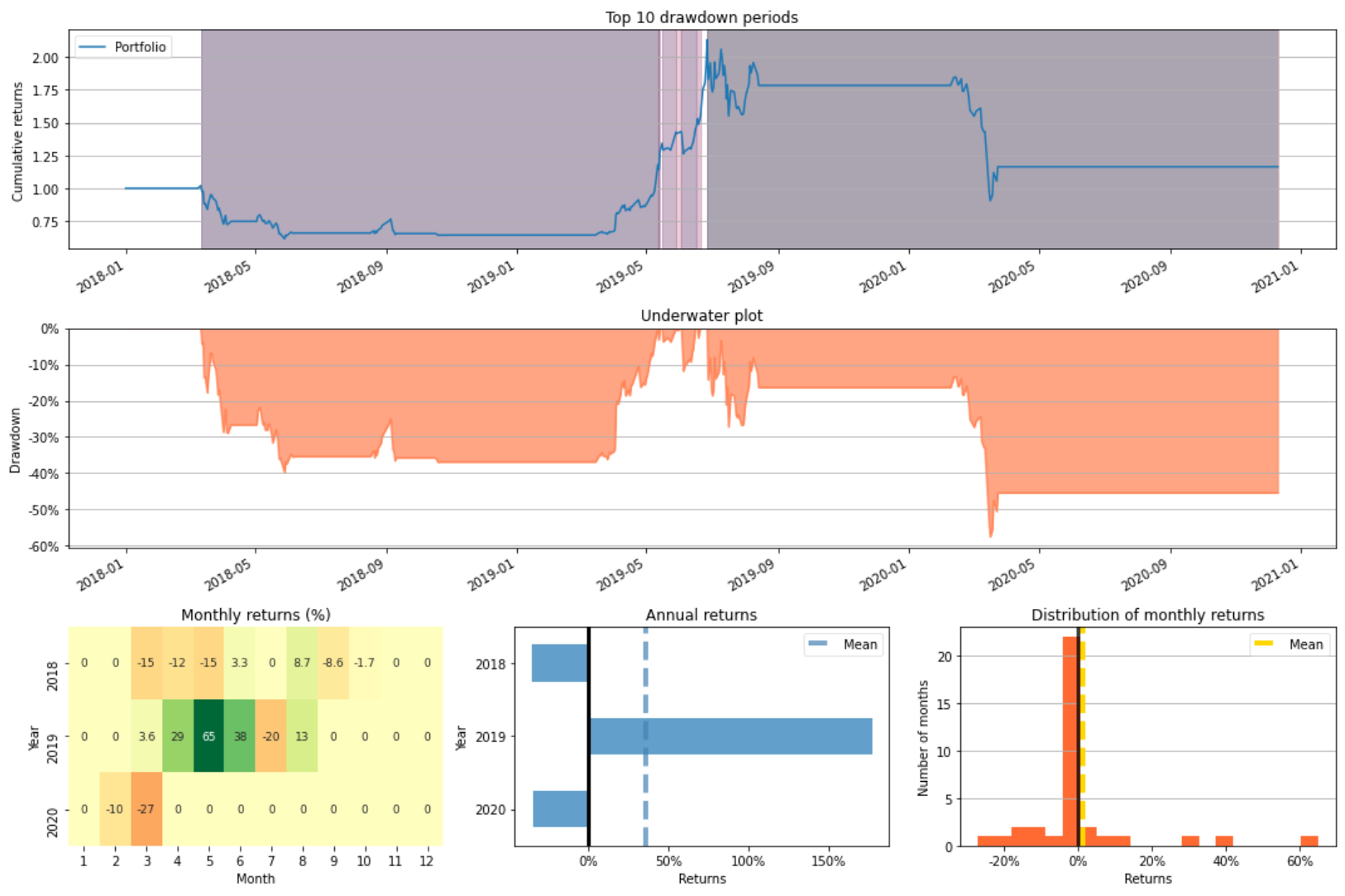

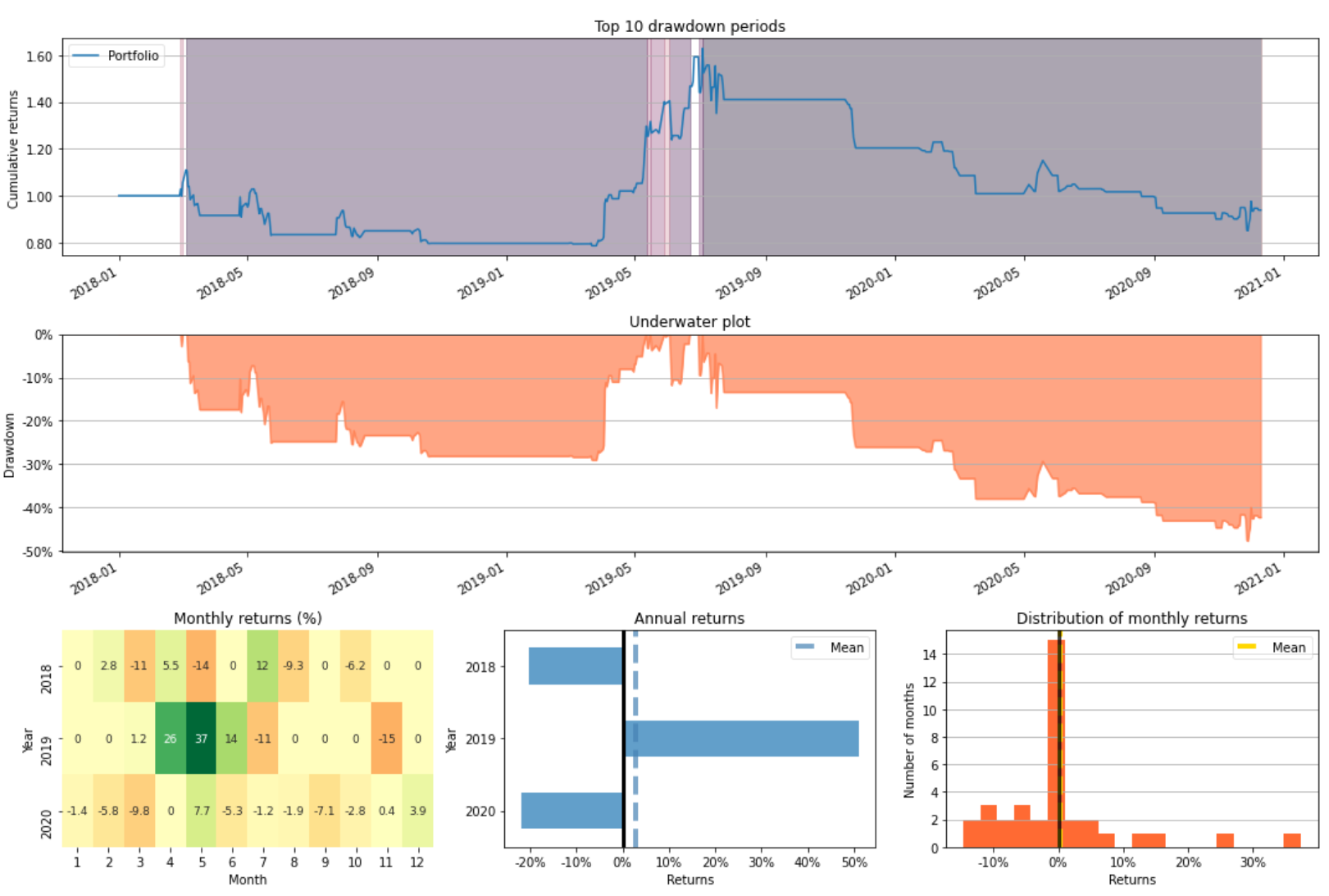

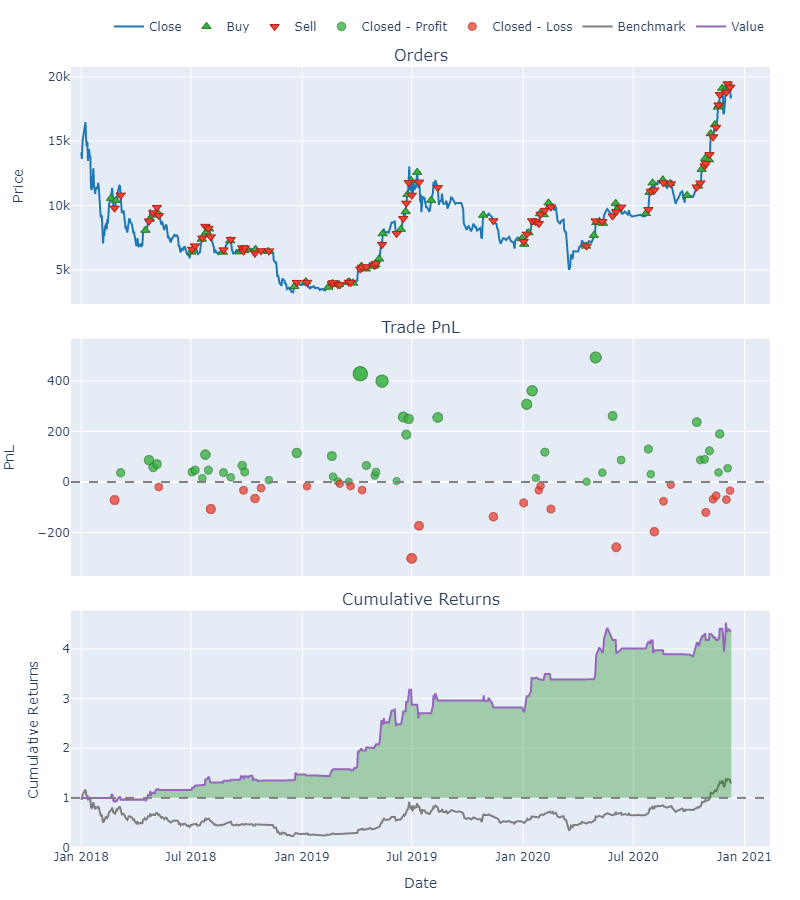

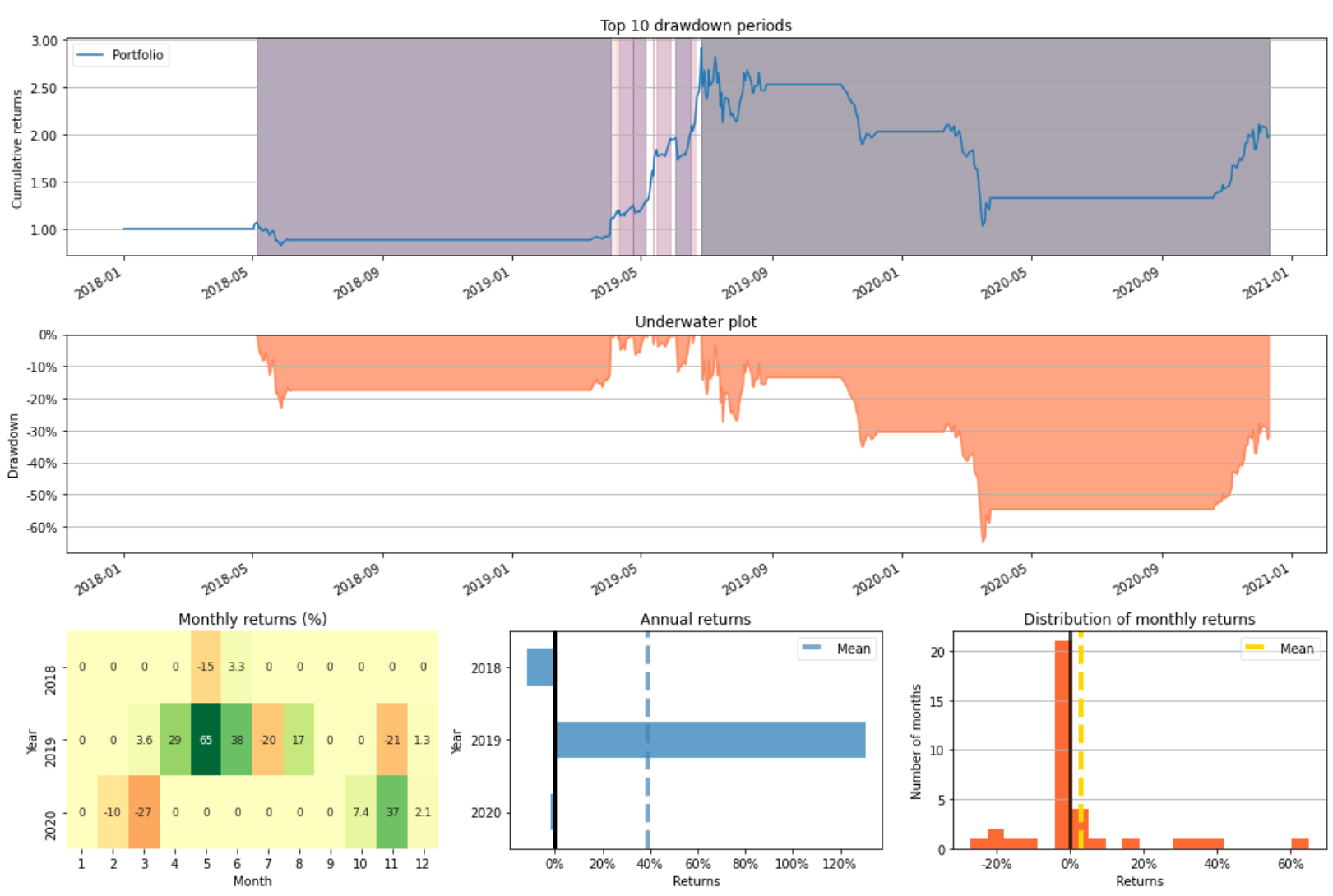

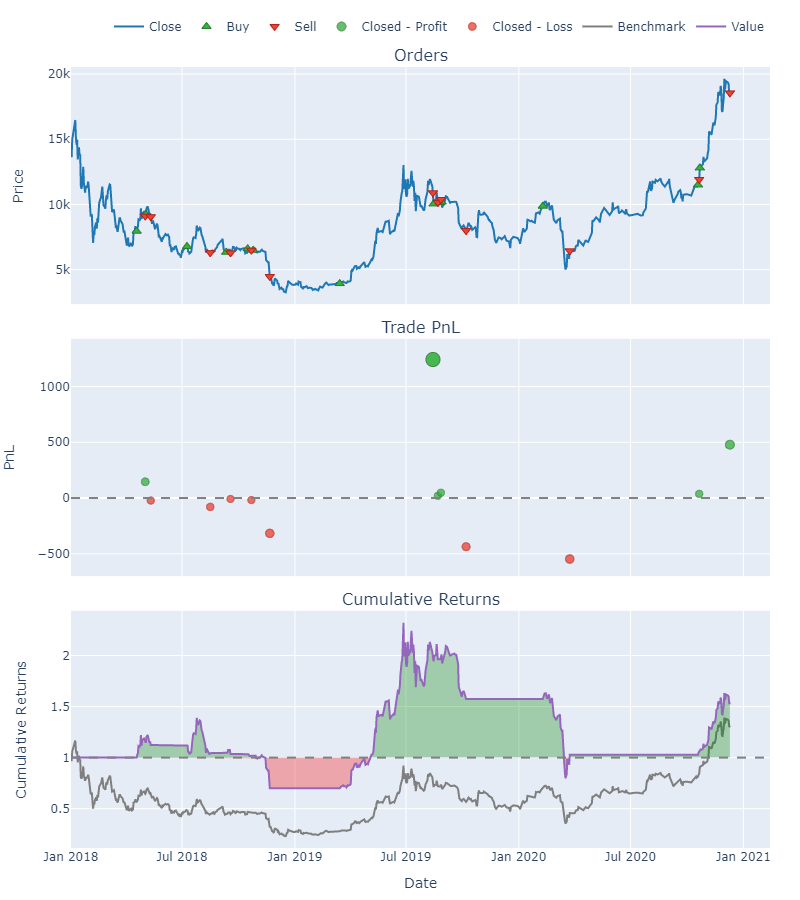

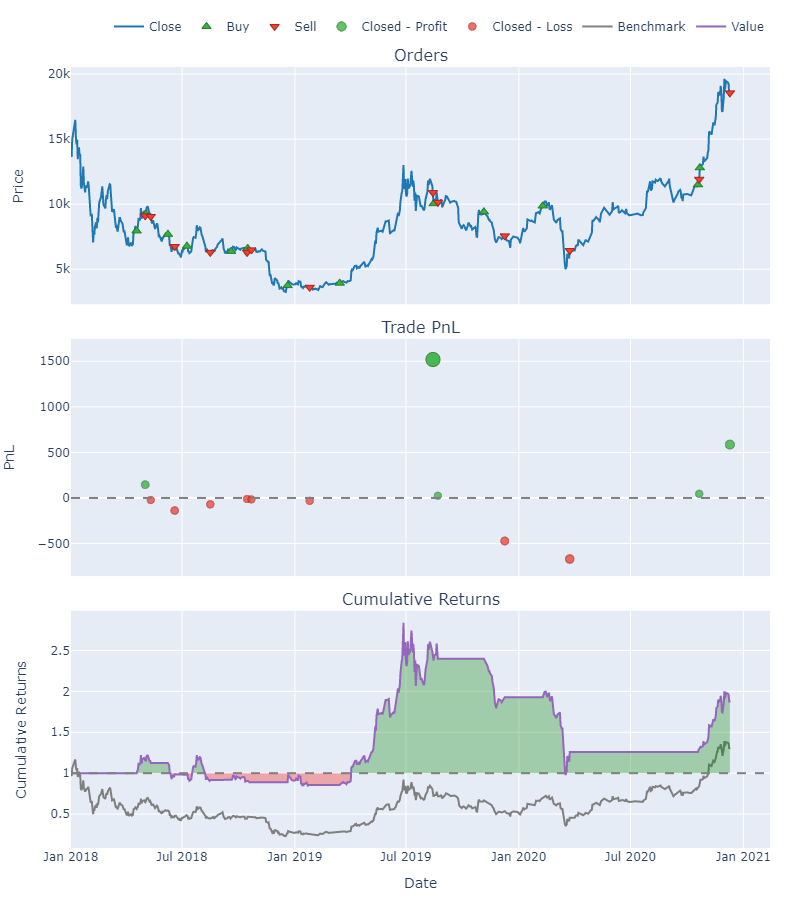

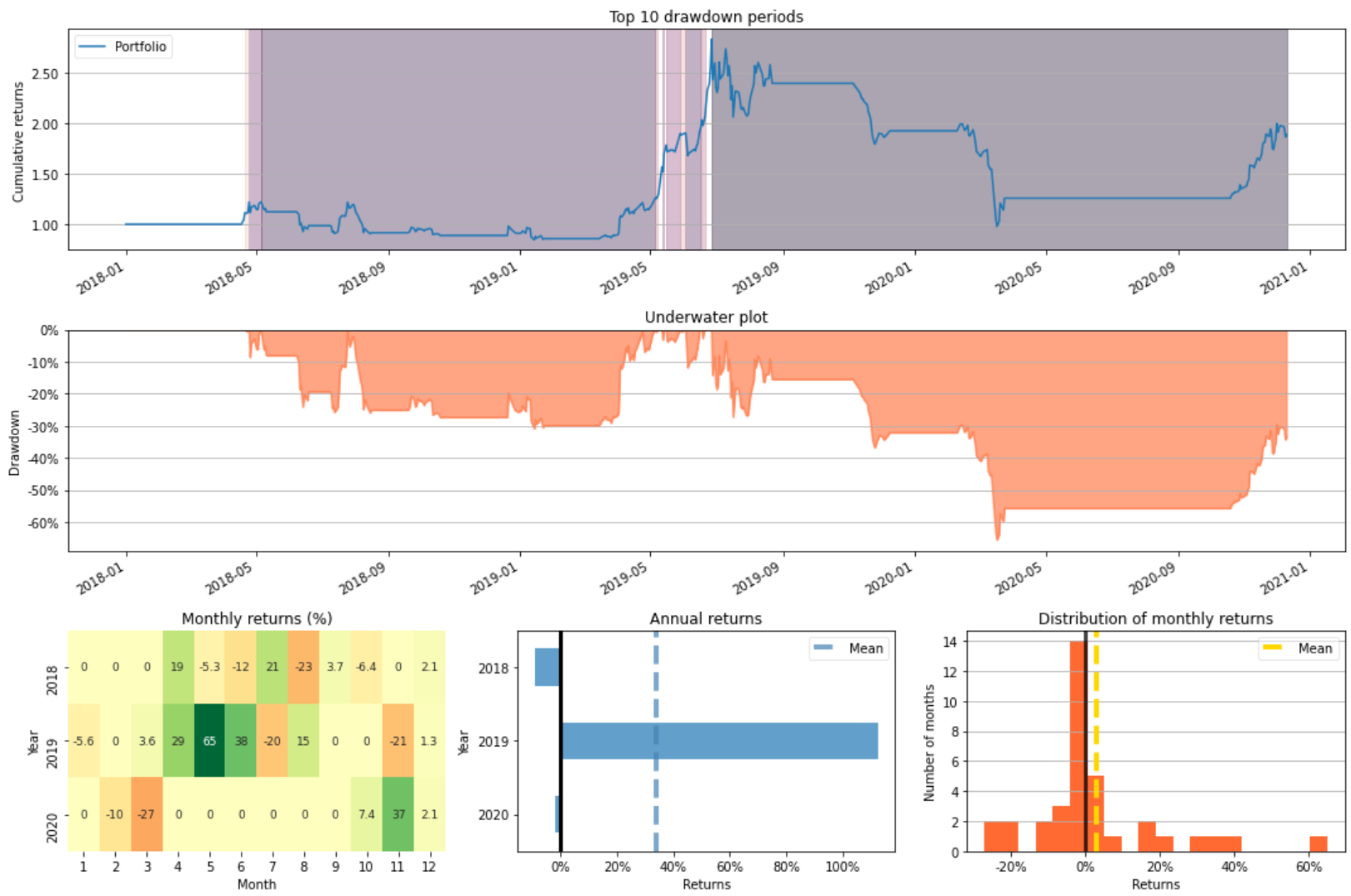

Backtest

Backtesting is a way for determining how well a strategy or model would have performed in the absence of the strategy or model. Backtesting is a method of determining the viability of a trading strategy by examining how it would perform in the real world using previous data. If backtesting proves to be effective, traders and analysts may be more willing to use it in the future.

trends = np.argmax(test_probs, axis=1)

entries, exits = trend_to_signal(pd.Series(trends))

price_test = text_price_df.iloc[-X_test.shape[0]:]

mlbp_textcnn = MachineLearningBacktestPortfolio(price_test.open,

entries,

exits,

show=True)

mlbp_textcnn.plot_risk(figsize=(15, 10))

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit -271.728922

Total Return [%] -27.172892

Benchmark Return [%] 31.469924

Position Coverage [%] 12.404288

Max. Drawdown [%] 52.866542

Avg. Drawdown [%] 26.433271

Max. Drawdown Duration 636 days 00:00:00

Avg. Drawdown Duration 319 days 00:00:00

Num. Trades 70

Win Rate [%] 51.428571

Best Trade [%] 18.039317

Worst Trade [%] -14.736523

Avg. Trade [%] -0.335031

Max. Trade Duration 3 days 00:00:00

Avg. Trade Duration 1 days 03:46:17.142857142

Expectancy -3.881842

SQN -0.96268

Gross Exposure 0.124043

Sharpe Ratio -0.418759

Sortino Ratio -0.581125

Calmar Ratio -0.307222BERT

Google created a Transformer-based machine learning methodology for natural language processing pre-training called Bidirectional Encoder Representations from Transformers. Jacob Devlin and his Google colleagues designed and published BERT in 2018.

from transformers import BertModel, AdamW

class BERTBaseUncased(LightningMultiClassModule):

def __init__(self, num_classes, learning_rate=3e-5):

super(BERTBaseUncased, self).__init__()

self.learning_rate = learning_rate

self.bert = BertModel.from_pretrained("bert-base-uncased")

self.dropout = nn.Dropout(0.3)

self.bn = nn.BatchNorm1d(768)

self.classifier = nn.Linear(768, num_classes)

def forward(self, x):

outputs = self.bert(x)

b_o = self.dropout(outputs.pooler_output)

logits = self.classifier(self.bn(b_o))

return logits

def freeze_bert_encoder(self):

for param in self.bert.parameters():

param.requires_grad = False

def unfreeze_bert_encoder(self):

for param in self.bert.parameters():

param.requires_grad = True

def configure_optimizers(self):

optimizer = AdamW(self.parameters(), lr=self.learning_rate)

return optimizerStart Training Process

bert = BERTBaseUncased(num_classes=Config.NUM_CLASSES)

bert.unfreeze_bert_encoder()

trainer = pl.Trainer(gpus=1,

precision=16,

fast_dev_run=False,

max_epochs=10,

num_sanity_val_steps=0,

deterministic=True)

trainer.fit(bert, train_dataloader, valid_dataloader)Performance

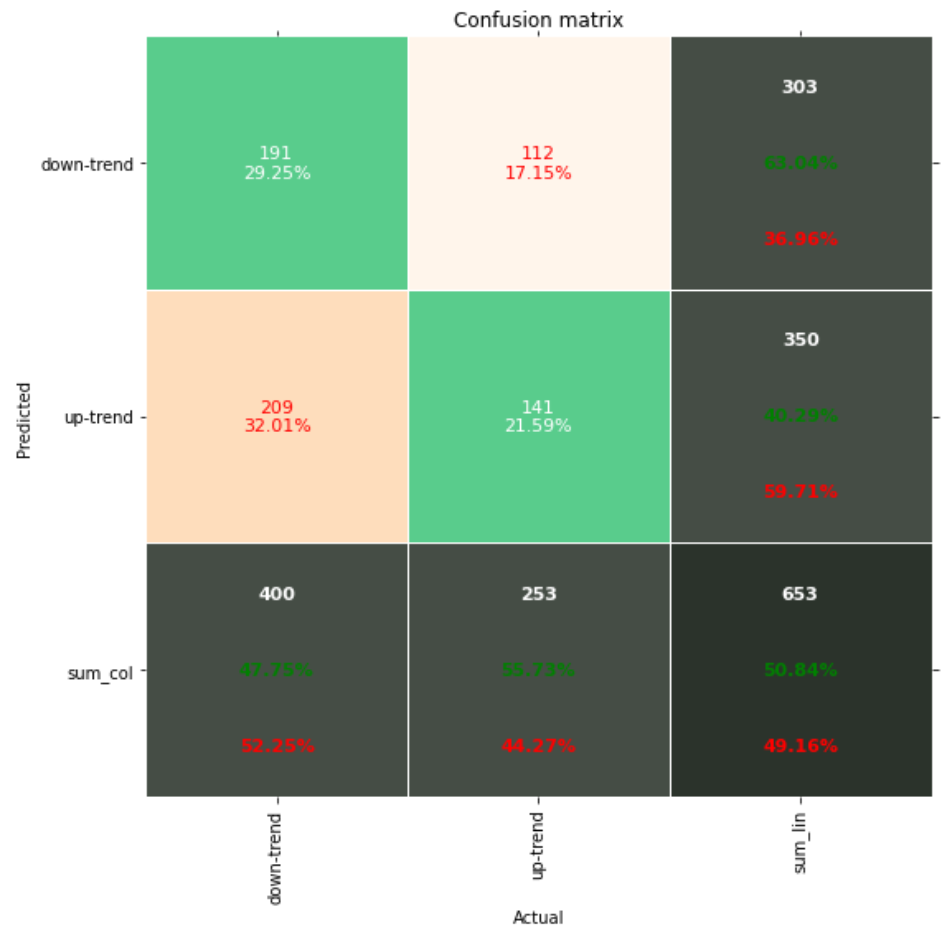

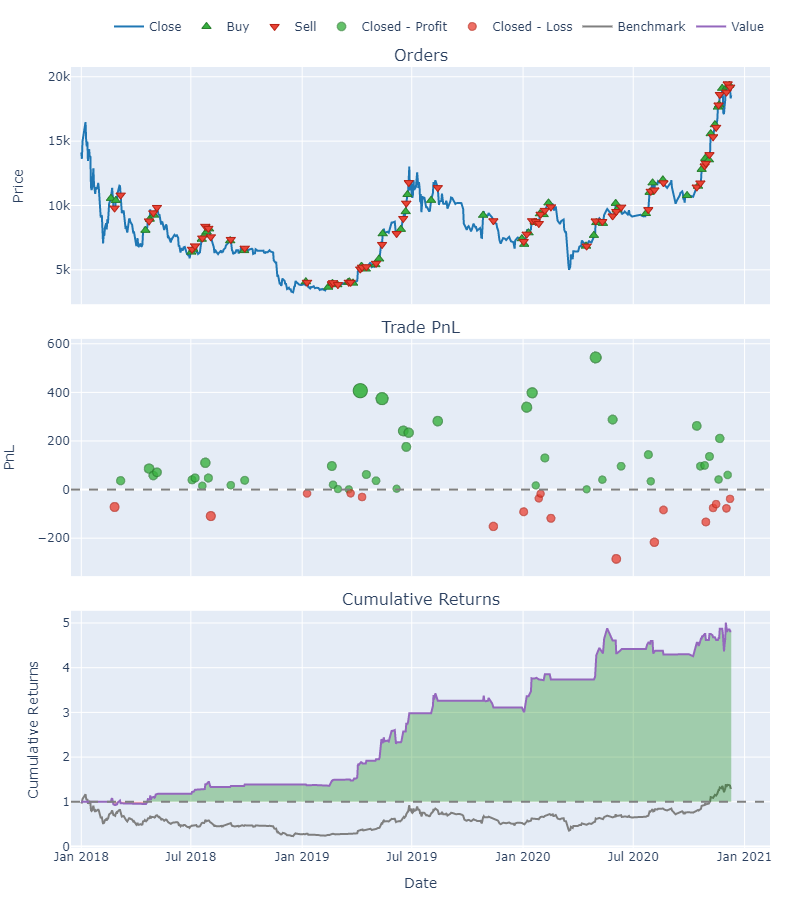

After training 20 epochs, we can get f1 score of 51.4047% and accuracy of 50.8423%.

test_probs = bert.predict_proba(test_dataloader)

test_preds = np.argmax(test_probs, axis=1)

metrics.f1_score(y_test, test_preds, average="weighted"), metrics.accuracy_score(y_test, test_preds)Accuracy curve is as follow.

Loss curve is as follow.

Confusion matrix is as follow.

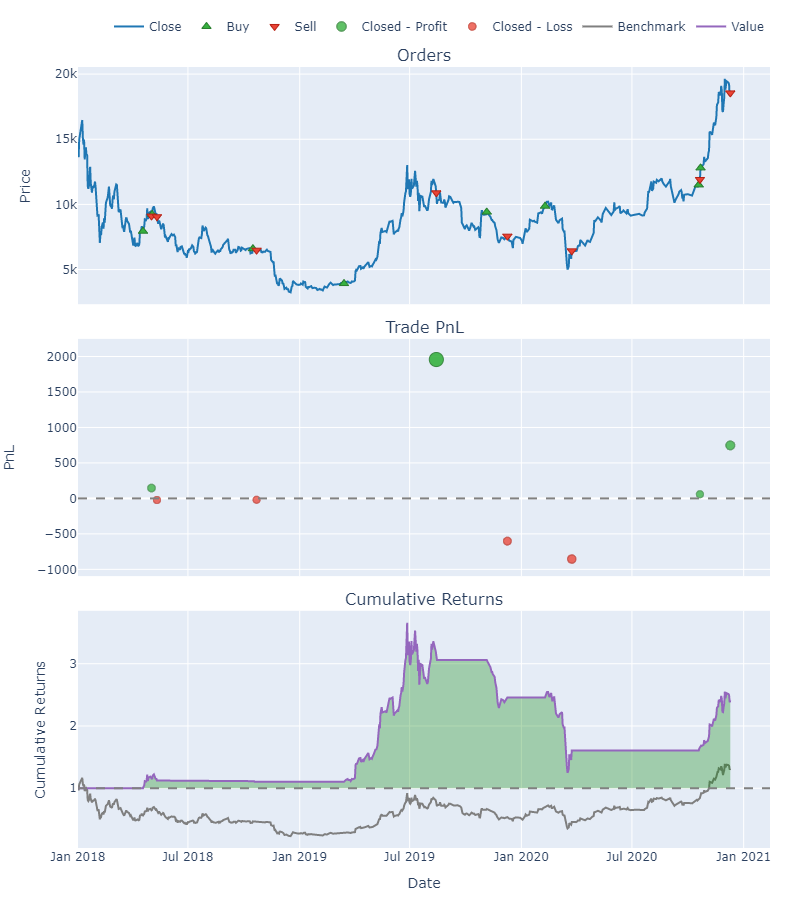

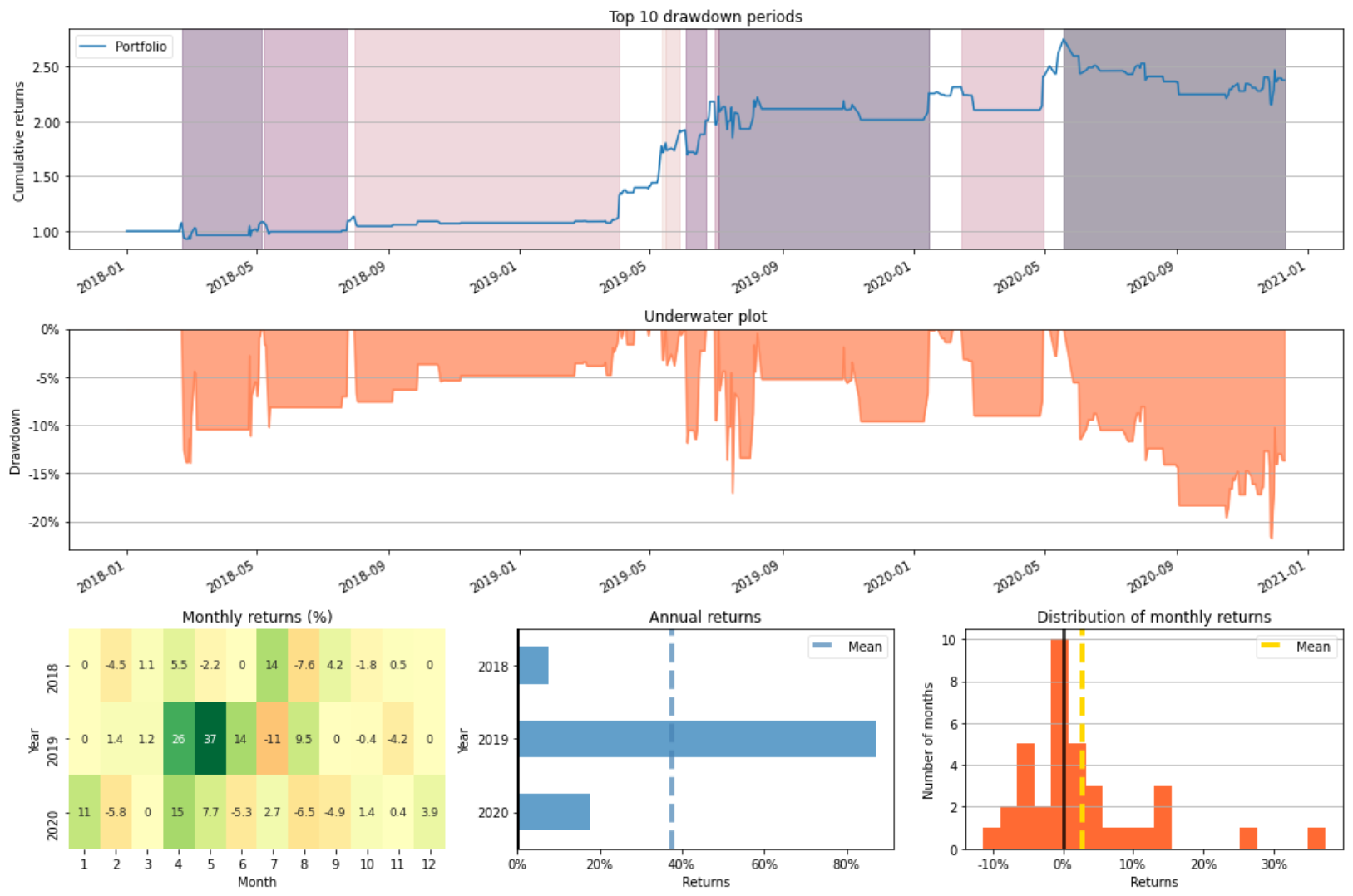

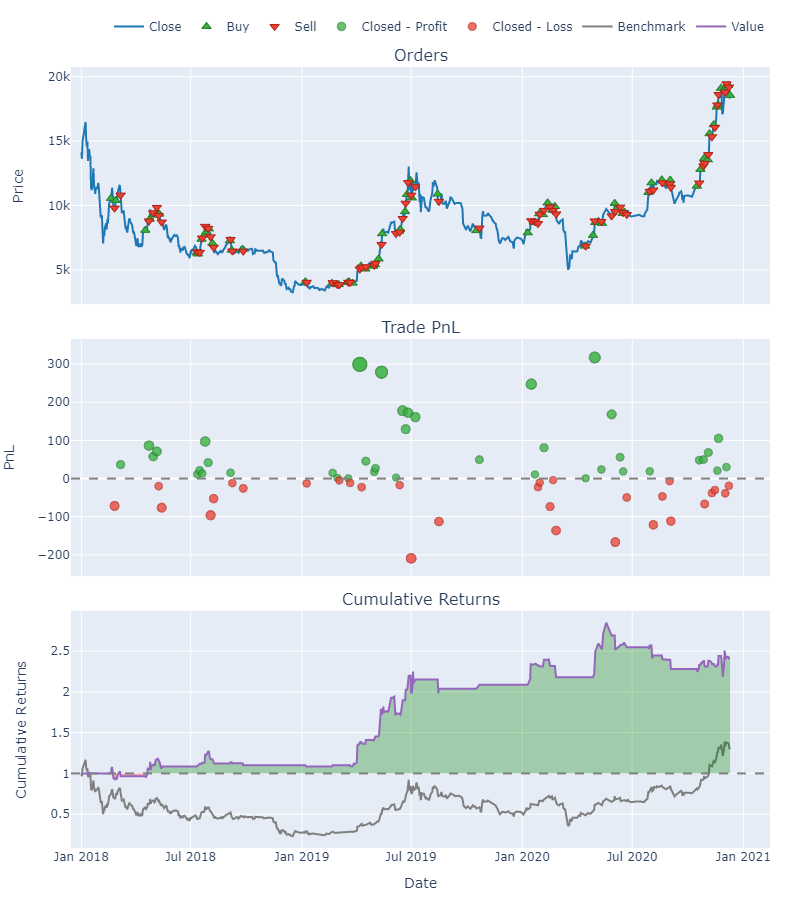

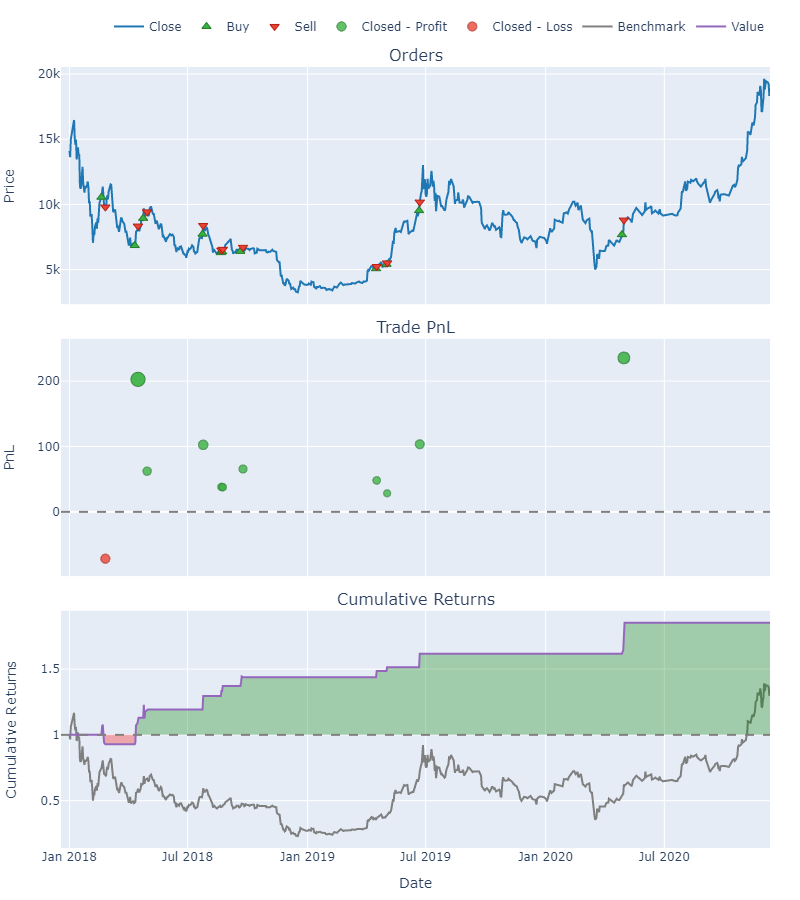

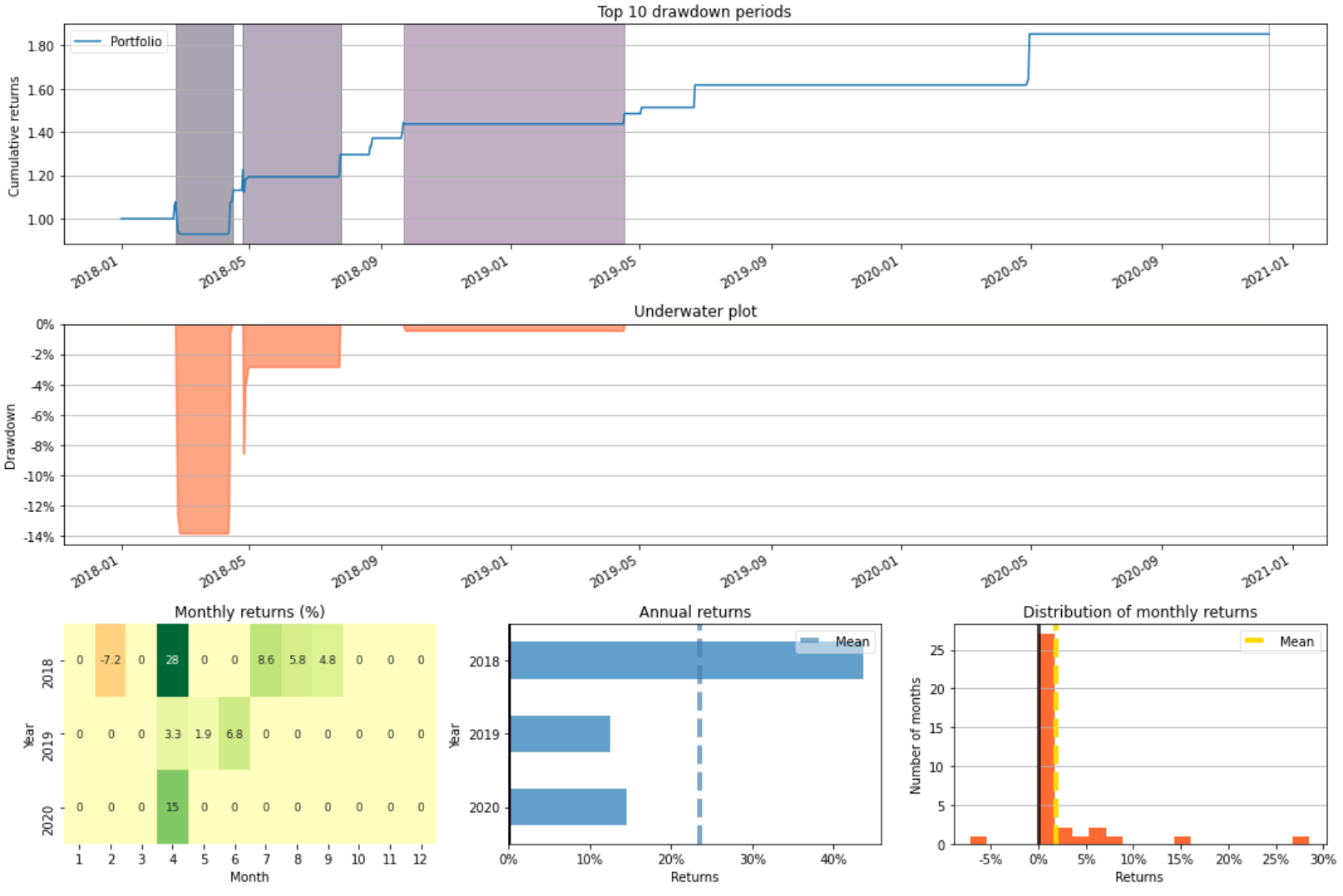

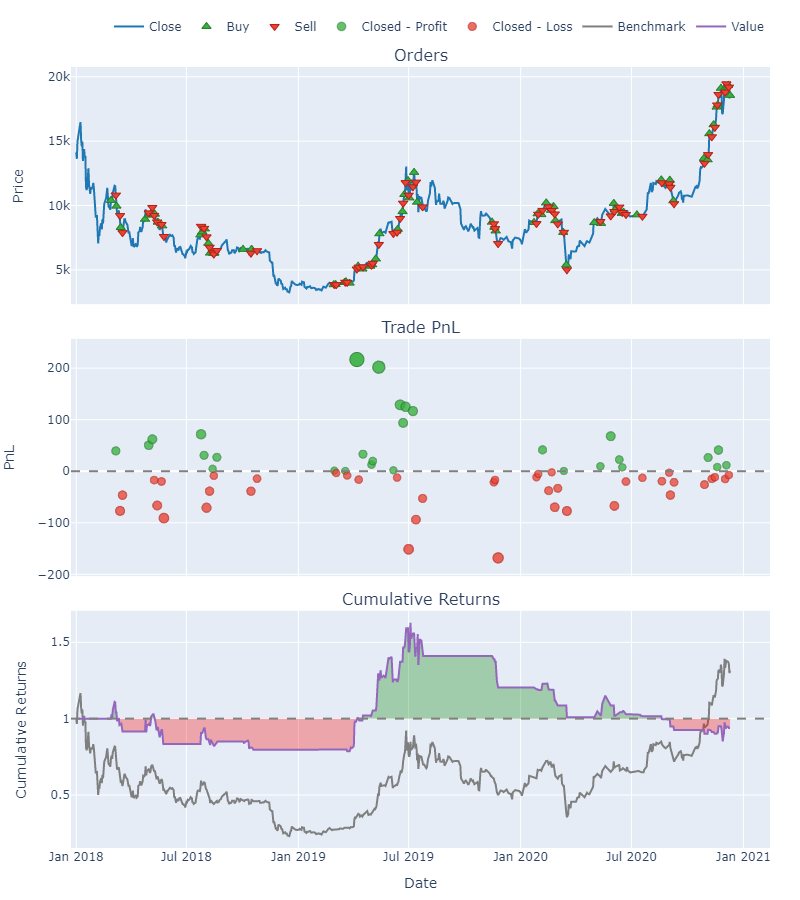

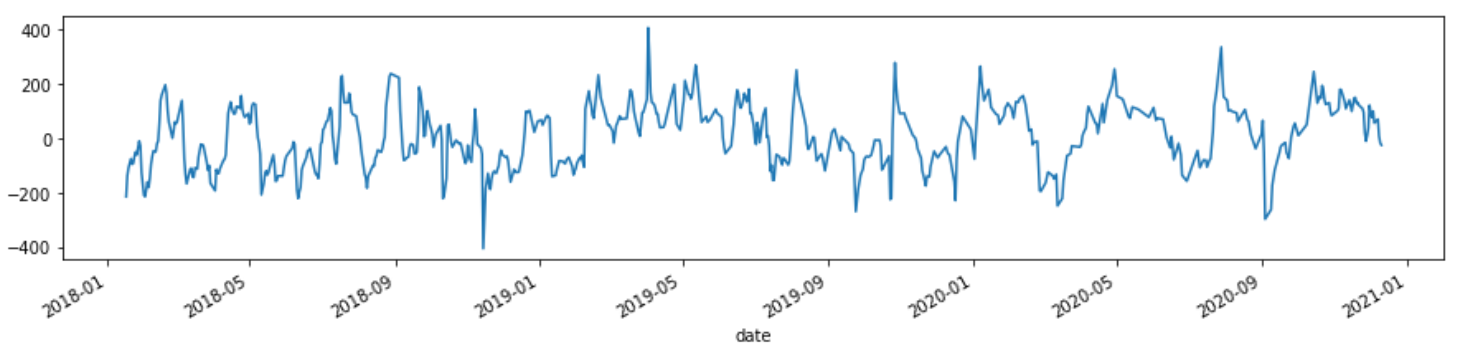

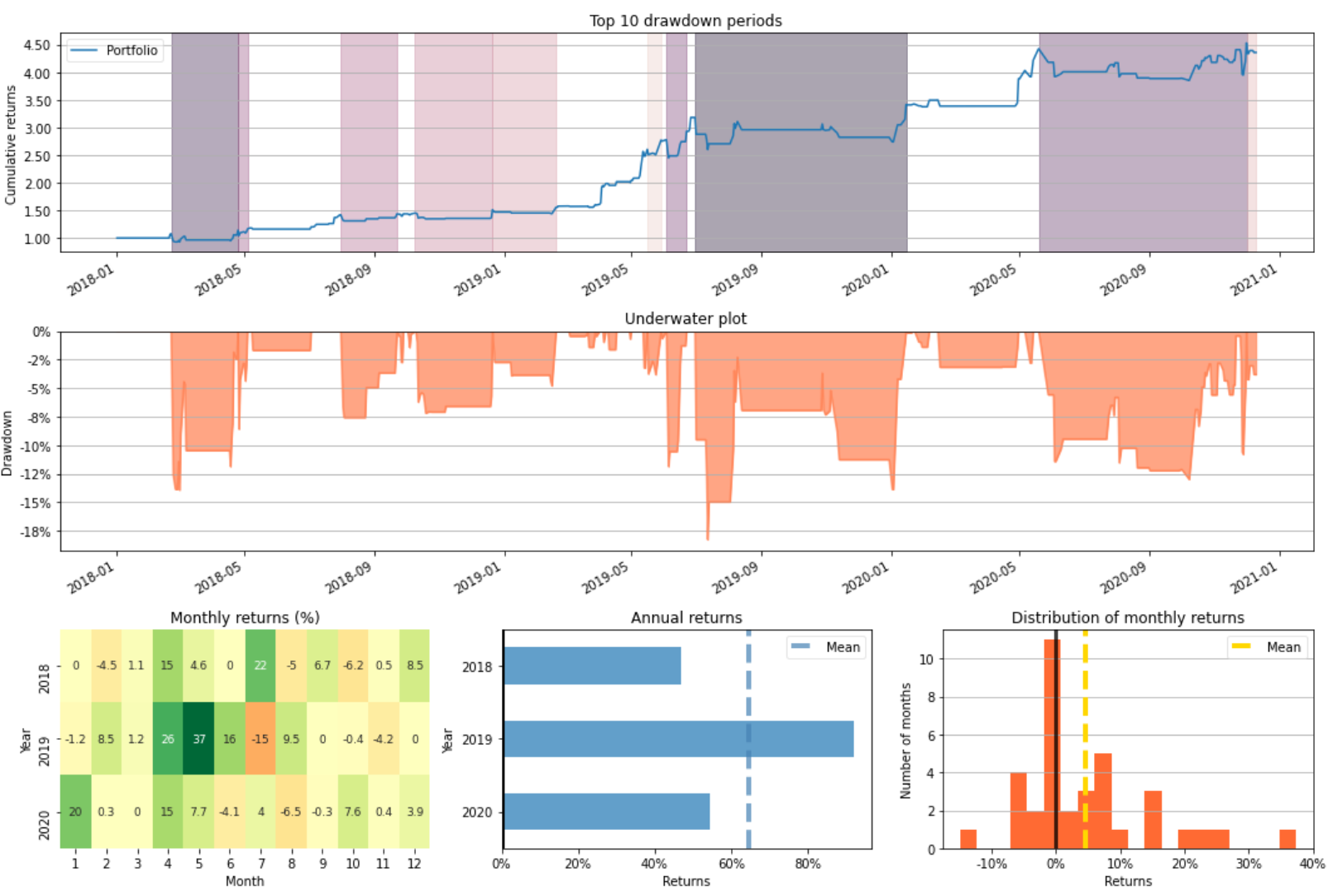

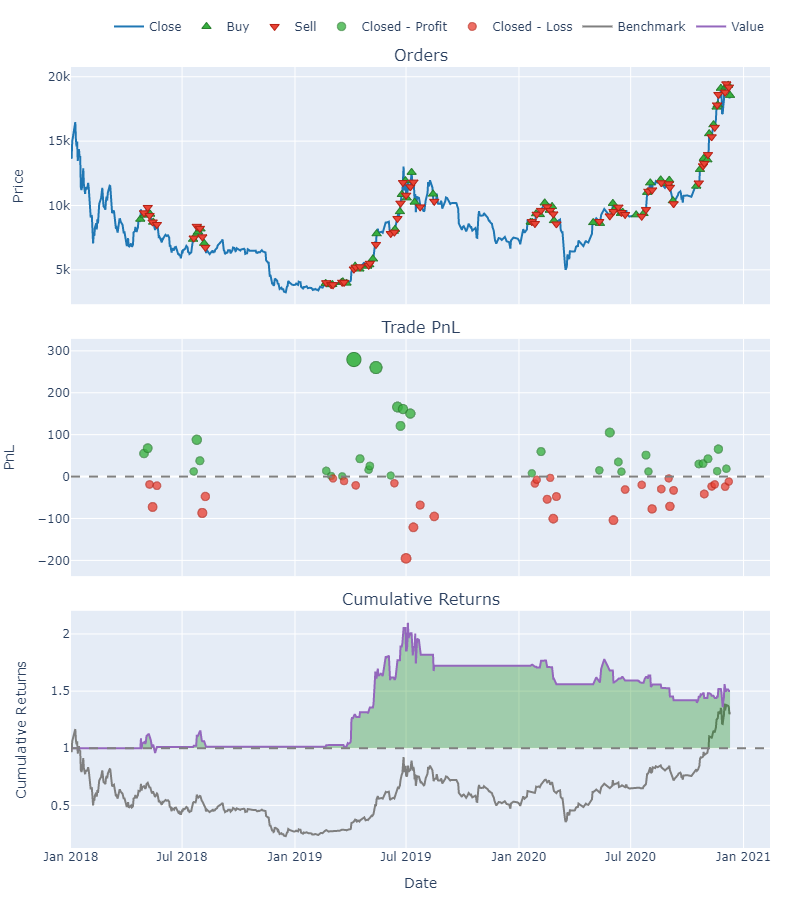

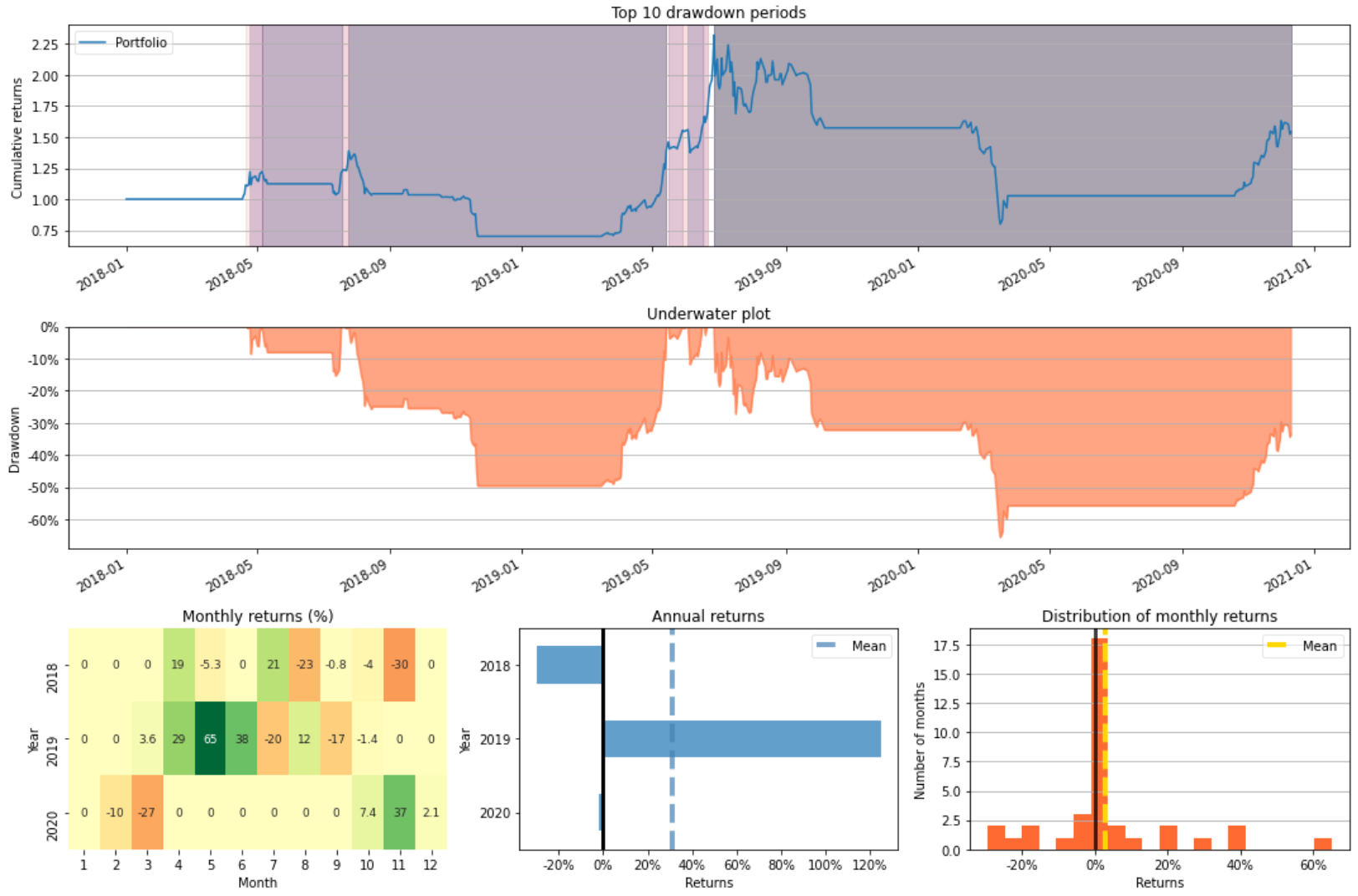

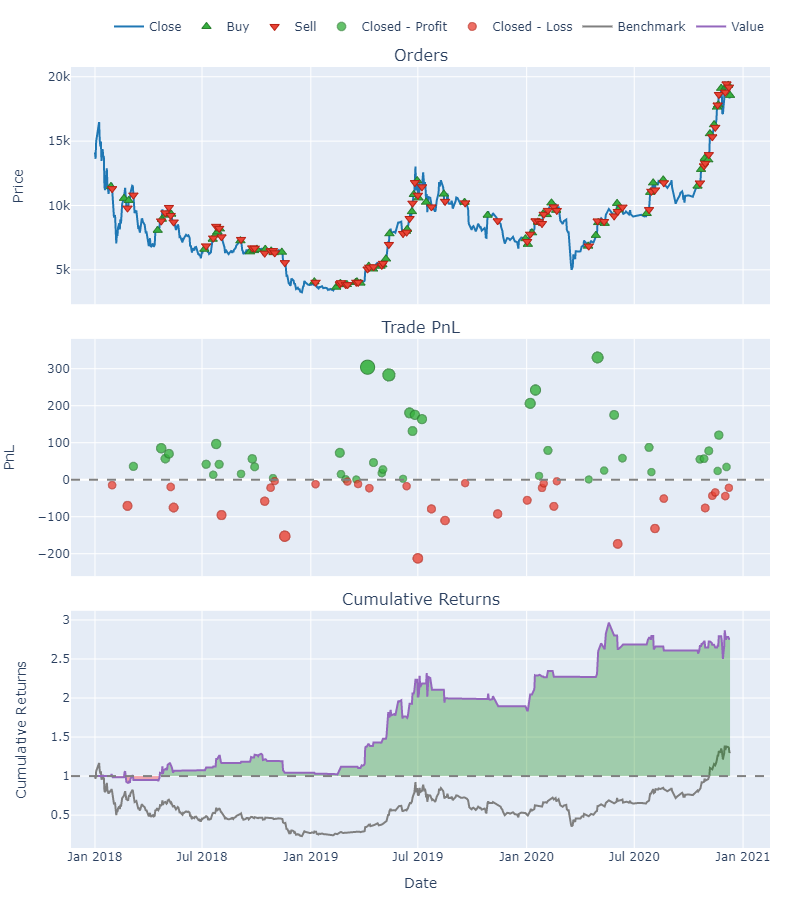

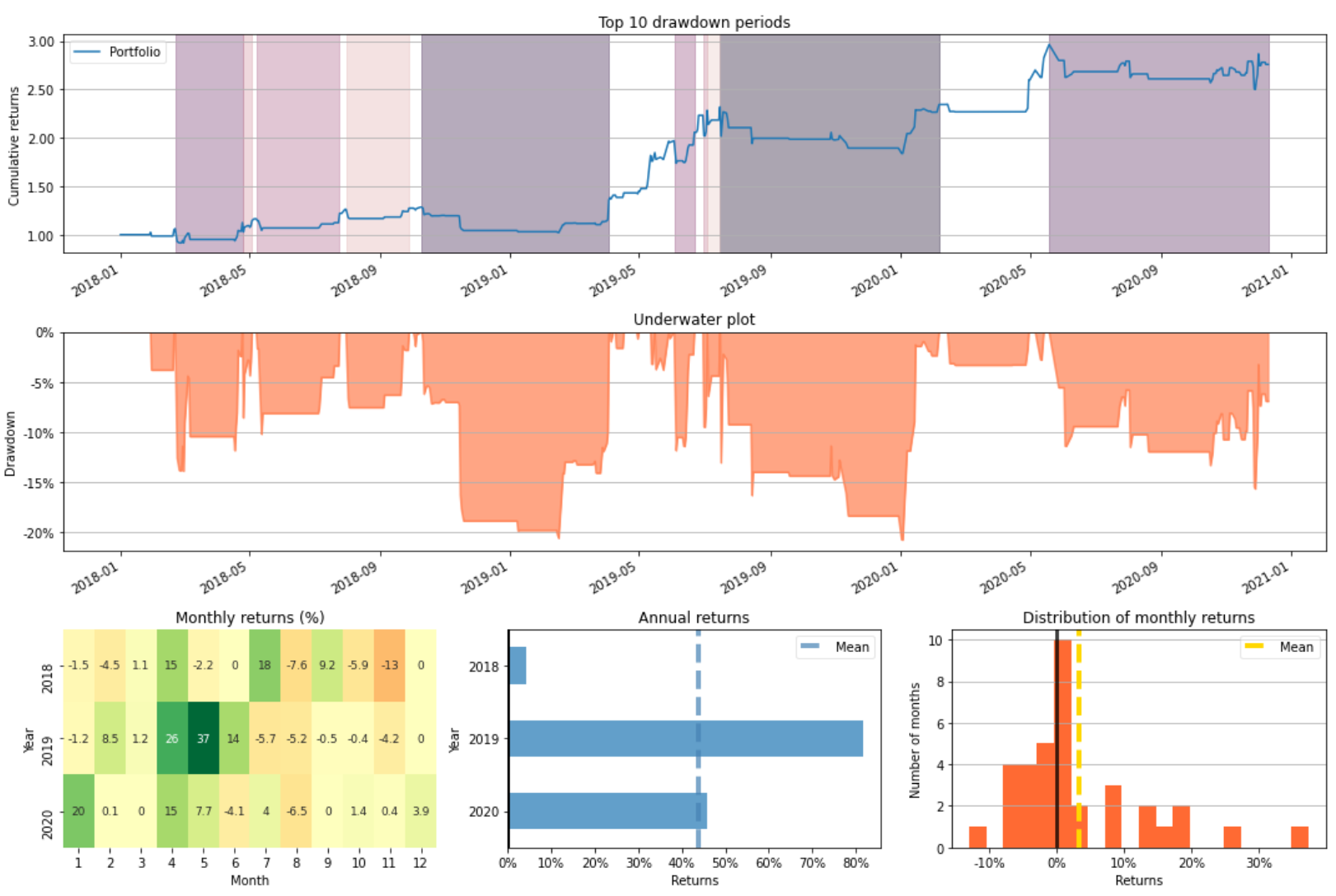

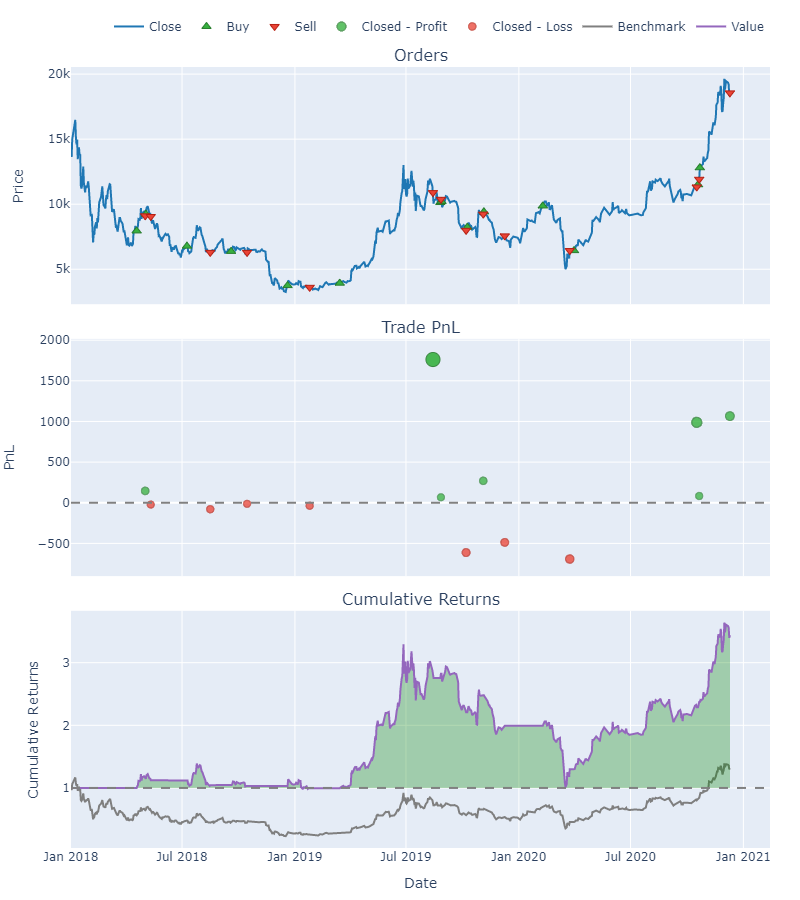

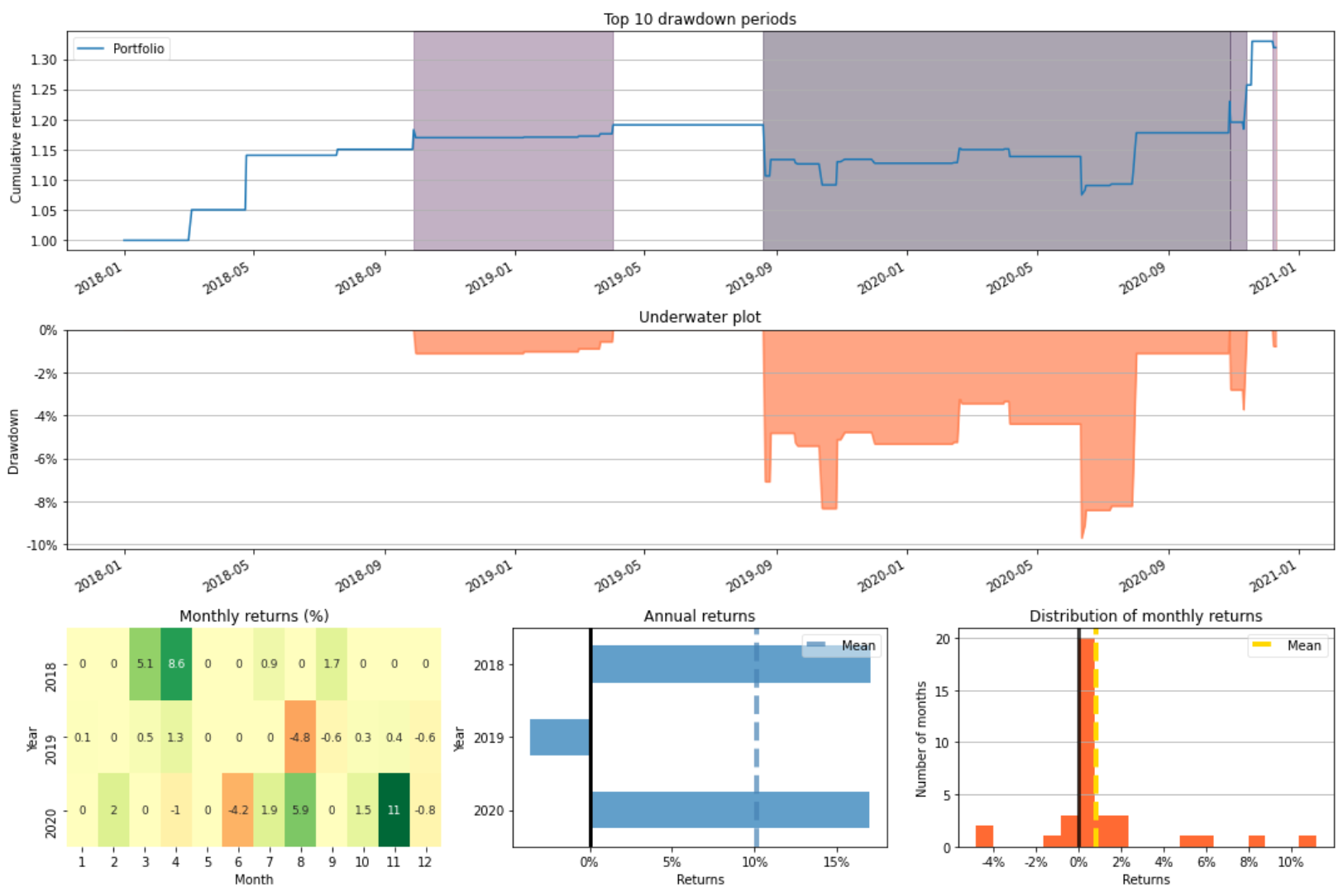

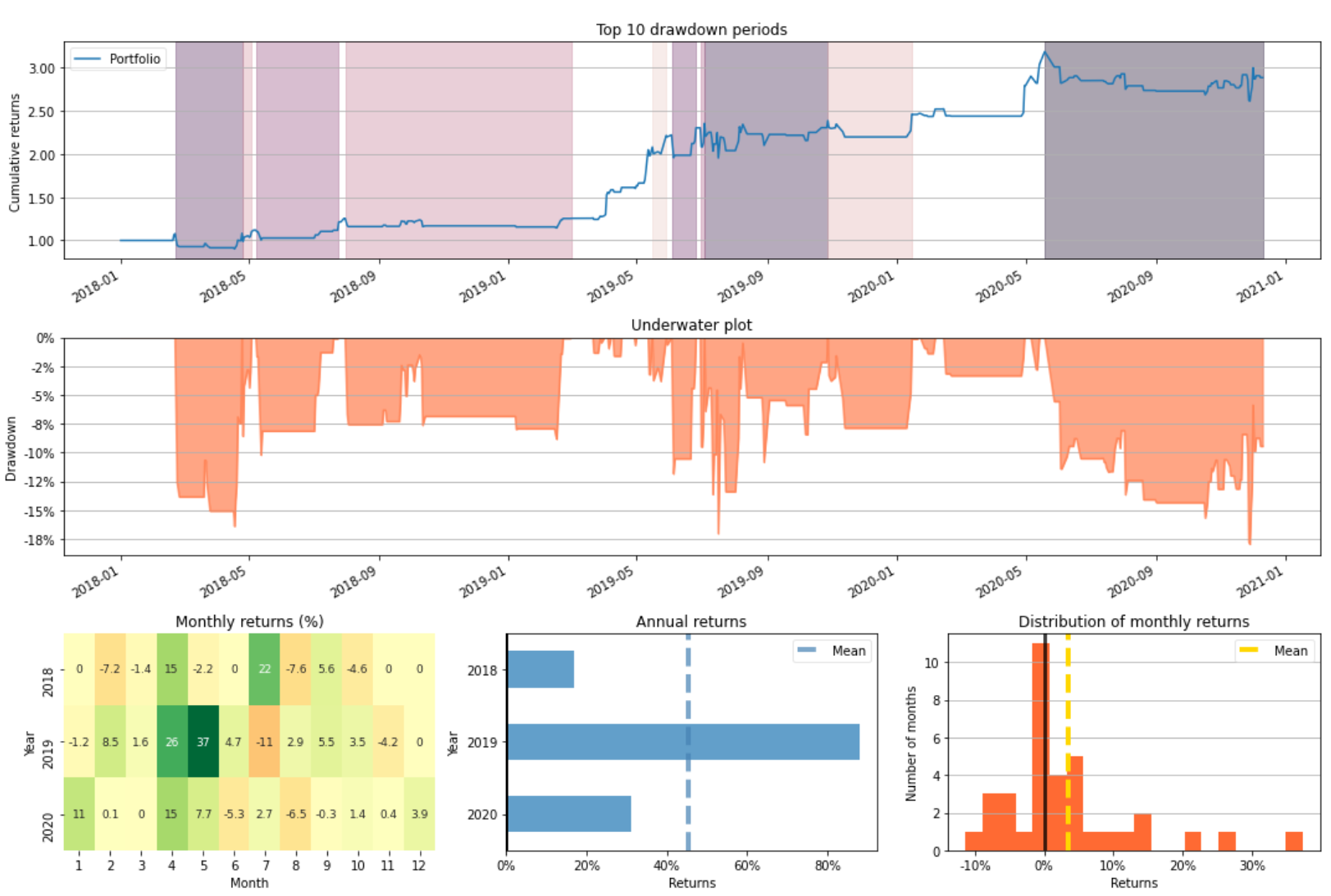

Backtest

trends = np.argmax(test_probs, axis=1)

entries, exits = trend_to_signal(pd.Series(trends))

price_test = text_price_df.iloc[-X_test.shape[0]:]

mlbp_bert = MachineLearningBacktestPortfolio(price_test.open,

entries,

exits,

show=True)

mlbp_bert.plot_risk(figsize=(15, 10))

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 546.37027

Total Return [%] 54.637027

Benchmark Return [%] 31.469924

Position Coverage [%] 53.598775

Max. Drawdown [%] 48.250763

Avg. Drawdown [%] 14.777709

Max. Drawdown Duration 345 days 00:00:00

Avg. Drawdown Duration 63 days 21:36:00

Num. Trades 154

Win Rate [%] 50.0

Best Trade [%] 27.551075

Worst Trade [%] -16.969197

Avg. Trade [%] 0.468629

Max. Trade Duration 12 days 00:00:00

Avg. Trade Duration 2 days 06:23:22.597402597

Expectancy 3.547859

SQN 0.711113

Gross Exposure 0.535988

Sharpe Ratio 0.69902

Sortino Ratio 1.059683

Calmar Ratio 0.571815Save and Load Model

trainer.save_checkpoint("bert.ckpt")

bert_reload = BERTBaseUncased.load_from_checkpoint(

"bert.ckpt",

num_classes=Config.NUM_CLASSES

)NLP based Indicators and Technical Indicators

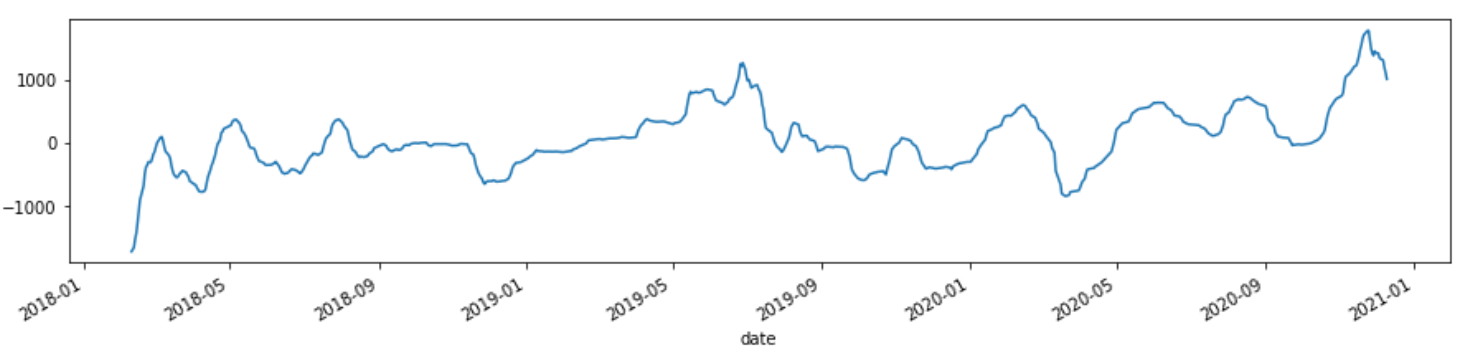

To make a profitable strategy, multiple criteria of entry-and-exit signals are often combined to filter out false positive decisions. In this work, NLP based indicators and technical indicators are combined into one single entry-and-exit signal array with true/false value using logical operators. There are two operators that combine multiple true or false values into a single true/false value.

ANDoperator: returns true only if both values are true.ORoperator: returns true when one of the values is true.

NLP based models are trained to predict whether the trend of the price is increasing or decreasing. Next, NLP based indicators are constructed by some trading rules as follow:

- If the forecast on

T-1day is “down-trend” and the forecast onTday is “up-trend”, then “buy” the open price onT+1day. - If the forecast on

T-1day is “up-trend” and the forecast onTday is “down-trend”, then “sell” the open price onT+1day. - If continue forecasting “up-trend”, then keep holding with the long-position.

- If continue forecasting “down-trend”, then keep holding without any long-position.

There are two basic types oftechnical indicators: Overlay Indicators and Oscillator Indicators.

In this project, only AND operator is used to set the condition to two criteria (NLP based indicators and technical indicators). For example, the entry signal is triggered when the RSI is above 50 and the NLP based indicator is producing a buy signal.

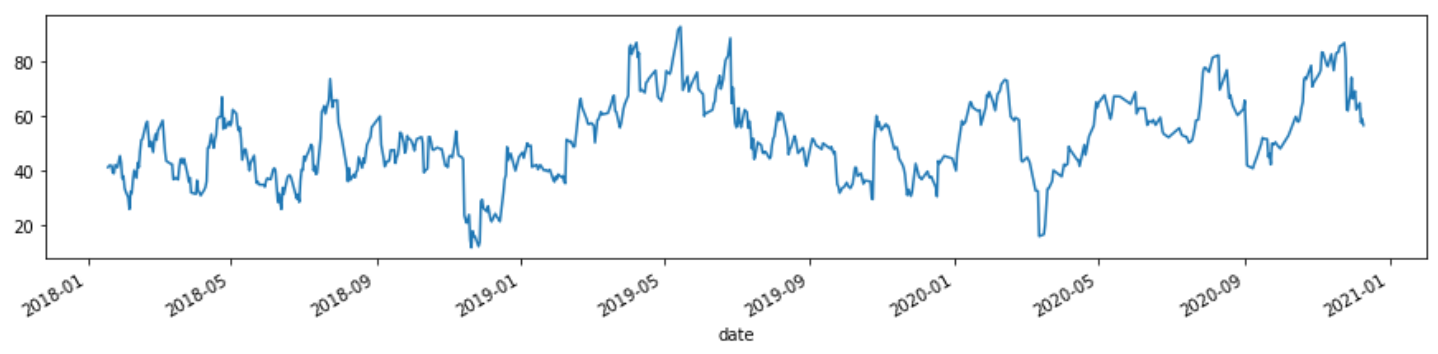

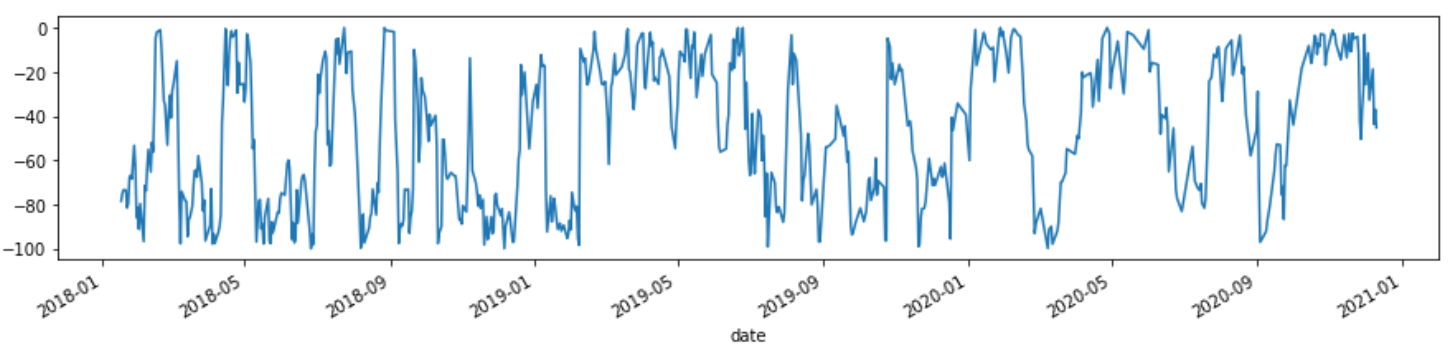

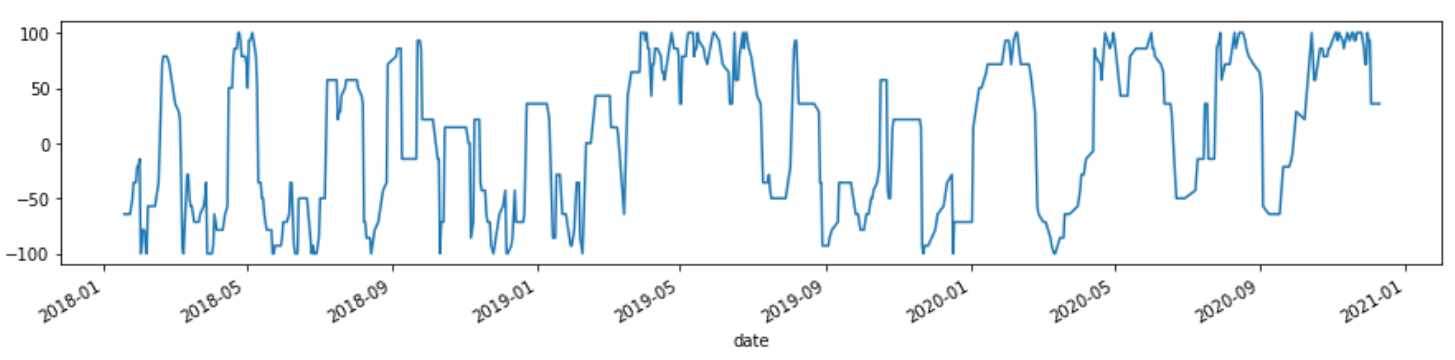

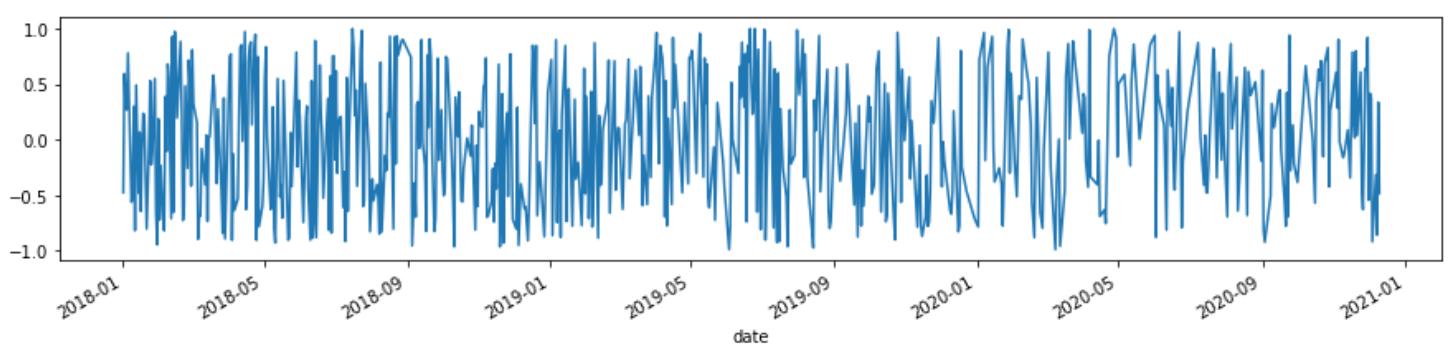

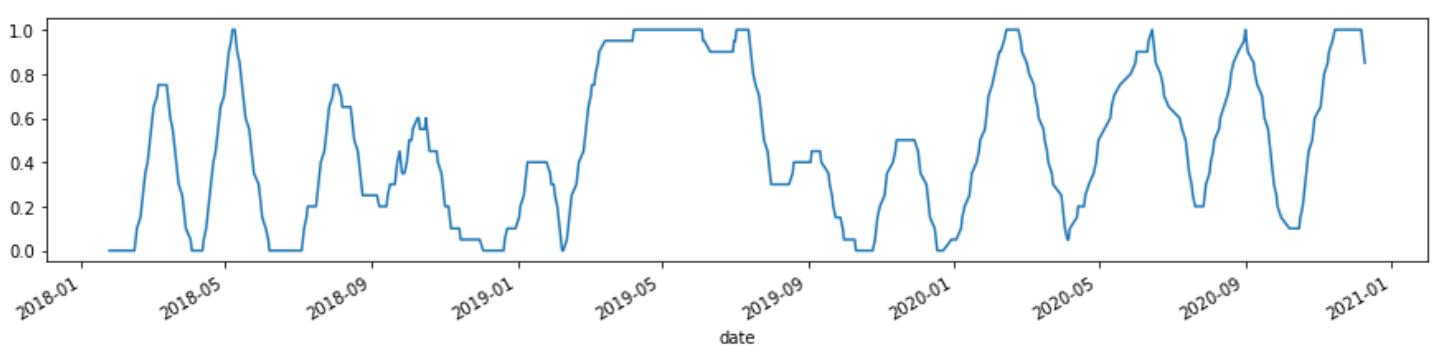

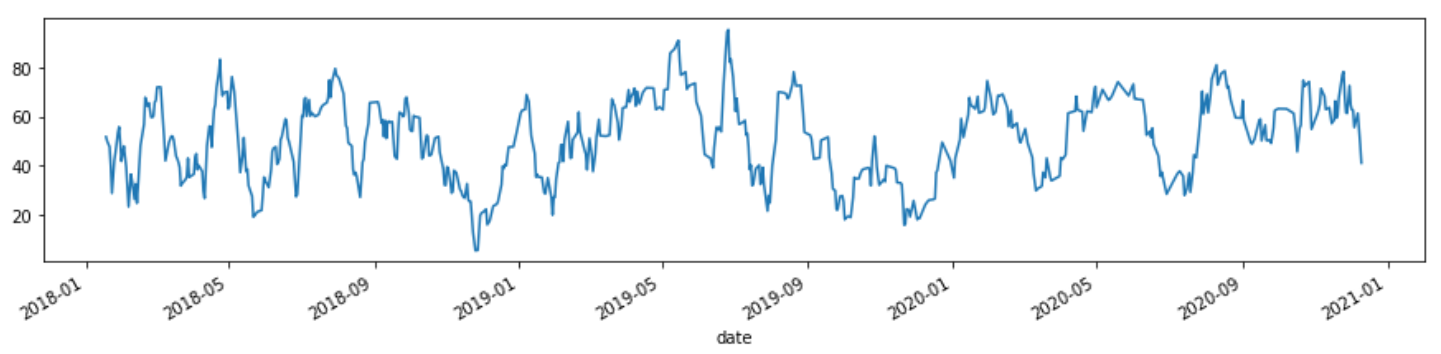

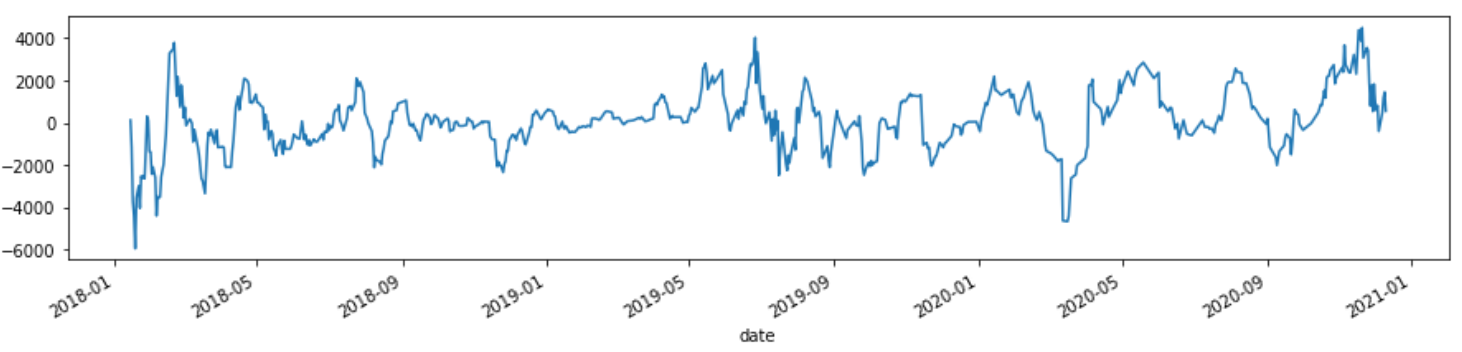

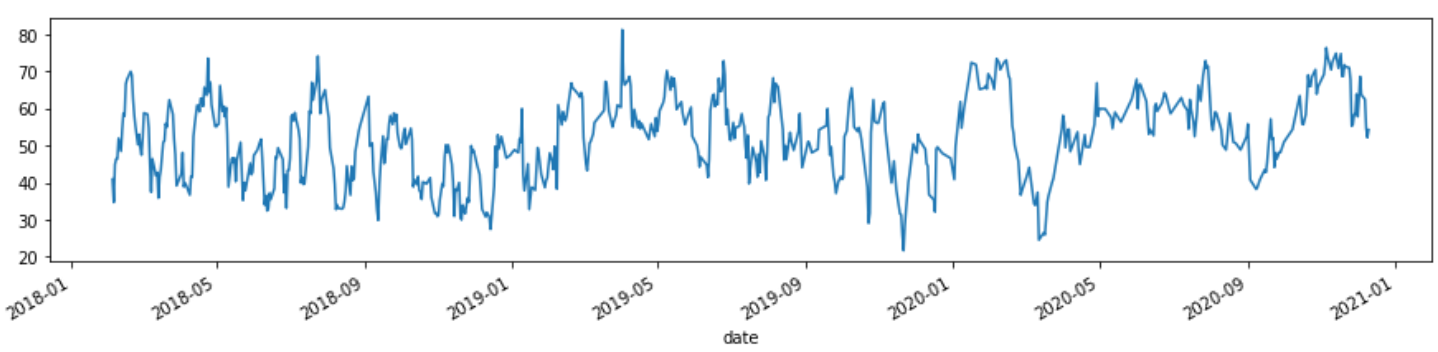

Relative Strength Index (RSI)

The Stochastic RSI (StochRSI) is a technical analysis indicator that ranges from 0 to 1 (or 0 to 100 on some charting platforms). It is calculated by applying the Stochastic oscillator formula to a collection of relative strength indexes (RSI). Overbought is defined as a StochRSI value above 0.8, while oversold is defined as a reading below 0.2. On the zero to 100 scale, above 80 is overbought, and below 20 is oversold.

price_test = text_price_df.iloc[-X_test.shape[0]:]

close = price_test.close

rsi = talib.RSI(close, timeperiod=14)

rsi.plot()

mlbp_rsi = MachineLearningBacktestPortfolio(price_test.open,

entries=(rsi>=50).values&entries,

exits=exits,

show=True)

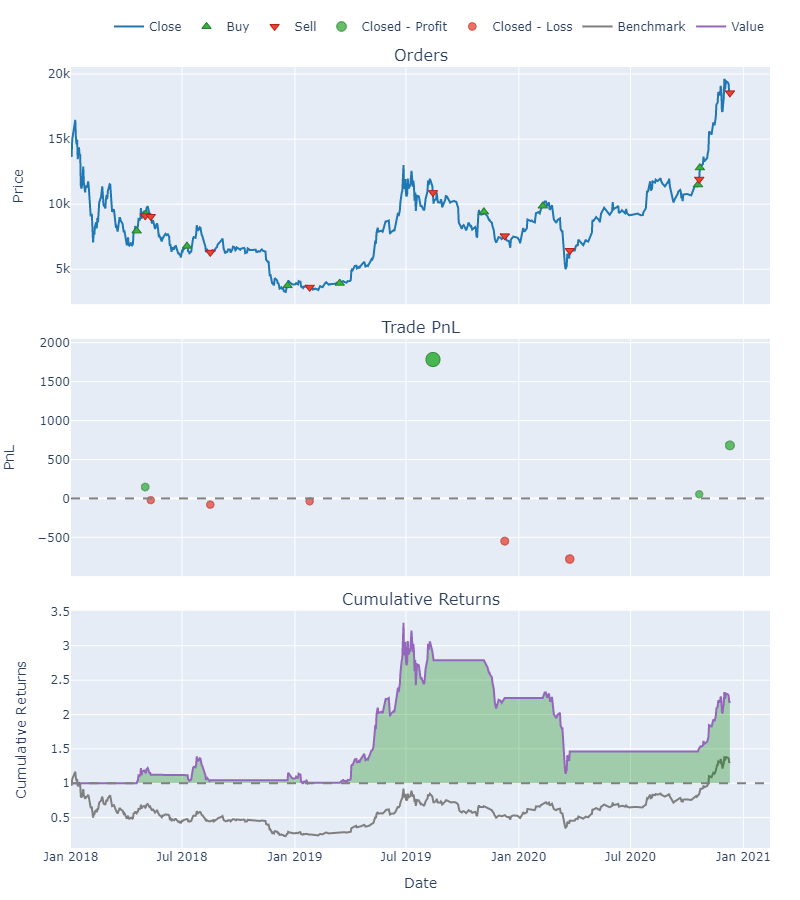

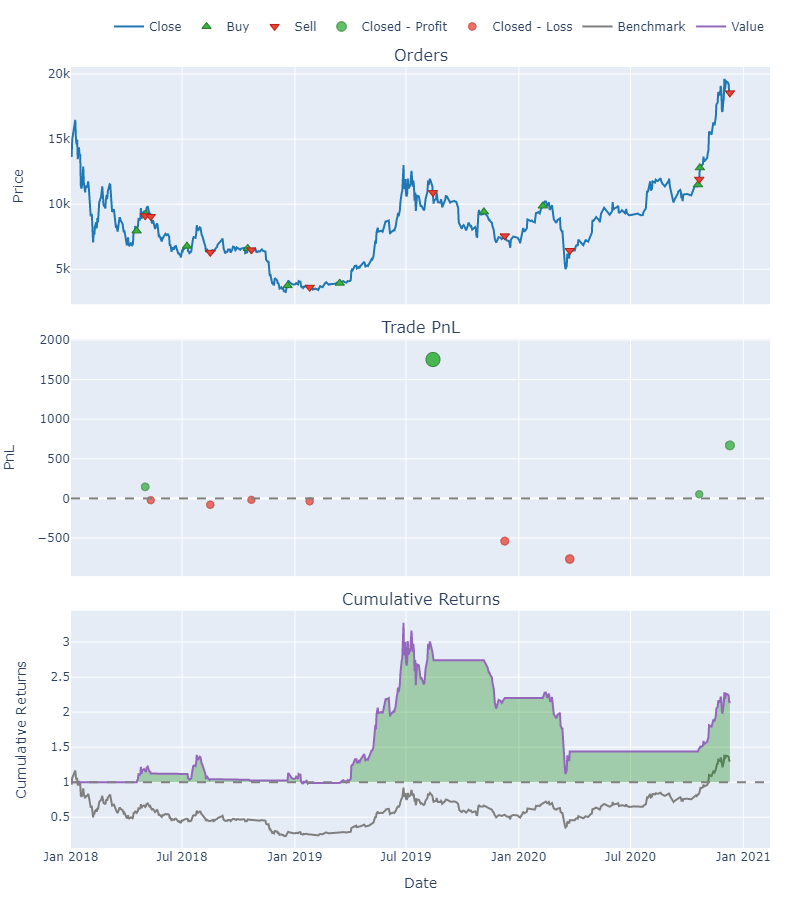

mlbp_rsi.plot_risk(figsize=(15, 10))TextCNN and RSI

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 1410.484857

Total Return [%] 141.048486

Benchmark Return [%] 31.469924

Position Coverage [%] 30.015314

Max. Drawdown [%] 65.917264

Avg. Drawdown [%] 8.716855

Max. Drawdown Duration 272 days 00:00:00

Avg. Drawdown Duration 39 days 05:08:34.285714286

Num. Trades 8

Win Rate [%] 50.0

Best Trade [%] 177.321644

Worst Trade [%] -34.745424

Avg. Trade [%] 22.796415

Max. Trade Duration 99 days 00:00:00

Avg. Trade Duration 24 days 12:00:00

Expectancy 176.310607

SQN 0.575284

Gross Exposure 0.300153

Sharpe Ratio 1.160131

Sortino Ratio 1.730172

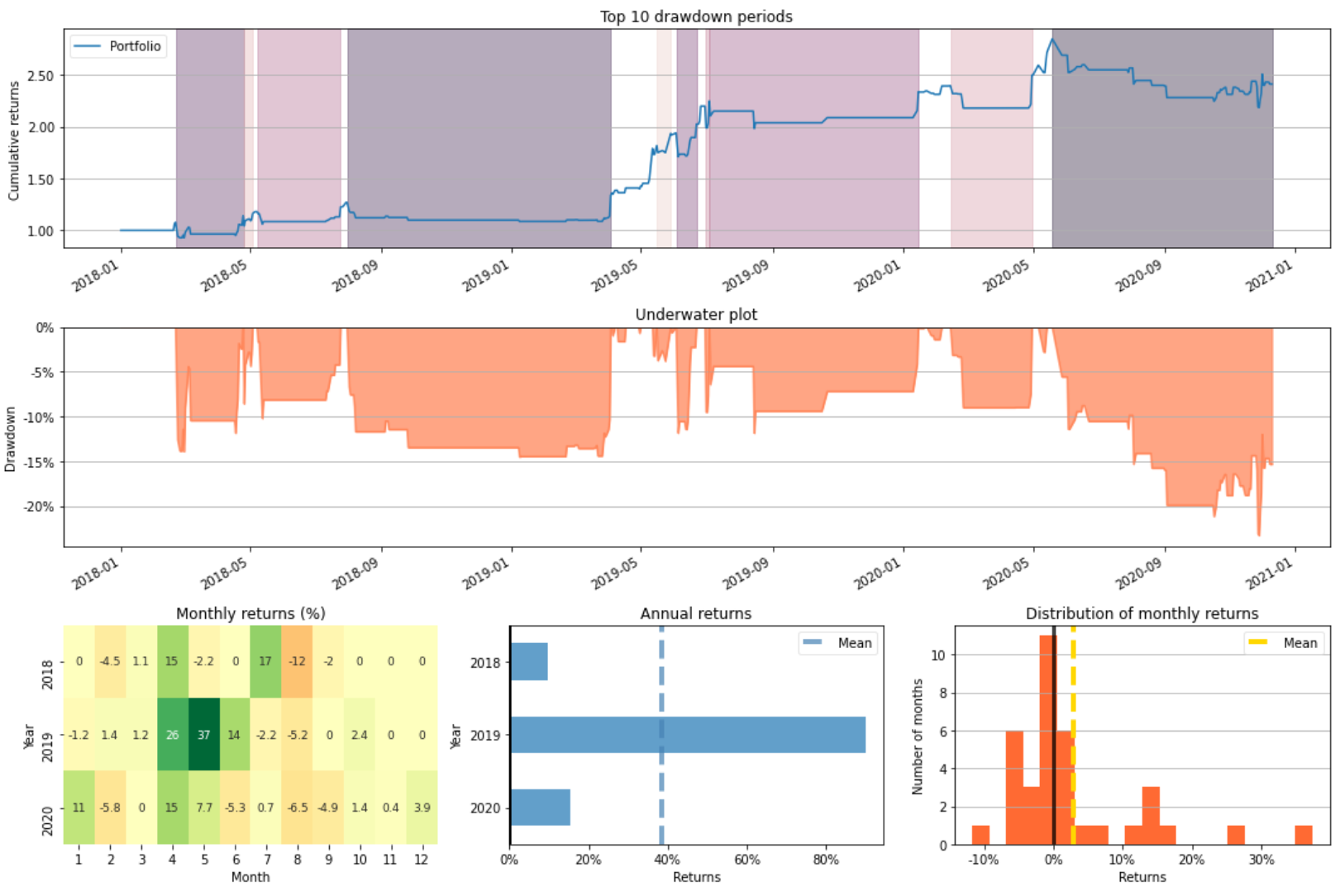

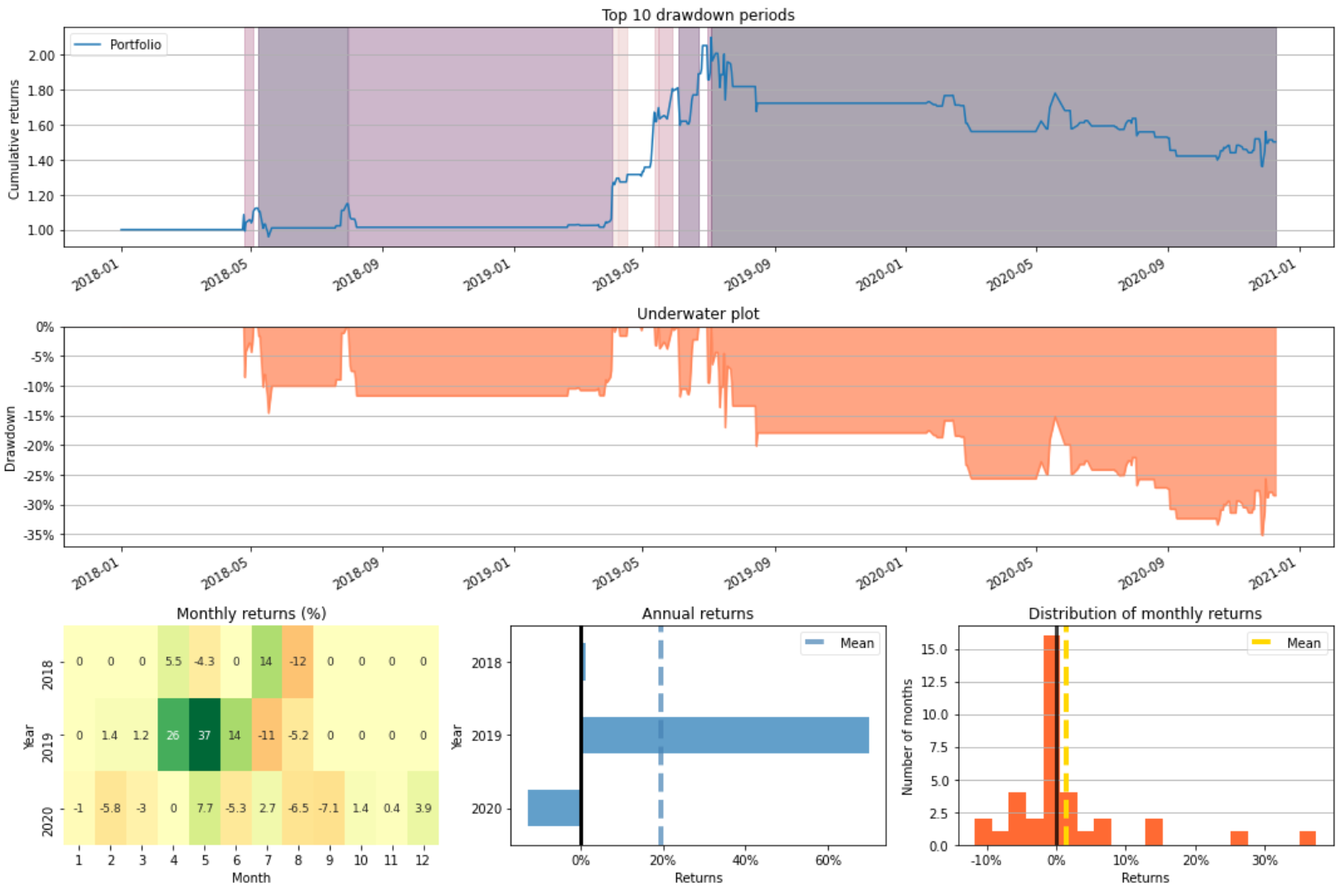

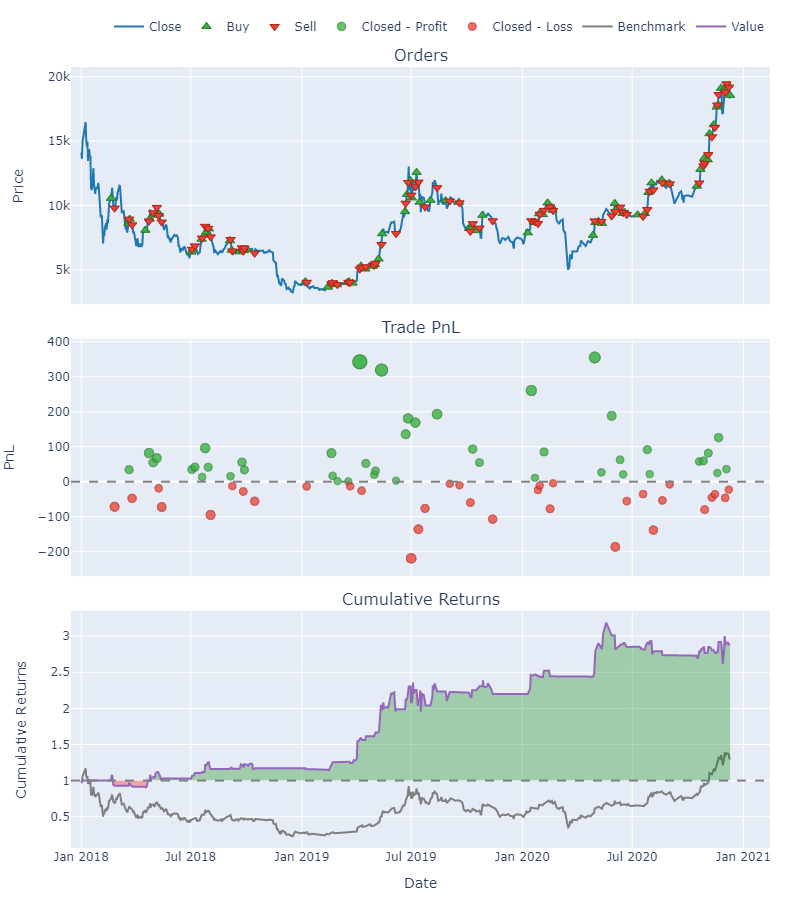

Calmar Ratio 0.963688BERT and RSI

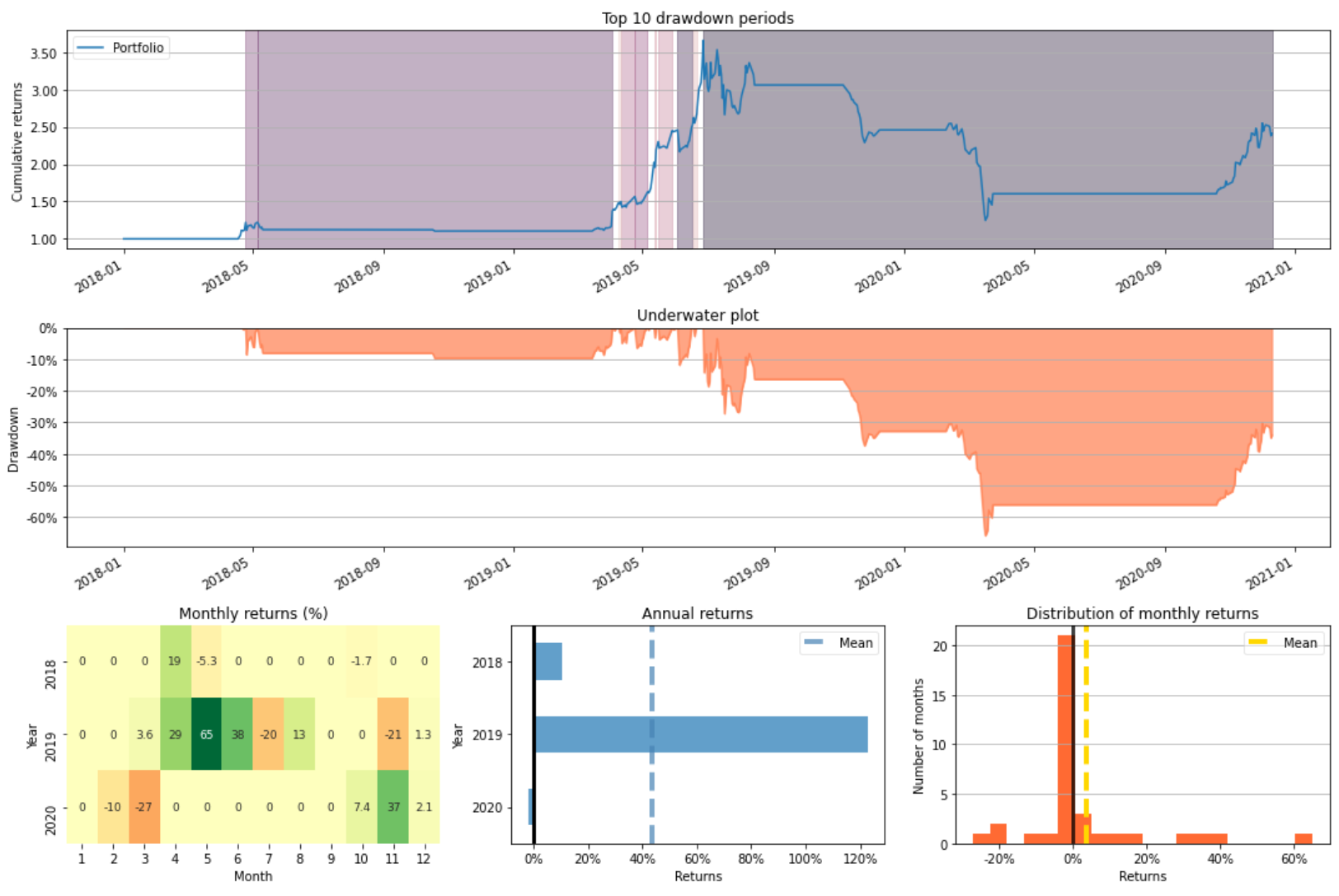

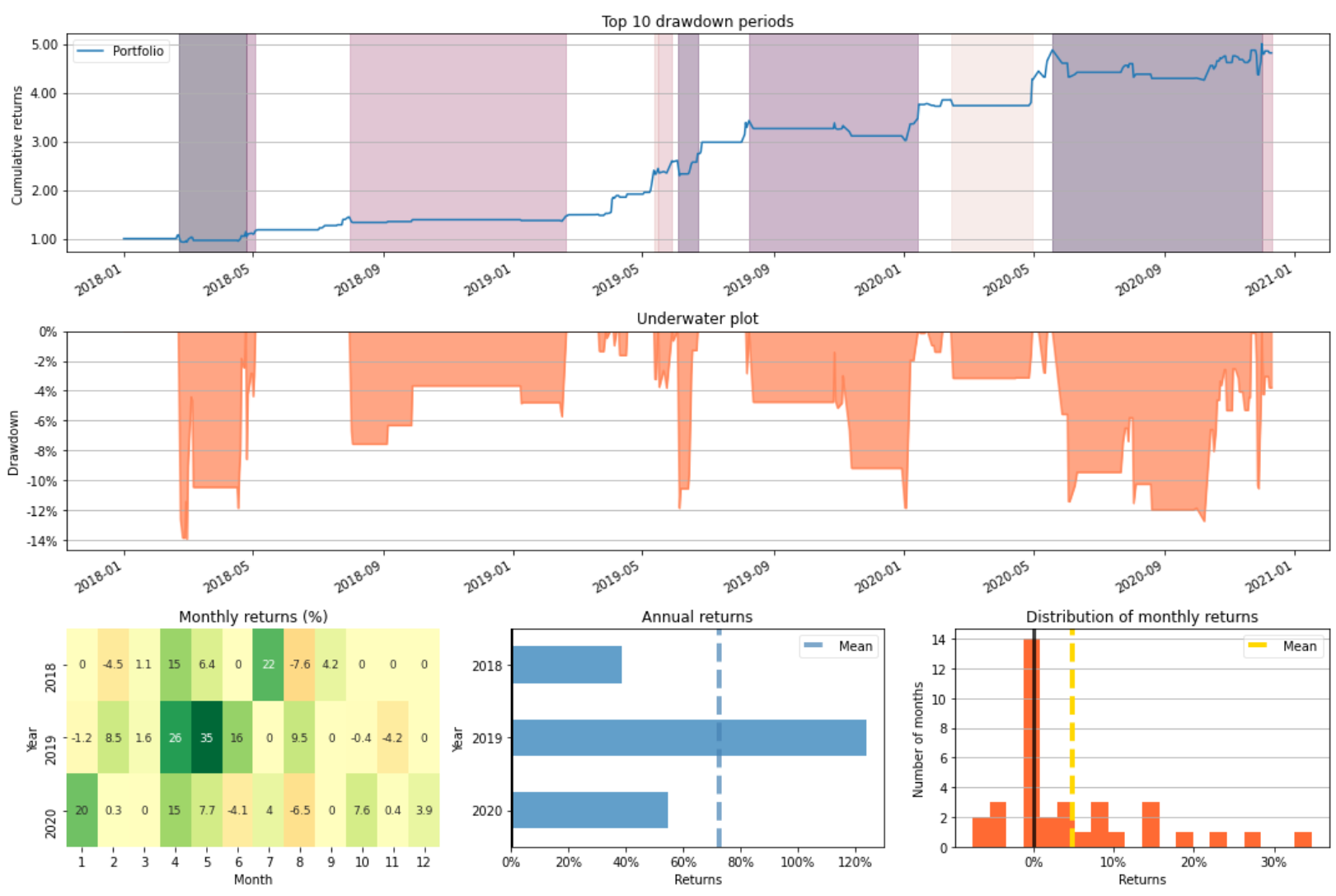

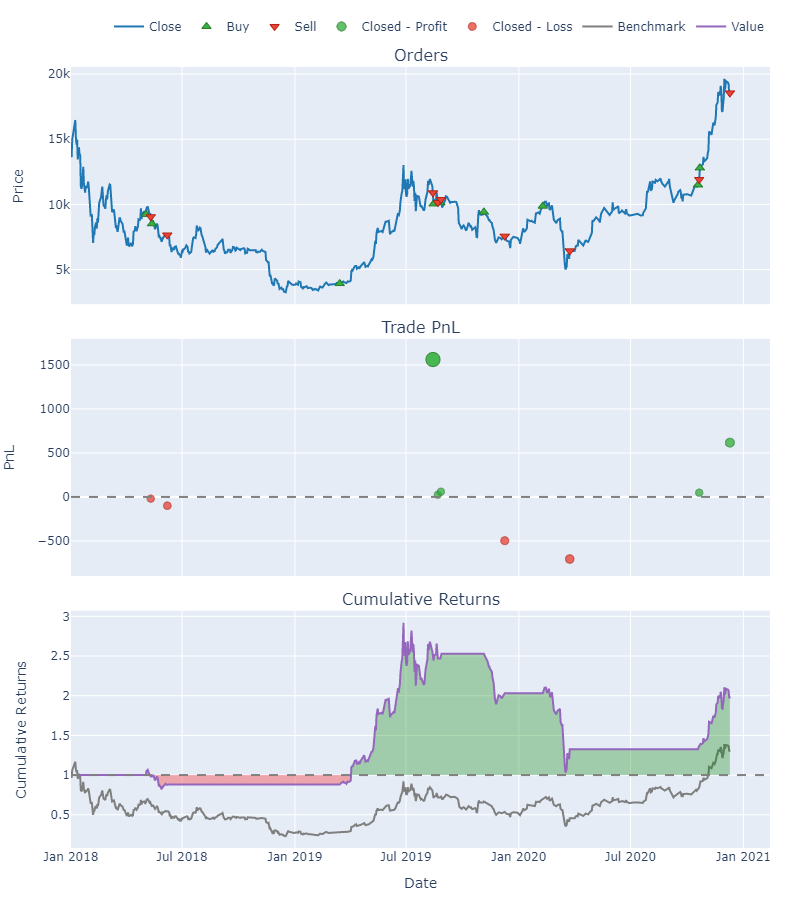

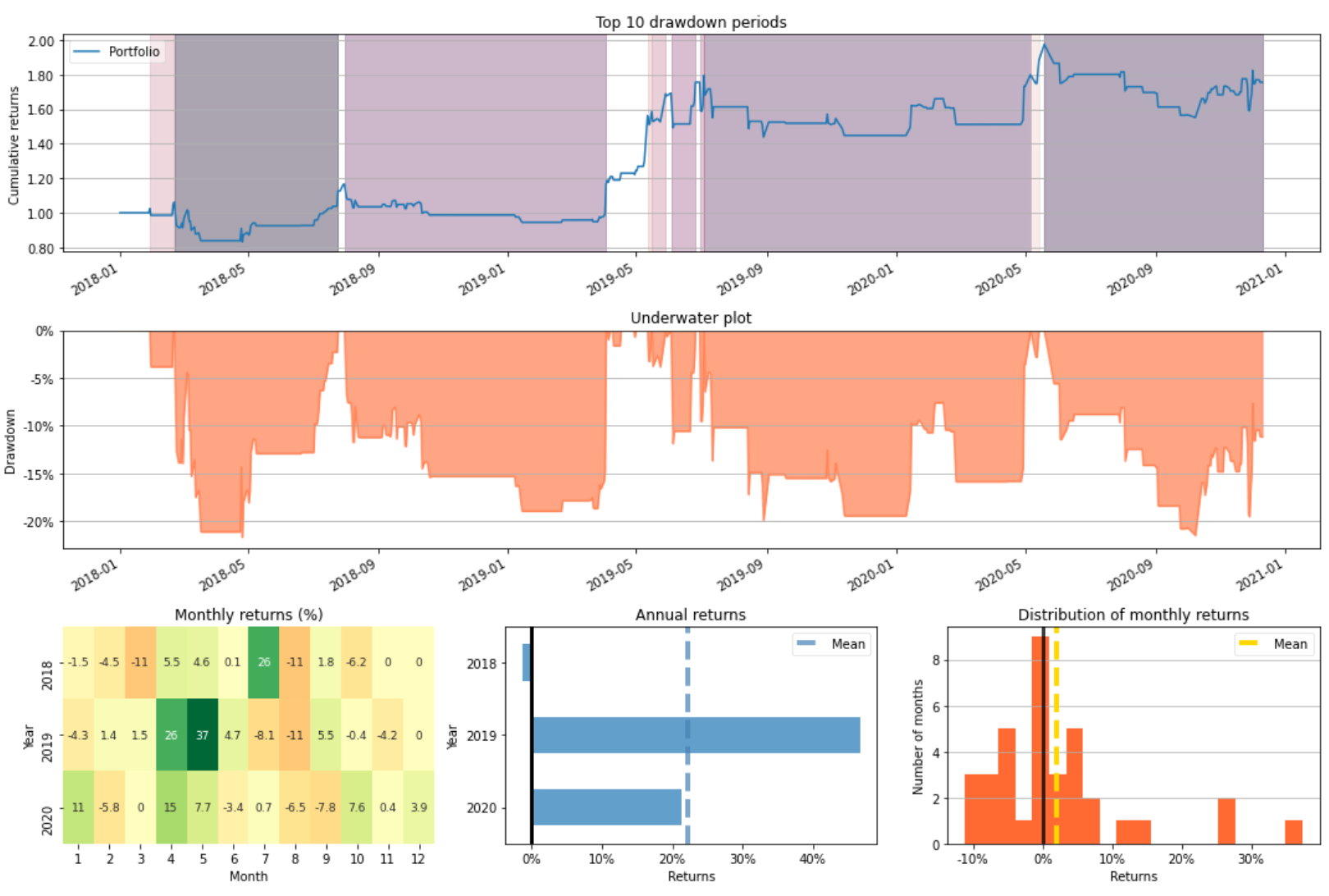

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 1372.905056

Total Return [%] 137.290506

Benchmark Return [%] 31.469924

Position Coverage [%] 25.267994

Max. Drawdown [%] 21.791524

Avg. Drawdown [%] 6.460679

Max. Drawdown Duration 164 days 00:00:00

Avg. Drawdown Duration 32 days 01:20:00

Num. Trades 69

Win Rate [%] 56.521739

Best Trade [%] 27.551075

Worst Trade [%] -9.51275

Avg. Trade [%] 1.430394

Max. Trade Duration 12 days 00:00:00

Avg. Trade Duration 2 days 09:02:36.521739130

Expectancy 19.897175

SQN 1.63859

Gross Exposure 0.25268

Sharpe Ratio 1.309545

Sortino Ratio 2.280386

Calmar Ratio 2.849444Williams %R (WILLR)

The Williams %R, often known as the Williams Percent Range, is a sort of momentum indicator that monitors overbought and oversold conditions and travels between 0 and -100. The Williams %R can be used to determine market entrance and exit points. A reading of -20 indicates that the market is overbought. A value of -80 indicates that the market is oversold.

high = price_test.high

low = price_test.low

close = price_test.close

willr = talib.WILLR(high, low, close, timeperiod=14)

willr.plot()

mlbp_willr = MachineLearningBacktestPortfolio(price_test.open,

entries=(willr>=-40).values&entries,

exits=exits,

show=True)

mlbp_willr.plot_risk(figsize=(15, 10))TextCNN and WILLR

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 1197.129932

Total Return [%] 119.712993

Benchmark Return [%] 31.469924

Position Coverage [%] 36.600306

Max. Drawdown [%] 65.917264

Avg. Drawdown [%] 11.492131

Max. Drawdown Duration 272 days 00:00:00

Avg. Drawdown Duration 42 days 07:23:04.615384615

Num. Trades 9

Win Rate [%] 44.444444

Best Trade [%] 177.321644

Worst Trade [%] -34.745424

Avg. Trade [%] 19.2688

Max. Trade Duration 99 days 00:00:00

Avg. Trade Duration 26 days 13:20:00

Expectancy 133.014437

SQN 0.536334

Gross Exposure 0.366003

Sharpe Ratio 1.038628

Sortino Ratio 1.546713

Calmar Ratio 0.838452BERT and WILLR

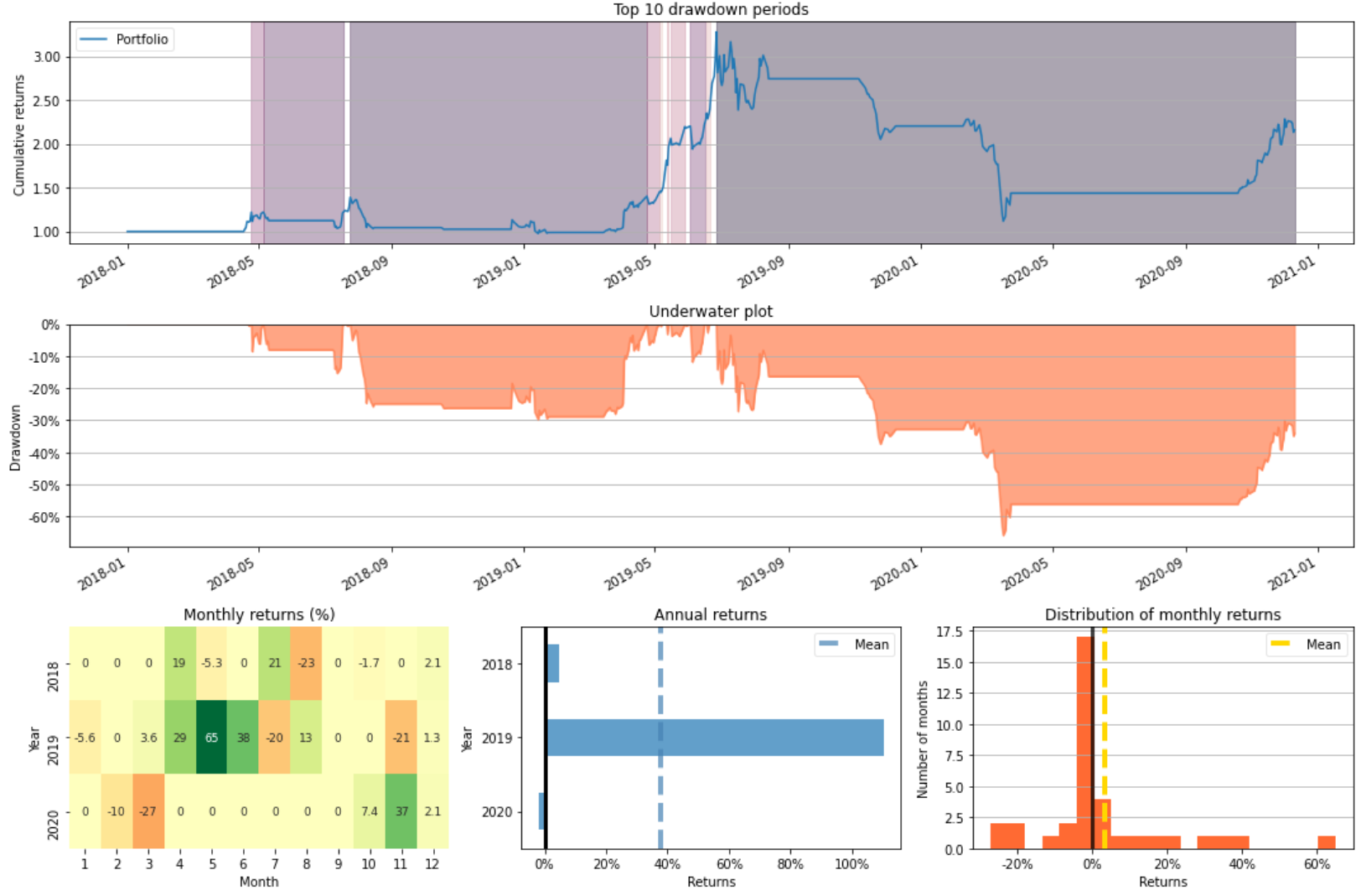

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 3817.273877

Total Return [%] 381.727388

Benchmark Return [%] 31.469924

Position Coverage [%] 21.898928

Max. Drawdown [%] 13.930189

Avg. Drawdown [%] 4.238248

Max. Drawdown Duration 138 days 00:00:00

Avg. Drawdown Duration 21 days 10:54:32.727272727

Num. Trades 60

Win Rate [%] 70.0

Best Trade [%] 27.551075

Worst Trade [%] -7.566861

Avg. Trade [%] 2.823779

Max. Trade Duration 12 days 00:00:00

Avg. Trade Duration 2 days 09:12:00

Expectancy 63.621231

SQN 3.163193

Gross Exposure 0.218989

Sharpe Ratio 2.360838

Sortino Ratio 4.953118

Calmar Ratio 10.107593Aroon Oscillator (AROONOSC)

The Aroon indicator is a technical indicator that may be used to detect price trend changes as well as the strength of that trend. In essence, the indicator calculates the time between highs and lows over a given period of time. The notion is that strong uptrends will see new highs on a frequent basis, whereas strong downtrends would see new lows on a frequent basis.

high = price_test.high

low = price_test.low

aroonosc = talib.AROONOSC(high, low, timeperiod=14)

aroonosc.plot()

mlbp_aroonosc = MachineLearningBacktestPortfolio(price_test.open,

entries=(aroonosc>=25).values&entries,

exits=exits,

show=True)

mlbp_aroonosc.plot_risk(figsize=(15, 10))TextCNN and AROONOSC

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 58.852402

Total Return [%] 5.88524

Benchmark Return [%] 31.469924

Position Coverage [%] 16.385911

Max. Drawdown [%] 60.573478

Avg. Drawdown [%] 17.173099

Max. Drawdown Duration 494 days 00:00:00

Avg. Drawdown Duration 112 days 09:36:00

Num. Trades 8

Win Rate [%] 62.5

Best Trade [%] 44.929126

Worst Trade [%] -34.745424

Avg. Trade [%] 2.854736

Max. Trade Duration 33 days 00:00:00

Avg. Trade Duration 13 days 09:00:00

Expectancy 7.35655

SQN 0.104441

Gross Exposure 0.163859

Sharpe Ratio 0.301499

Sortino Ratio 0.397515

Calmar Ratio 0.053622BERT and AROONOSC

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 1411.933816

Total Return [%] 141.193382

Benchmark Return [%] 31.469924

Position Coverage [%] 22.205207

Max. Drawdown [%] 23.302887

Avg. Drawdown [%] 6.746358

Max. Drawdown Duration 164 days 00:00:00

Avg. Drawdown Duration 30 days 07:34:44.210526315

Num. Trades 70

Win Rate [%] 57.142857

Best Trade [%] 27.551075

Worst Trade [%] -9.51275

Avg. Trade [%] 1.430573

Max. Trade Duration 12 days 00:00:00

Avg. Trade Duration 2 days 01:22:17.142857142

Expectancy 20.170483

SQN 1.70467

Gross Exposure 0.222052

Sharpe Ratio 1.403516

Sortino Ratio 2.525902

Calmar Ratio 2.728357Balance Of Power (BOP)

Balance of Power (BOP) is an oscillator that measures the strength of buying and selling pressure. Introduced by Igor Levshin in the August 2001 issue of Technical Analysis of Stocks & Commodities magazine, this indicator compares the power of buyers to push prices to higher extremes with the power of sellers to move prices to lower extremes. When the indicator is in positive territory, the bulls are in charge; and sellers dominate when the indicator is negative. A reading near the zero line indicates a balance between the two and can mean a trend reversal.

open_ = price_test.open

high = price_test.high

low = price_test.low

close = price_test.close

bop = talib.BOP(open_, high, low, close)

bop.plot()

mlbp_bop = MachineLearningBacktestPortfolio(price_test.open,

entries=(bop>=0.8).values&entries,

exits=exits,

show=True)

mlbp_bop.plot_risk(figsize=(15, 10))TextCNN and BOP

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit -387.11781

Total Return [%] -38.711781

Benchmark Return [%] 31.469924

Position Coverage [%] 9.49464

Max. Drawdown [%] 58.149854

Avg. Drawdown [%] 33.387792

Max. Drawdown Duration 469 days 00:00:00

Avg. Drawdown Duration 276 days 12:00:00

Num. Trades 4

Win Rate [%] 0.0

Best Trade [%] -0.620421

Worst Trade [%] -34.745424

Avg. Trade [%] -10.232098

Max. Trade Duration 22 days 00:00:00

Avg. Trade Duration 15 days 12:00:00

Expectancy -96.779453

SQN -1.261007

Gross Exposure 0.094946

Sharpe Ratio -0.546112

Sortino Ratio -0.662911

Calmar Ratio -0.411706BERT and BOP

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 852.560933

Total Return [%] 85.256093

Benchmark Return [%] 31.469924

Position Coverage [%] 3.675345

Max. Drawdown [%] 13.856424

Avg. Drawdown [%] 7.633348

Max. Drawdown Duration 139 days 00:00:00

Avg. Drawdown Duration 82 days 00:00:00

Num. Trades 11

Win Rate [%] 90.909091

Best Trade [%] 21.832492

Worst Trade [%] -7.165814

Avg. Trade [%] 5.996617

Max. Trade Duration 5 days 00:00:00

Avg. Trade Duration 2 days 04:21:49.090909090

Expectancy 77.505539

SQN 3.051468

Gross Exposure 0.036753

Sharpe Ratio 1.699568

Sortino Ratio 3.867465

Calmar Ratio 2.969575Market Meanness Index (MMI)

The Market Meanness Index tells whether the market is currently moving in or out of a ‘trending’ regime. It can this way prevent losses by false signals of trend indicators. It is a purely statisticalalgorithm and not based on volatility, trends, or cycles of the price curve.

mmi_days = 20

close = price_test.close

median = close.rolling(mmi_days).median()

p1 = close>median

p2 = close.shift() > median

mmi = (p1 & p2).astype(int).rolling(mmi_days).mean()

mmi.plot()

mlbp_mmi = MachineLearningBacktestPortfolio(price_test.open,

entries=(mmi>=0.5).values&entries,

exits=exits,

show=True)

mlbp_mmi.plot_risk(figsize=(15, 10))TextCNN and MMI

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 164.578985

Total Return [%] 16.457898

Benchmark Return [%] 31.469924

Position Coverage [%] 28.024502

Max. Drawdown [%] 57.57344

Avg. Drawdown [%] 17.096136

Max. Drawdown Duration 294 days 00:00:00

Avg. Drawdown Duration 83 days 17:08:34.285714285

Num. Trades 7

Win Rate [%] 14.285714

Best Trade [%] 177.321644

Worst Trade [%] -34.745424

Avg. Trade [%] 14.702369

Max. Trade Duration 99 days 00:00:00

Avg. Trade Duration 26 days 03:25:42.857142857

Expectancy 23.511284

SQN 0.115111

Gross Exposure 0.280245

Sharpe Ratio 0.445331

Sortino Ratio 0.622654

Calmar Ratio 0.154401BERT and MMI

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit -61.14569

Total Return [%] -6.114569

Benchmark Return [%] 31.469924

Position Coverage [%] 24.808576

Max. Drawdown [%] 47.765242

Avg. Drawdown [%] 13.595813

Max. Drawdown Duration 299 days 00:00:00

Avg. Drawdown Duration 74 days 12:00:00

Num. Trades 69

Win Rate [%] 42.028986

Best Trade [%] 27.551075

Worst Trade [%] -12.259609

Avg. Trade [%] 0.08213

Max. Trade Duration 12 days 00:00:00

Avg. Trade Duration 2 days 08:00:00

Expectancy -0.886169

SQN -0.113694

Gross Exposure 0.248086

Sharpe Ratio 0.125302

Sortino Ratio 0.199014

Calmar Ratio -0.072548Commodity Channel Index (CCI)

The Commodity Channel Index (CCI) is a momentum-based oscillator used to help determine when an investment vehicle is reaching a condition of being overbought or oversold. When the CCI is above zero, it indicates the price is above the historic average. Conversely, when the CCI is below zero, the price is below the historic average.

high = price_test.high

low = price_test.low

close = price_test.close

cci = talib.CCI(high, low, close, timeperiod=14)

cci.plot()

mlbp_cci = MachineLearningBacktestPortfolio(price_test.open,

entries=(cci>=0).values&entries,

exits=exits,

show=True)

mlbp_cci.plot_risk(figsize=(15, 10))TextCNN and CCI

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 1158.734851

Total Return [%] 115.873485

Benchmark Return [%] 31.469924

Position Coverage [%] 37.212864

Max. Drawdown [%] 65.917264

Avg. Drawdown [%] 11.588112

Max. Drawdown Duration 272 days 00:00:00

Avg. Drawdown Duration 42 days 07:23:04.615384615

Num. Trades 10

Win Rate [%] 40.0

Best Trade [%] 177.321644

Worst Trade [%] -34.745424

Avg. Trade [%] 17.167169

Max. Trade Duration 99 days 00:00:00

Avg. Trade Duration 24 days 07:12:00

Expectancy 115.873485

SQN 0.530371

Gross Exposure 0.372129

Sharpe Ratio 1.022194

Sortino Ratio 1.522095

Calmar Ratio 0.815354BERT and CCI

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 3357.754498

Total Return [%] 335.77545

Benchmark Return [%] 31.469924

Position Coverage [%] 26.799387

Max. Drawdown [%] 18.274166

Avg. Drawdown [%] 4.626804

Max. Drawdown Duration 110 days 00:00:00

Avg. Drawdown Duration 21 days 21:07:12

Num. Trades 73

Win Rate [%] 64.383562

Best Trade [%] 27.551075

Worst Trade [%] -9.51275

Avg. Trade [%] 2.201906

Max. Trade Duration 12 days 00:00:00

Avg. Trade Duration 2 days 09:32:03.287671232

Expectancy 45.996637

SQN 2.703271

Gross Exposure 0.267994

Sharpe Ratio 2.123362

Sortino Ratio 4.15713

Calmar Ratio 6.986814Moving Average Convergence/Divergence (MACD)

Moving average convergence divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD is calculated by subtracting the 26-period exponential moving average (EMA) from the 12-period EMA.

close = price_test.close

macd, macdsignal, macdhist = talib.MACD(close, fastperiod=12, slowperiod=26, signalperiod=9)

macd.plot()

mlbp_macd = MachineLearningBacktestPortfolio(price_test.open,

entries=(macd>=0).values&entries,

exits=exits,

show=True)

mlbp_macd.plot_risk(figsize=(15, 10))TextCNN and MACD

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 990.617772

Total Return [%] 99.061777

Benchmark Return [%] 31.469924

Position Coverage [%] 31.087289

Max. Drawdown [%] 64.725467

Avg. Drawdown [%] 10.406998

Max. Drawdown Duration 272 days 00:00:00

Avg. Drawdown Duration 44 days 22:00:00

Num. Trades 9

Win Rate [%] 55.555556

Best Trade [%] 177.321644

Worst Trade [%] -34.745424

Avg. Trade [%] 18.092523

Max. Trade Duration 99 days 00:00:00

Avg. Trade Duration 22 days 13:20:00

Expectancy 110.068641

SQN 0.501126

Gross Exposure 0.310873

Sharpe Ratio 0.969612

Sortino Ratio 1.428536

Calmar Ratio 0.725122BERT and MACD

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 501.301519

Total Return [%] 50.130152

Benchmark Return [%] 31.469924

Position Coverage [%] 21.133231

Max. Drawdown [%] 35.199714

Avg. Drawdown [%] 8.540103

Max. Drawdown Duration 266 days 00:00:00

Avg. Drawdown Duration 44 days 18:00:00

Num. Trades 64

Win Rate [%] 50.0

Best Trade [%] 27.551075

Worst Trade [%] -9.51275

Avg. Trade [%] 0.792115

Max. Trade Duration 12 days 00:00:00

Avg. Trade Duration 2 days 03:22:30

Expectancy 7.832836

SQN 0.779408

Gross Exposure 0.211332

Sharpe Ratio 0.756469

Sortino Ratio 1.262302

Calmar Ratio 0.724393Money Flow Index (MFI)

The Money Flow Index (MFI) is a technical oscillator that uses price and volume data for identifying overbought or oversold signals in an asset. It can also be used to spot divergences which warn of a trend change in price. The oscillator moves between 0 and 100. Unlike conventional oscillators such as the Relative Strength Index (RSI), the Money Flow Index incorporates both price and volume data, as opposed to just price. For this reason, some analysts call MFI the volume-weighted RSI.

high = price_test.high

low = price_test.low

close = price_test.close

volume = price_test.volume

mfi = talib.MFI(high, low, close, volume, timeperiod=14)

mfi.plot()

mlbp_mfi = MachineLearningBacktestPortfolio(price_test.open,

entries=(mfi>=50).values&entries,

exits=exits,

show=True)

mlbp_mfi.plot_risk(figsize=(15, 10))TextCNN and MFI

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 543.096364

Total Return [%] 54.309636

Benchmark Return [%] 31.469924

Position Coverage [%] 39.356815

Max. Drawdown [%] 65.619075

Avg. Drawdown [%] 15.958521

Max. Drawdown Duration 272 days 00:00:00

Avg. Drawdown Duration 55 days 04:48:00

Num. Trades 13

Win Rate [%] 46.153846

Best Trade [%] 177.321644

Worst Trade [%] -34.745424

Avg. Trade [%] 11.136054

Max. Trade Duration 99 days 00:00:00

Avg. Trade Duration 19 days 18:27:41.538461538

Expectancy 41.776643

SQN 0.338795

Gross Exposure 0.393568

Sharpe Ratio 0.710413

Sortino Ratio 1.016296

Calmar Ratio 0.418163BERT and MFI

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 755.505657

Total Return [%] 75.550566

Benchmark Return [%] 31.469924

Position Coverage [%] 28.024502

Max. Drawdown [%] 21.682457

Avg. Drawdown [%] 8.642257

Max. Drawdown Duration 164 days 00:00:00

Avg. Drawdown Duration 43 days 06:51:25.714285714

Num. Trades 81

Win Rate [%] 53.08642

Best Trade [%] 27.551075

Worst Trade [%] -9.51275

Avg. Trade [%] 0.84668

Max. Trade Duration 12 days 00:00:00

Avg. Trade Duration 2 days 06:13:19.999999999

Expectancy 9.32723

SQN 1.140512

Gross Exposure 0.280245

Sharpe Ratio 0.943201

Sortino Ratio 1.598255

Calmar Ratio 1.704851Momentum (MOM)

The Momentum Indicator (MOM) is a leading indicator measuring a security’s rate-of-change. It compares the current price with the previous price from a number of periods ago.The ongoing plot forms an oscillator that moves above and below 0. It is a fully unbounded oscillator and has no lower or upper limit. Bullish and bearish interpretations are found by looking for divergences, centerline crossovers and extreme readings. The indicator is often used in combination with other signals.

close = price_test.close

mom = talib.MOM(close, timeperiod=10)

mom.plot()

mlbp_mom = MachineLearningBacktestPortfolio(price_test.open,

entries=(mom>=0).values&entries,

exits=exits,

show=True)

mlbp_mom.plot_risk(figsize=(15, 10))TextCNN and MOM

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 889.771213

Total Return [%] 88.977121

Benchmark Return [%] 31.469924

Position Coverage [%] 42.113323

Max. Drawdown [%] 65.563822

Avg. Drawdown [%] 12.87516

Max. Drawdown Duration 272 days 00:00:00

Avg. Drawdown Duration 55 days 04:48:00

Num. Trades 13

Win Rate [%] 38.461538

Best Trade [%] 177.321644

Worst Trade [%] -34.745424

Avg. Trade [%] 12.246031

Max. Trade Duration 99 days 00:00:00

Avg. Trade Duration 21 days 03:41:32.307692307

Expectancy 68.443939

SQN 0.469819

Gross Exposure 0.421133

Sharpe Ratio 0.891946

Sortino Ratio 1.312906

Calmar Ratio 0.651662BERT and MOM

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 1759.54364

Total Return [%] 175.954364

Benchmark Return [%] 31.469924

Position Coverage [%] 28.177642

Max. Drawdown [%] 20.780414

Avg. Drawdown [%] 7.379898

Max. Drawdown Duration 116 days 00:00:00

Avg. Drawdown Duration 29 days 12:00:00

Num. Trades 75

Win Rate [%] 57.333333

Best Trade [%] 27.551075

Worst Trade [%] -12.763619

Avg. Trade [%] 1.539368

Max. Trade Duration 12 days 00:00:00

Avg. Trade Duration 2 days 10:33:36

Expectancy 23.460582

SQN 2.002748

Gross Exposure 0.281776

Sharpe Ratio 1.466978

Sortino Ratio 2.55946

Calmar Ratio 3.674804Ultimate Oscillator (ULTOSC)

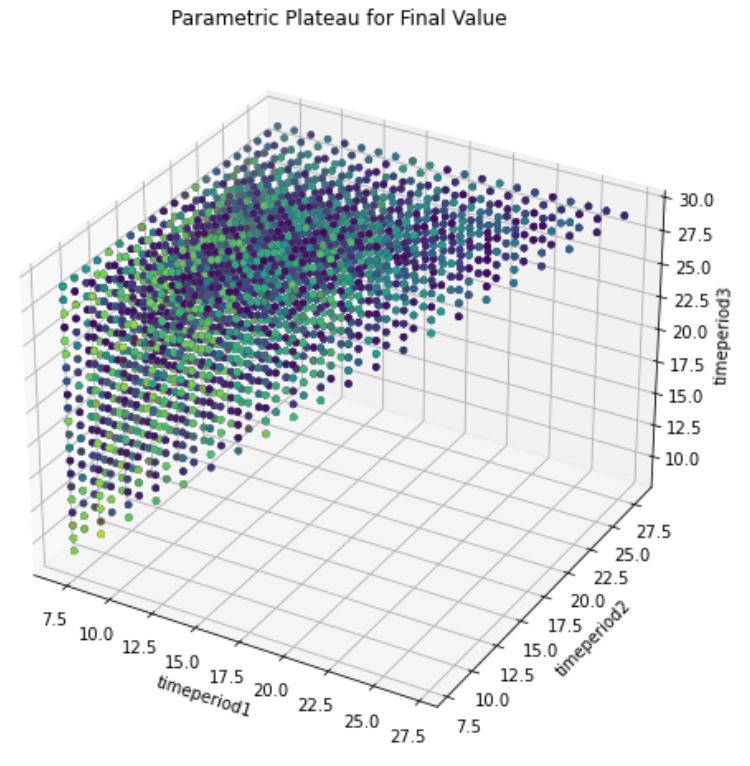

The Ultimate Oscillator is a technical indicator that was developed by Larry Williams in 1976 to measure the price momentum of an asset across multiple timeframes. By using the weighted average of three different timeframes the indicator has less volatility and fewer trade signals compared to other oscillators that rely on a single timeframe. Buy and sell signals are generated following divergences. The Ultimately Oscillator generates fewer divergence signals than other oscillators due to its multi-timeframe construction. Buy signals occur when there is bullish divergence, the divergence low is below 30 on the indicator, and the oscillator then rises above the divergence high. A sell signal occurs when there is bearish divergence, the divergence high is above 70, and the oscillator then falls below the divergence low.

high = price_test.high

low = price_test.low

close = price_test.close

ultosc = talib.ULTOSC(high, low, close, timeperiod1=7, timeperiod2=14, timeperiod3=28)

ultosc.plot()

mlbp_ultosc = MachineLearningBacktestPortfolio(price_test.open,

entries=(ultosc>=50).values&entries,

exits=exits,

show=True)

mlbp_ultosc.plot_risk(figsize=(15, 10))TextCNN and ULTOSC

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 2438.525894

Total Return [%] 243.852589

Benchmark Return [%] 31.469924

Position Coverage [%] 58.499234

Max. Drawdown [%] 69.323364

Avg. Drawdown [%] 10.761178

Max. Drawdown Duration 255 days 00:00:00

Avg. Drawdown Duration 34 days 06:00:00

Num. Trades 14

Win Rate [%] 50.0

Best Trade [%] 177.321644

Worst Trade [%] -34.745424

Avg. Trade [%] 17.228297

Max. Trade Duration 99 days 00:00:00

Avg. Trade Duration 27 days 06:51:25.714285714

Expectancy 174.180421

SQN 0.959201

Gross Exposure 0.584992

Sharpe Ratio 1.341326

Sortino Ratio 2.085091

Calmar Ratio 1.434422BERT and ULTOSC

Start 2018-01-01 00:00:00

End 2020-12-10 00:00:00

Duration 653 days 00:00:00

Init. Cash 1000.0

Total Profit 1885.787803

Total Return [%] 188.57878

Benchmark Return [%] 31.469924

Position Coverage [%] 28.177642

Max. Drawdown [%] 17.968363

Avg. Drawdown [%] 6.135872

Max. Drawdown Duration 145 days 00:00:00

Avg. Drawdown Duration 26 days 21:42:51.428571428

Num. Trades 77

Win Rate [%] 57.142857

Best Trade [%] 27.551075

Worst Trade [%] -9.51275

Avg. Trade [%] 1.541911

Max. Trade Duration 12 days 00:00:00

Avg. Trade Duration 2 days 09:02:20.259740259

Expectancy 24.490751

SQN 2.06409

Gross Exposure 0.281776

Sharpe Ratio 1.544248

Sortino Ratio 2.746532

Calmar Ratio 4.498422Performance

The total return is -27.1728% if only the TextCNN model is used to produce buy-and-sell signals. After using various technical indicators to filter out false negative signals, all average drawdowns are smaller than when using TextCNN alone.

Ten different technical indicators are deployed as filters in this project. Only BOP produces a worse Sharpe Ratio when utilising technical indicators as filters than when using TextCNN alone; on the other hand, the other 9 technical indicators produce a higher Sharpe Ratio score. However, the maximum drawdown is higher when utilising technical indicators as filters than when using TextCNN alone for all technical indicators.

| Technical Indicator | Total Return [%] | Max. Drawdown [%] | Avg. Drawdown [%] | Sharpe Ratio |

|---|---|---|---|---|

| TextCNN | -27.1728 | 52.8665 | 26.4332 | -0.4187 |

| TextCNN + RSI | 141.0484 | 65.9172 | 8.7168 | 1.1601 |

| TextCNN + WILLR | 119.7129 | 65.9172 | 11.4921 | 1.0386 |

| TextCNN + AROONOSC | 5.8852 | 60.5734 | 17.1731 | 0.3014 |

| TextCNN + BOP | -38.7117 | 58.1498 | 33.3877 | -0.5461 |

| TextCNN + MMI | 16.4578 | 57.5734 | 17.0961 | 0.4453 |

| TextCNN + CCI | 115.8734 | 65.9172 | 11.5881 | 1.0221 |

| TextCNN + MACD | 99.0617 | 64.7254 | 10.4069 | 0.9696 |

| TextCNN + MFI | 54.3096 | 65.6190 | 15.9585 | 0.7104 |

| TextCNN + MOM | 88.9771 | 65.5638 | 12.8751 | 0.8919 |

| TextCNN + ULTOSC | 243.8525 | 69.3233 | 10.7611 | 1.3413 |

BERT appears to produce a better outcome than TextCNN. Except for MMI, all of the indicators that integrate with BERT can have a total return of more than 50%. Despite having a negative total return of -6.1145, BERT + MMI has a positive Sharpe Ratio of 0.1253. When combining BERT and technical indicators, the maximum and average drawdowns are smaller than when using the language model alone, and the Sharpe Ratio are all positive. WILLR and CCI can even triple the total return compared to the original.

| Technical Indicator | Total Return [%] | Max. Drawdown [%] | Avg. Drawdown [%] | Sharpe Ratio |

|---|---|---|---|---|

| BERT | 54.6370 | 48.2507 | 14.7777 | 0.6990 |

| BERT + RSI | 137.2905 | 21.7915 | 6.4606 | 1.3095 |

| BERT + WILLR | 381.7274 | 13.9302 | 4.2382 | 2.3608 |

| BERT + AROONOSC | 141.1933 | 23.3028 | 6.7464 | 1.4035 |

| BERT + BOP | 85.2560 | 13.8564 | 7.6333 | 1.6996 |

| BERT + MMI | -6.1145 | 47.7652 | 13.5958 | 0.1253 |

| BERT + CCI | 335.7754 | 18.2741 | 4.6268 | 2.1233 |

| BERT + MACD | 50.1301 | 35.1997 | 8.5401 | 0.7564 |

| BERT + MFI | 75.5505 | 21.6824 | 8.6422 | 0.9432 |

| BERT + MOM | 175.9543 | 20.7804 | 7.3798 | 1.4669 |

| BERT + ULTOSC | 188.5787 | 17.9683 | 6.1358 | 1.5442 |

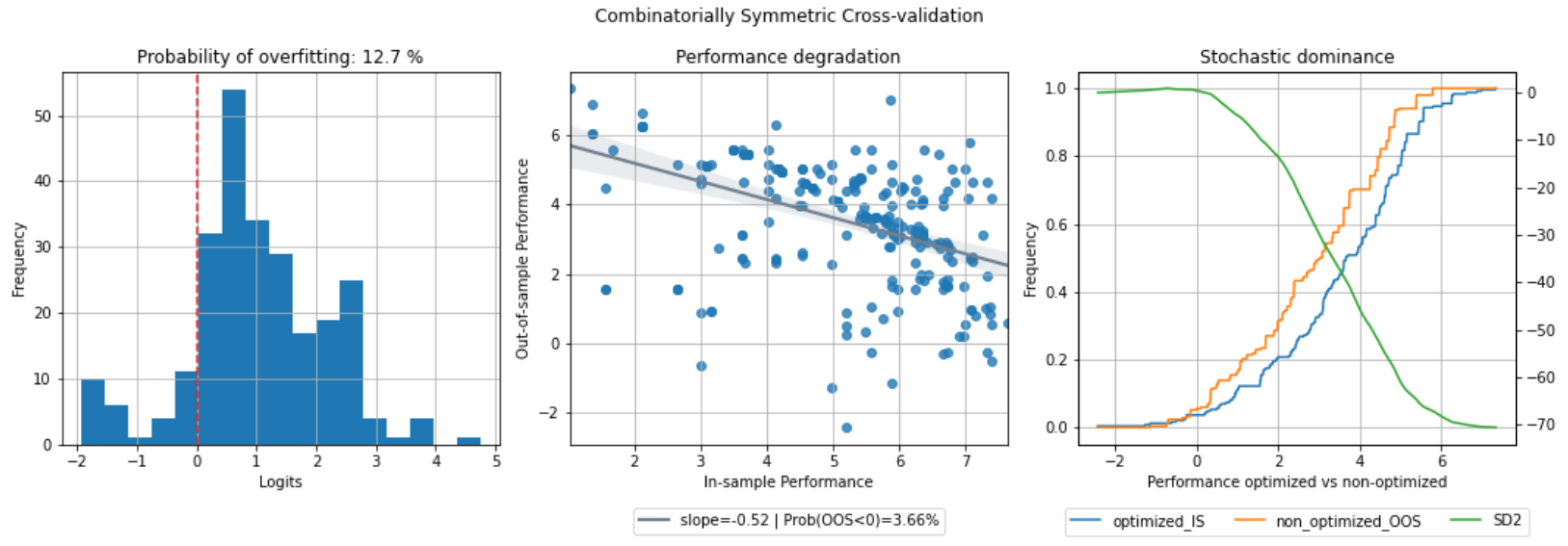

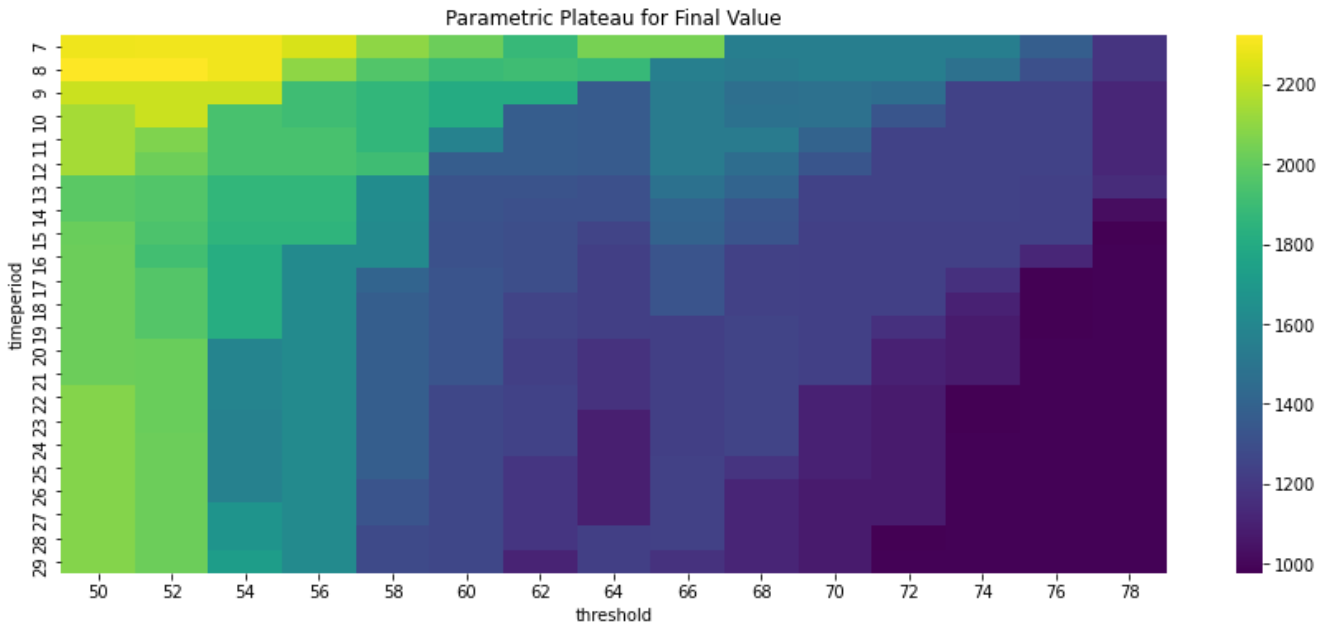

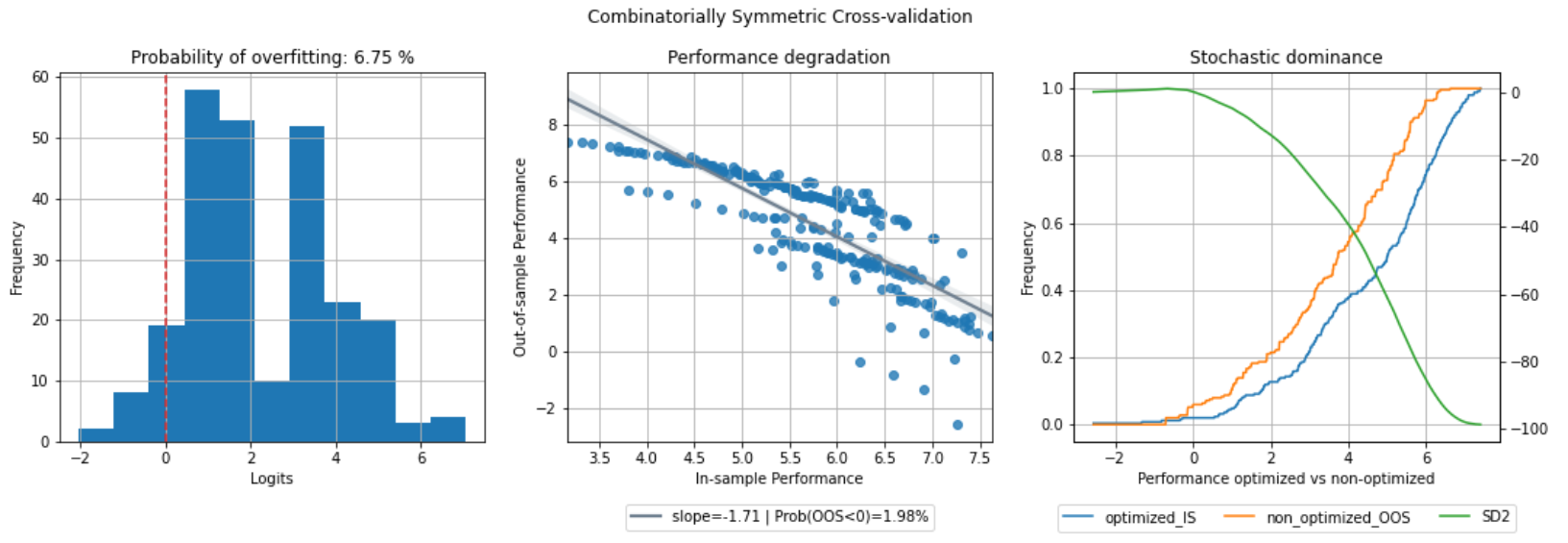

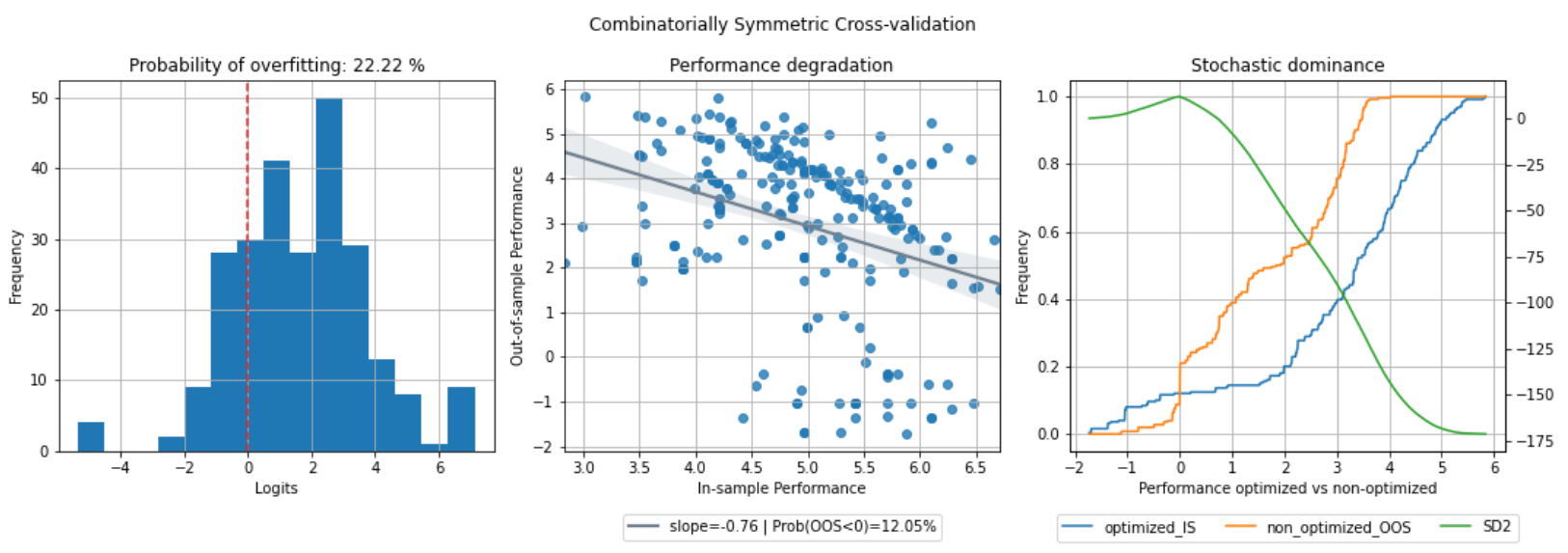

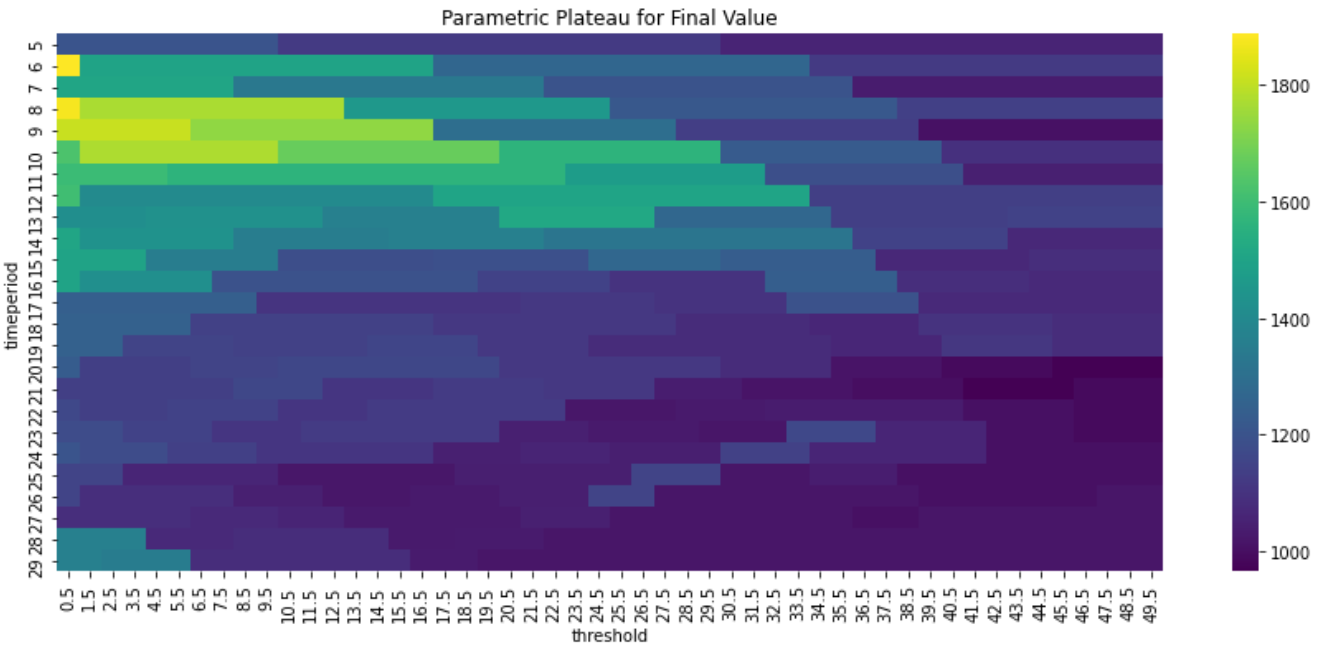

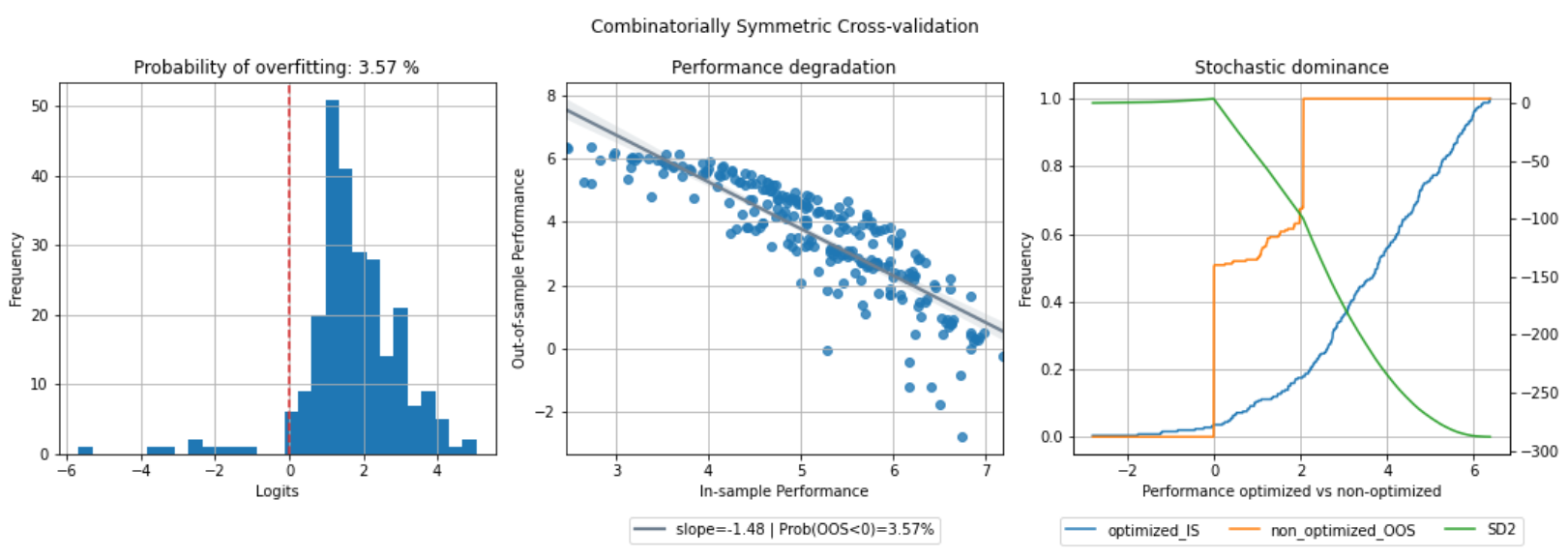

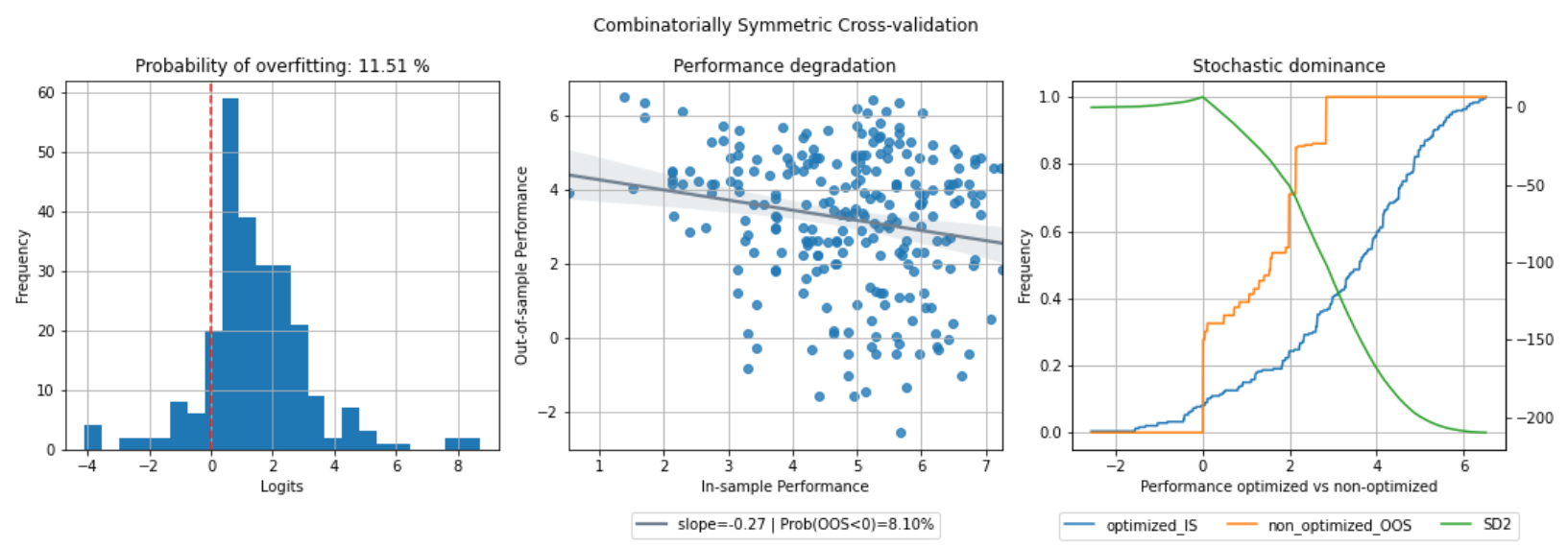

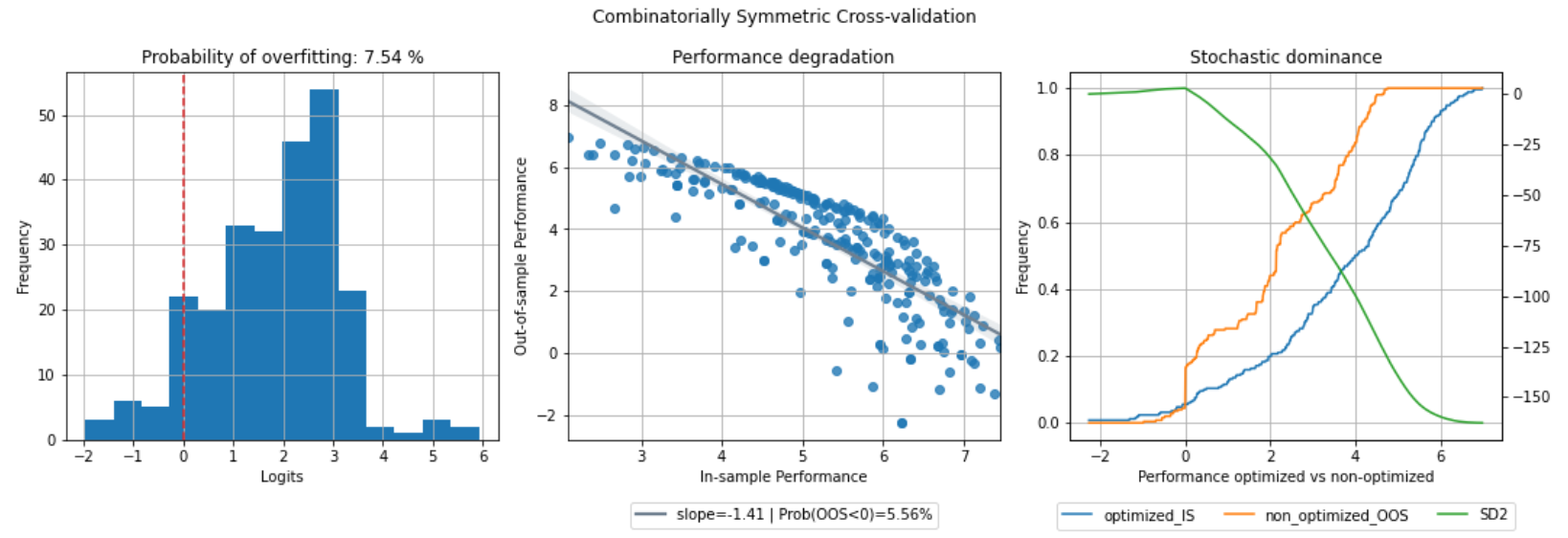

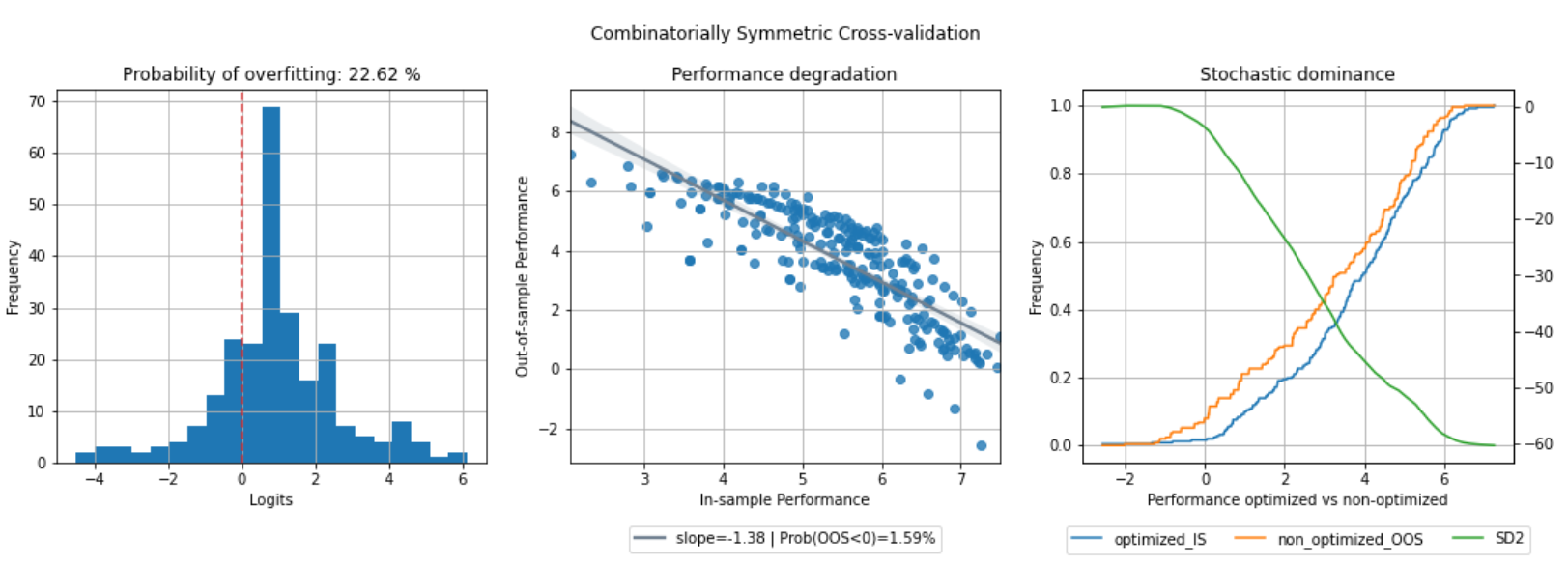

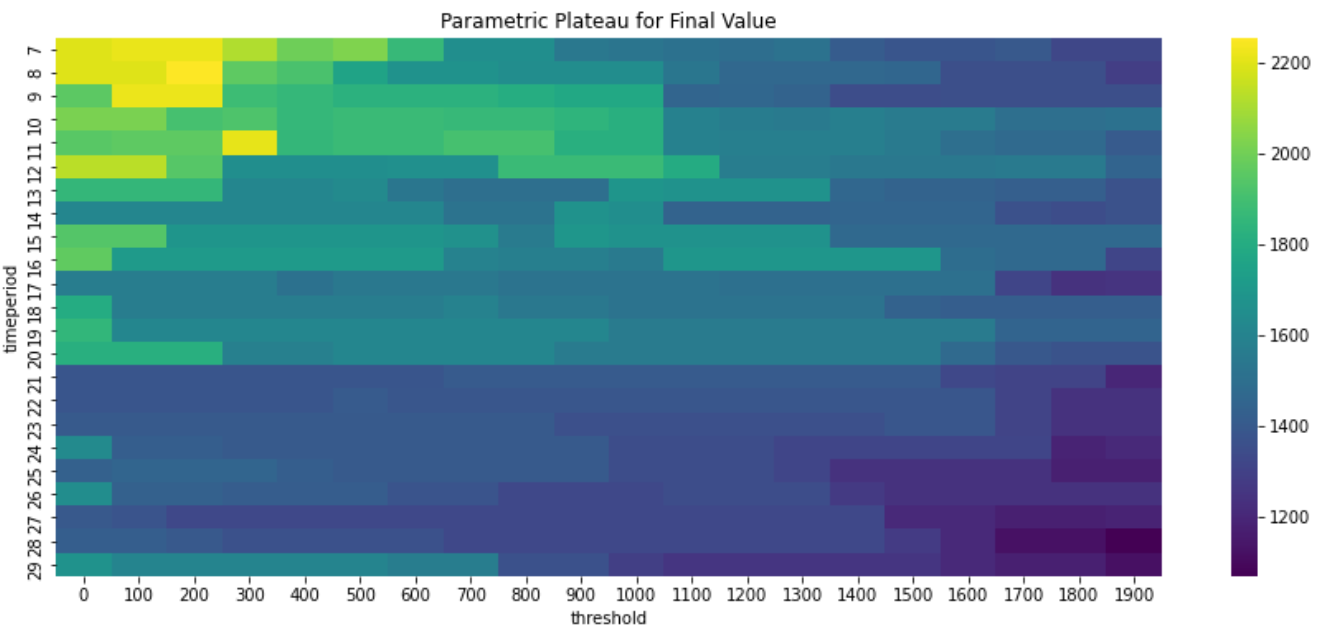

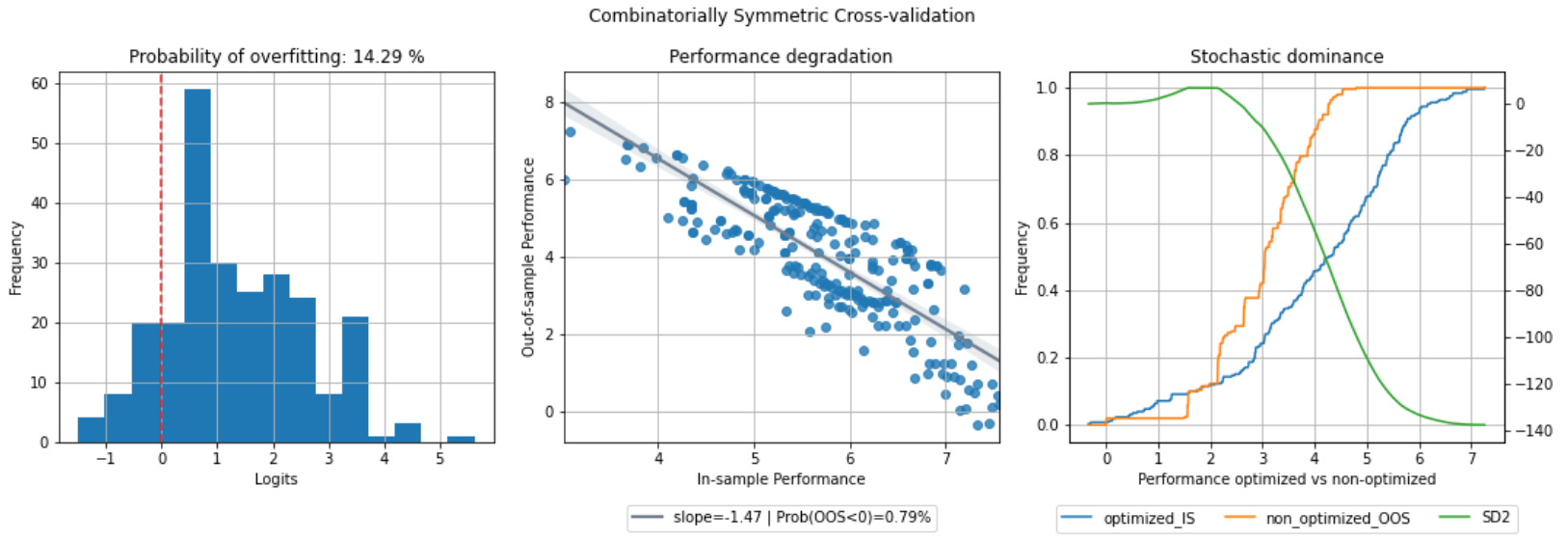

CSCV

I use combinatorially symmetric cross validation (CSCV) in particular to implement Sharpe ratio-based strategy performance testing. The probability of backtest overfit, performance degradation, probability of loss, and stochastic dominance are computed and visualised. The Sharpe ratio was employed as a performance metric by the writers in the reference. Other measurements are appropriate based on the assumptions made in the research.

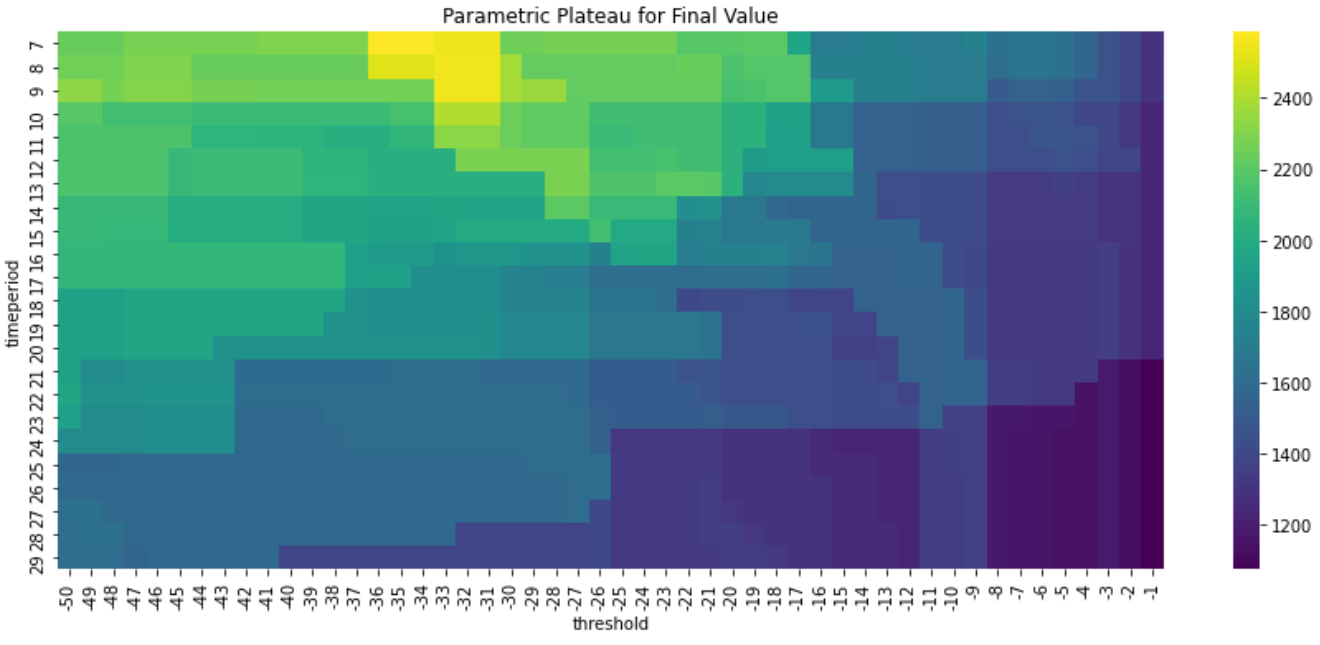

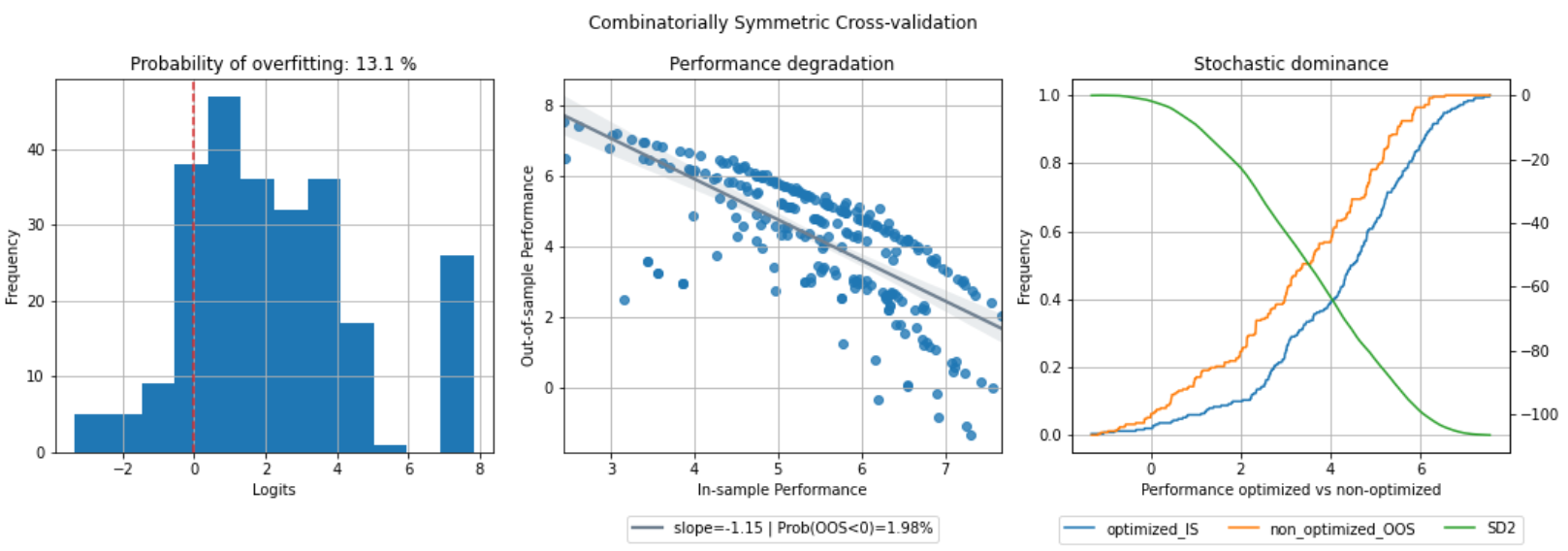

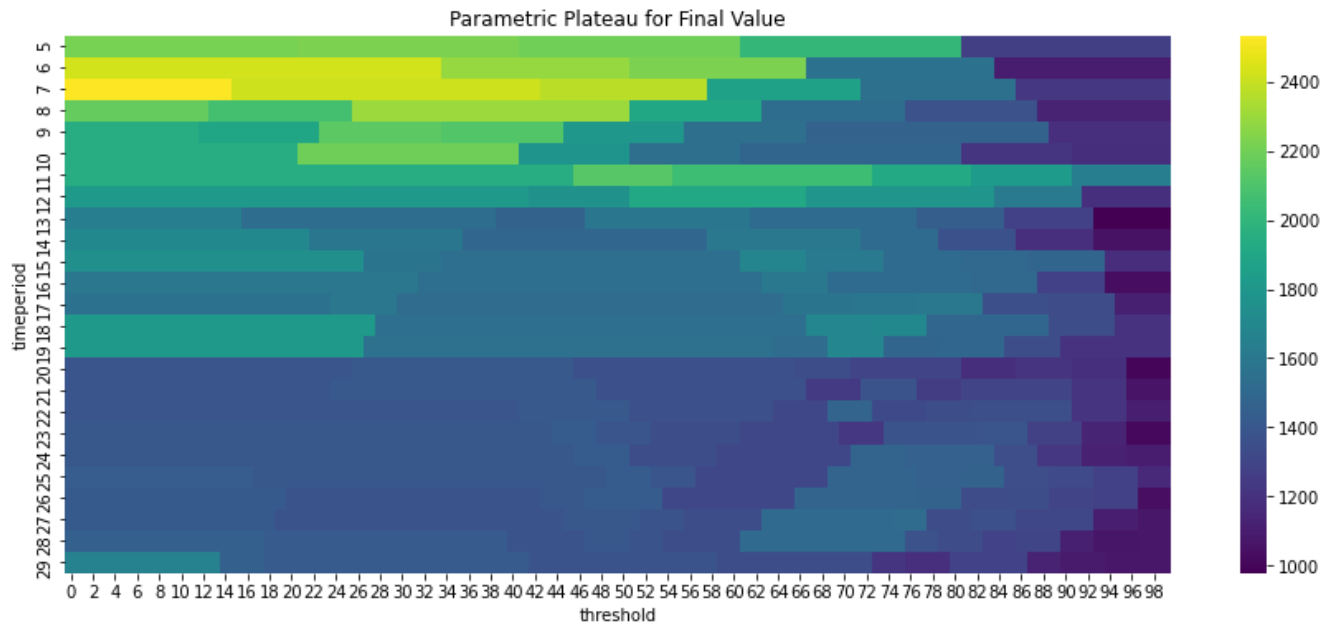

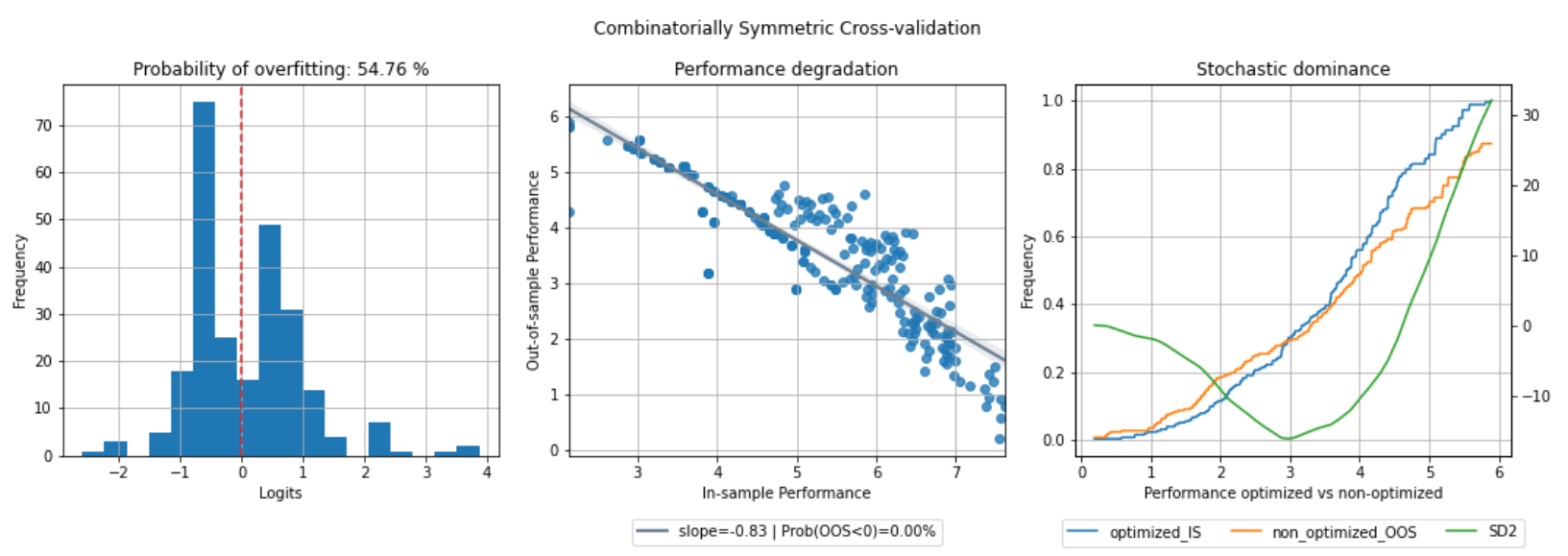

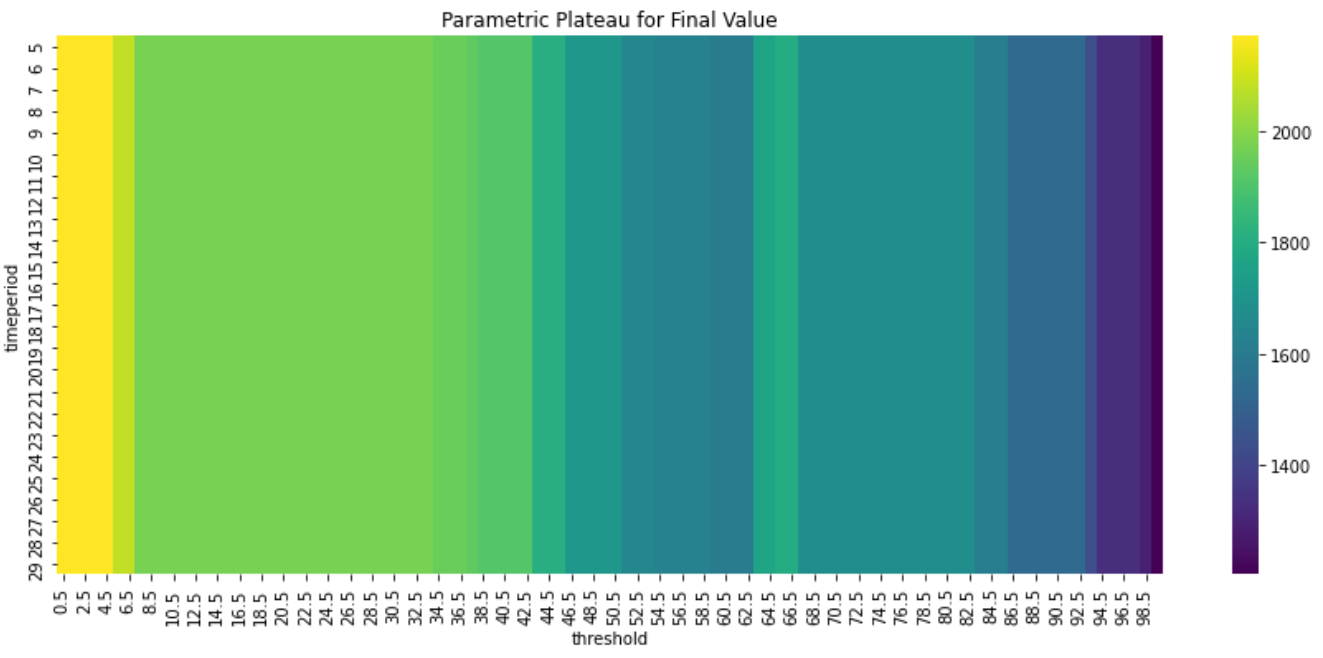

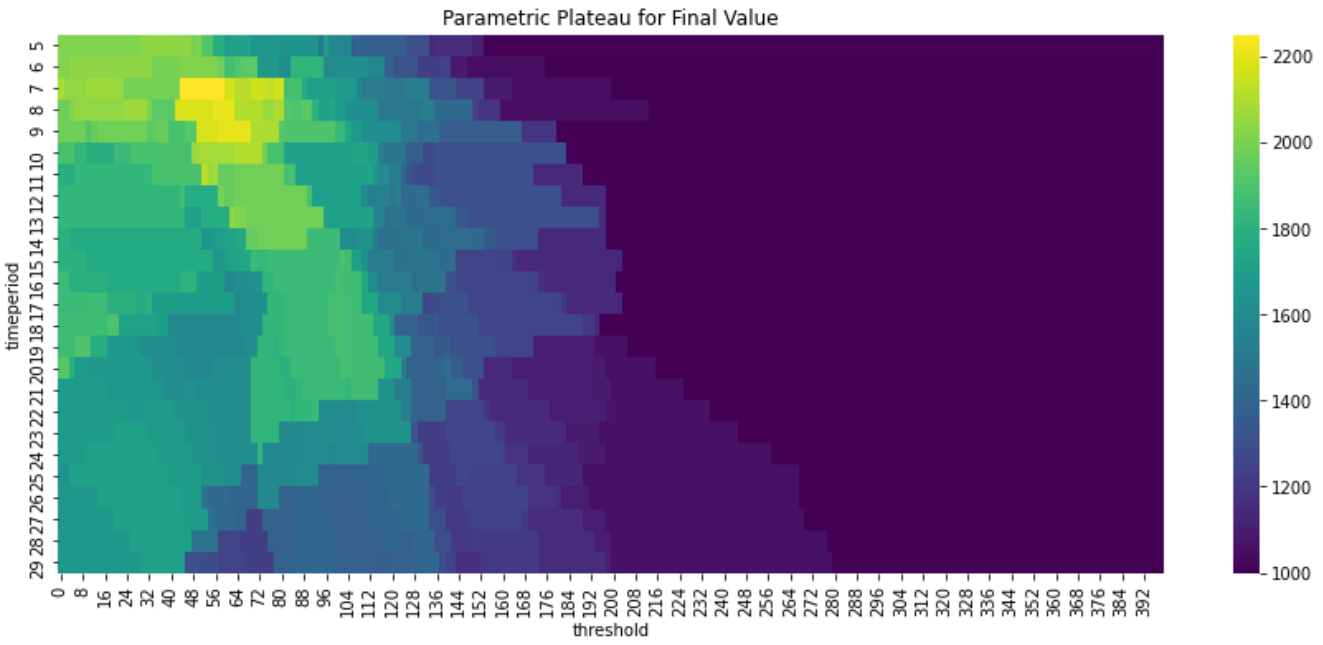

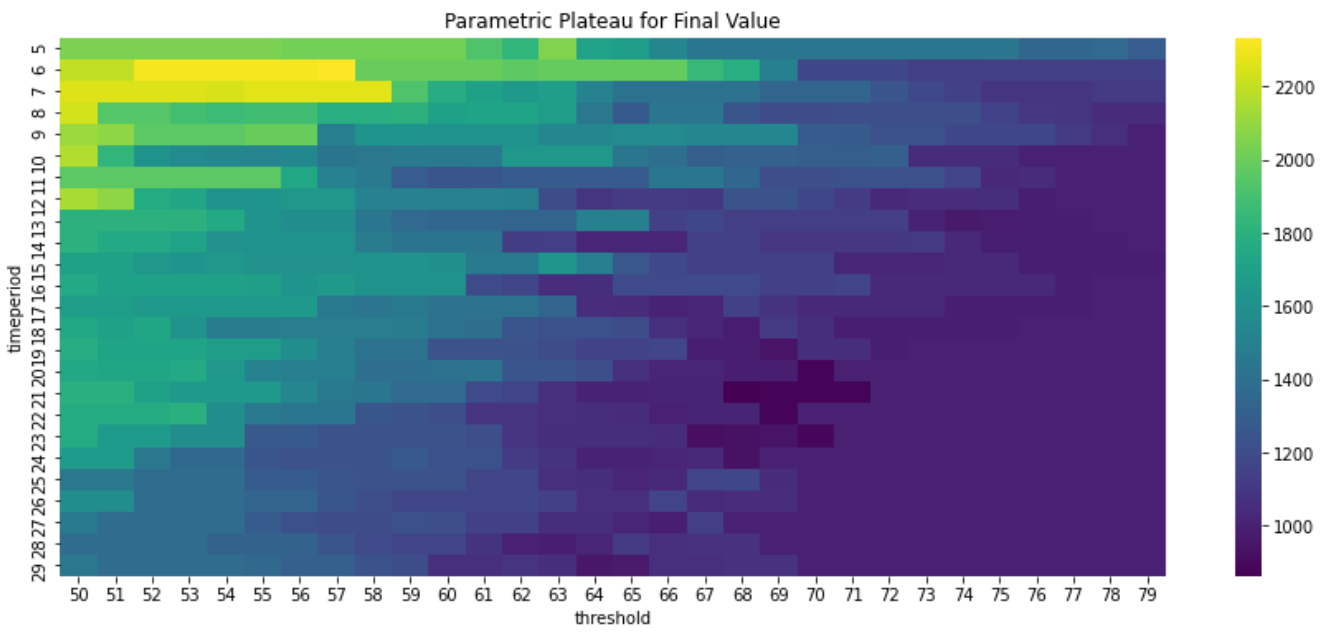

RSI

WILLR

AROONOSC

BOP

MMI

CCI

MACD

MFI

MOM

ULTOSC

PBO Results

PoL indicates Probability of Loss and PBO indicates Probability of Backtest Overfitting. Slope is for the measurement of Performance Degradation.

| Technical Indicator | PBO [%] | PBO (without LM) [%] | PoL [%] | PoL (without LM) [%] | Slope |

|---|---|---|---|---|---|

| BERT + RSI | 12.70 | 17.86 | 3.66 | 0.00 | -0.52 |

| BERT + WILLR | 6.75 | 26.98 | 1.98 | 17.34 | -1.71 |

| BERT + AROONOSC | 13.10 | 45.63 | 1.98 | 2.38 | -1.15 |

| BERT + BOP | 54.76 | - | 0.00 | - | -0.83 |

| BERT + MMI | 22.22 | 23.02 | 12.05 | 0.40 | -0.76 |

| BERT + CCI | 3.57 | 48.02 | 3.57 | 8.73 | -1.48 |

| BERT + MACD | 11.51 | - | 8.10 | - | -0.27 |

| BERT + MFI | 7.54 | 46.03 | 5.56 | 6.35 | -1.41 |

| BERT + MOM | 22.62 | 29.76 | 1.59 | 5.95 | -1.38 |

| BERT + ULTOSC | 14.29 | - | 0.79 | - | -1.47 |

Conclusion

When employing numerous criteria to make trading decisions, especially when combining NLP-based indicators with technical indicators, the profit and sharpe ratio can be greatly increased, and drawdown can be significantly decreased.